New prime minister has to grapple with ‘unsustainable’ UK indebtedness, fiscal watchdog warns

Britain is on “an unsustainable path” to high indebtedness unless action is taken to strengthen the public finances, the country’s fiscal watchdog warned today.

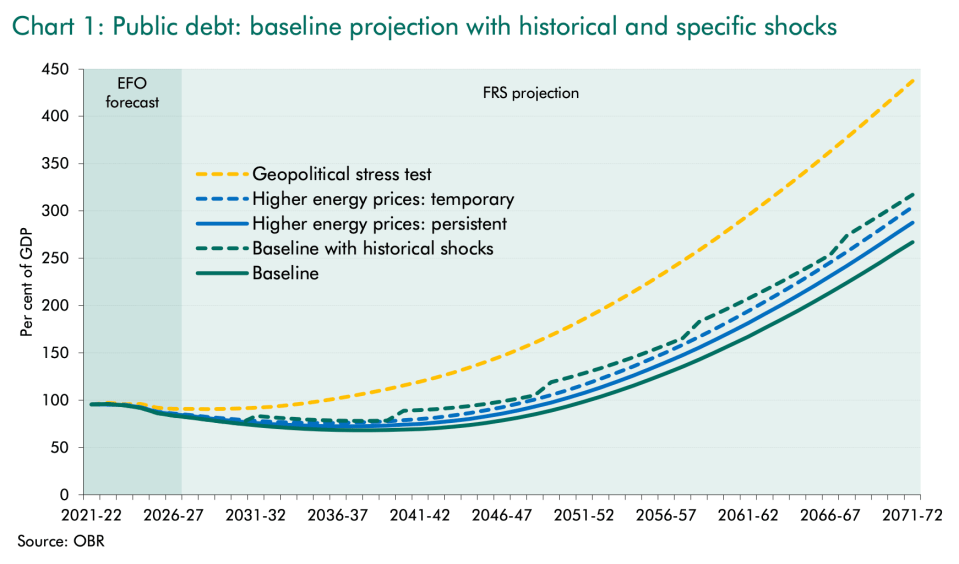

A combination of higher health spending to deal with an ageing society, the loss of motoring taxes due to the transition to net zero and greater geo-political risks could swell the UK’s stock of debt to over 400 per cent of the size of the economy in around 50 years’ time, the Office for Budget Responsibility (OBR) said today.

In a worse case scenario, in which “geopolitical tensions continue to rise, with threats to both security and economic integration crystallising, the fiscal outlook could be materially weaker,” Britain’s debt burden will reach historic levels, the OBR said in its latest fiscal risks report.

The projection illustrates the scale of the economic challenge whoever leads the treasury in the long-term will have to grapple with.

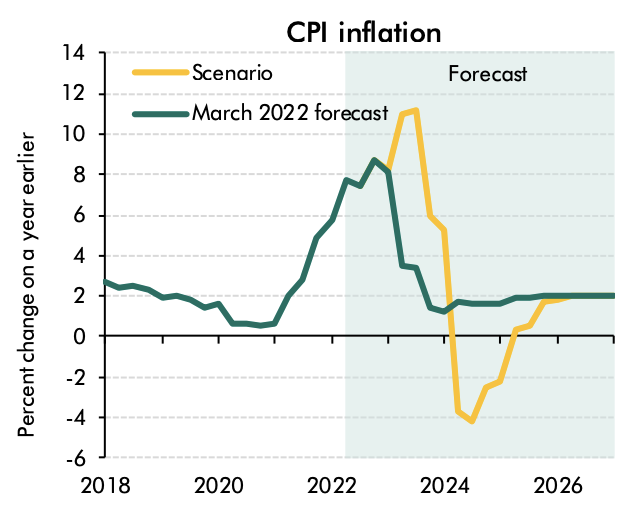

Not only is the UK’s indebtedness set to balloon over the coming decades, the economy will tip into recession next year due to higher energy prices triggering a spending slowdown and a sharp fall in living standards, the OBR said.

Inflation is projected to top 11 per cent later this year, taking it to the highest level since 1981.

The debt-to-GDP ratio will fall in the medium term, but then start to soar as the fraction of elderly people in the UK population increases. Under the most likely scenario, the debt burden reaches just over 250 per cent of GDP in 50 years.

Prime minister Boris Johnson today bowed to days of pressure and resigned, sparking a drawn out Conservative leadership election.

Although Nadhim Zahawi was made chancellor earlier this week, after his predecessor Rishi Sunak quit on Tuesday, it is unclear how long he will stay in the job, especially if he runs in the coming leadership contest.

The incoming leader will be under pressure to cut taxes to appease Tory MPs disgruntled with Johnson and Sunak’s economic strategy and ease the cost of living burden on households.

However, Andy King, OBR board member, said any tax giveaways that are not financed by spending cuts elsewhere will put “more pressure” on the finances through extra borrowing.

The government has to either raise taxes or cut spending to put the public finances on a sustainable trajectory, the OBR said.

Tax rises announced by Sunak – including a six percentage point corporation tax hike and 1.25 percentage point national insurance rise – are scheduled to send the tax burden to its highest levels since the late 1940s.

Today’s report was the first produced by the OBR that combined its fiscal risks and sustainability projections.

In the Treasury’s first long-term public finances snapshot, published two decades ago, the UK’s debt-to-GDP ratio was projected to hit 40 per cent around this time. However, the country’s debt stock has instead climbed to over 90 per cent, mainly caused by Covid-19 spending.

The debt overshoot has been driven by “the UK economy [being] buffeted by an unprecedented series of global shocks,” including the global financial crisis, the pandemic and Russia’s invasion of Ukraine, OBR chief Richard Hughes said.

In 50 years’ time, the size of the state will have increased to 60 per cent of the economy, but government tax revenues will lag behind spending. This gap will push the deficit to over 20 per cent of GDP.

City A.M. has contacted the treasury for comment.

Analysis: An un-stitching of the UK’s economic and demographic fabric

The UK, like most of the world’s developed countries, will undergo big changes in its economic structure over the coming decades.

An ageing population, compounded by ditching carbon-intensive goods and services and production processes, will shift the country’s economic and demographic fabric.

The old-age dependency ratio – a measure of the burden working people have to carry to fund elederly care – is set to increase 18 percentage points over the next five decades, according to the UN.

That rise will swell spending on healthcare to around 15 per cent in 50 years. Defence spending in response to greater geo-political instability and higher education expenditure will all add to the pressure on the finances.

Now, these projections are far, far into the future and are sure to be ripped up when more economic shocks hit.

In the near-to-medium term, tax rises help repair the public finances by bringing down the deficit and debt-to-GDP ratio.

All told, though, the state is set to play a much bigger role in people’s lives, according to the OBR.

How the next prime minister squares that off with Tory MPs when Johnson was booted in part for his economic policy will surely determine their fate.