Gazprom and Uniper shares plunge as fallout from Ukraine crisis deepens

Shares at two of Europe’s largest energy firms have plummeted this week, as the gas crisis and economic warfare between Russia and the West escalates.

Kremlin-backed gas behemoth Gazprom has opted not to pay out dividends on final year results – with investors missing out on what would have been their biggest ever pay day.

It is the first time that shareholders have not been paid out since 1998 after they chose to reverse a board recommendation to provide a dividend of 52.53 roubles per share.

Deputy chief executive of the firm, Famil Sadygov, revealed that shareholders had concluded it was “not advisable to pay dividends based on the 2021 results”, given the “current situation.”

The company instead intends to invest 526bn roubles ($10bn) by 2025 boosting Russia’s gasification levels, which have slumped to 72 per cent.

Earlier this morning, shares in the Russian energy titan tumbled 27 per cent.

Gazprom has been at the centre of disharmony across Europe following Russia’s brutal invasion of Ukraine.

Russia initially pledged to continue supplying global markets, but after Europe announced sanctions on energy sources – initially with a phased coal embargo and later with seaborne oil shipments – the Kremlin demanded “unfriendly” overseas buyers paid in roubles.

Some companies complied via a murky conversion process but others refused – resulting in Gazprom cutting off some of its gas supplies to Germany last month, stopping flows to Orsted and Shell Energy after both firms refused to make payments in roubles.

The firm also halted supplies to GasTerra in the Netherlands, as well as to Bulgaria, Poland and Finland.

There have also been reports of a sixty per cent drop in gas flows via the key Nord Stream 1 pipeline that transports energy from Russia to Germany – which has caused Germany to trigger the next phase of its emergency plans.

This second step follows the triggering of the “early phase” in March and signals to companies and households that painful cuts are on the way.

The plan could eventually lead to the country’s government dictating the distribution of energy across the country.

With the bloc dependent on Russia for around 40 per cent of its imports, it is highly vulnerable to future supply shocks.

Uniper pleas for help as Germany weighs up bailout

Gazprom’s reductions in supplies have even damaged one of its biggest customers, with German utility provider Uniper’s suffering a sharp drop in shares earlier this week.

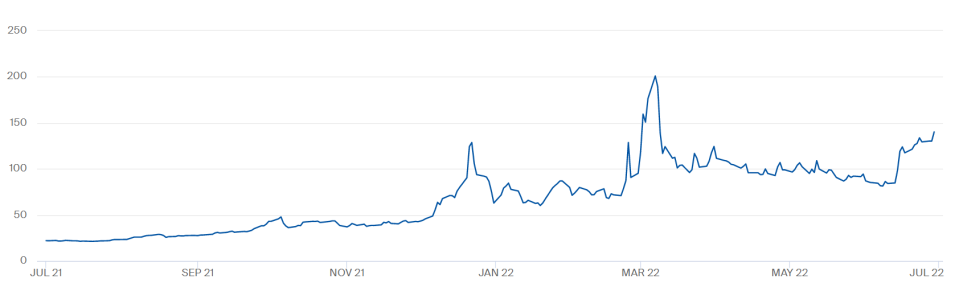

Uniper shares in the midcaps MDAXI index have dropped 16 per cent this week, and are down 68 per cent since the beginning of the year.

It is urging its government for help to cope with the financial fallout from steep-drop offs in Russian gas – raising the prospect of a bailout.

Uniper said it had received only 40 per cent of the contractually agreed gas volumes from Gazprom since June 16.

The lack of gas has forced utilities across Europe into purchasing gas through spot markets, which are far more expensive than long-term gas contracts.

Reflecting the current elevated costs, the benchmark Dutch front month price of gas has gone up 60 per cent this year.

A Berlin Economy Ministry spokesperson confirmed to news agency Reuters it was in talks with Uniper about stabilisation measures.

Uniper Chief Executive Klaus-Dieter Maubach has confirmed the talks entailed possible guarantees, raising credit facilities or even the state taking a share of Uniper’s equity.

The power giant was troubled prior to the eruption of conflict in Ukraine, and had asked for a Є2bn credit line from state-owned KfW bank to prepare for so-called gas margin calls. This has not yet been drawn