Exclusive: So Energy criticises ringfencing proposals amid deepening industry row

So Energy has stepped into a growing industry debate, raising concerns over Ofgem’s latest proposals to reform the energy market.

In particular, it warned that Ofgem’s push for credit balances to be ringfenced could pile on costs for households, with energy bills already at record highs.

So Energy’s co-founder Simon Oscroft told City A.M.: “Ofgem should be open with the public about the substantial real-term cost to consumers of these proposals. There are indications this could add as much as £30 per year to customer bills.”

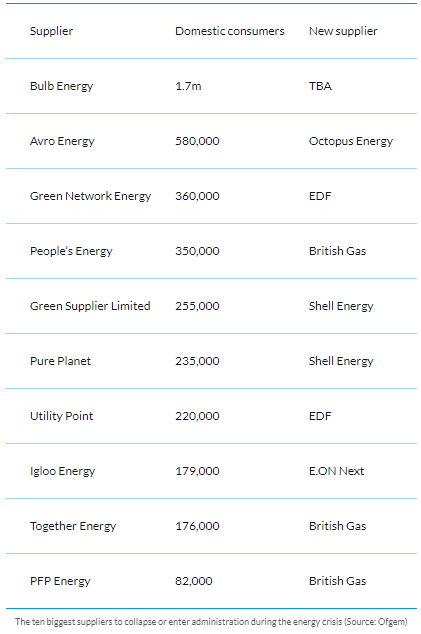

This follows Ofgem announcing a series of fresh proposals to reform the energy sector earlier this week, amid an industry crisis that has seen 29 suppliers collapse since last June.

The market carnage has directly affecting over four million customers, with Bulb Energy falling into de-facto nationalisation last November in the biggest state bailout since RBS in 2008.

Ofgem’s latest plans include the insulation of consumer credit balances and green levies from supplier failure, and limits on the direct debits levels suppliers can charge customers.

More controversially, it has also suggested at least 30 per cent of credit balances should be ringfenced in case of supplier collapse, and has continued an industry consultation on the issue.

The regulator is theoretically in favour of 100 per cent ringfencing, but has stopped short of such a requirement amid concerns it would leave smaller suppliers in financial difficulty.

Commenting on the reforms, Oscroft urged Ofgem to be measured in their plans for the energy sector, and not to rush through proposals in volatile market conditions.

He said: “There are also real issues with the short timelines and implementing these under current market conditions, negatively impacting supplier financial resilience which is the opposite of what the measures intend to do. Costs could be reduced significantly if these proposals were to be spread out over a longer timeframe, so we urge Ofgem to review this carefully.”

Energy firms at loggerheads over Ofgem reforms

So Energy is home to over 300,000 customers and joined forces last year with Irish supplier ESB Energy to consolidate its strong market position.

It is not the only firm to warn against ringfencing credit balances, with Octopus Energy (Octopus) describing the measure as “inadequate” earlier this week.

Octopus considers ringfencing to be an inadequate measure to tackle the causes and costs of supplier failure, which it argued was driven by insufficient hedging and poor management.

The supplier pointed to Ofgem data which revealed that an industry-wide lack of hedging was responsible for 85 per cent of the cost of failure during the crisis.

Octopus also highlighted its own research which suggests ringfencing would put more pressure on consumers – adding up to £30 to customer bills every year, while increasing supplier profits.

Instead, Octopus favours an insurance protection policy for credit balances, comparable to the kind provided to holidaymakers use to protect bank deposits.

Greg Jackson, chief executive and founder of Octopus, said: “It’d be bonkers to raise customer prices and increase supplier profits when much cheaper alternatives would be at least as effective in protecting customers’ money. Crude ringfencing is financially illiterate, which is why it’s not used in other industries. Its proponents need to be honest that it would cost customers a lot more than it saves, and would actually drive up supplier profits.”

Octopus and So Energy are not the only firms with concerns, as City A.M. understands Ovo Energy has also raised issues over the proposal.

So Energy’s intervention deepens an intense industry row, with the UK’s biggest supplier Centrica calling for Ofgem to go further with its ringfencing pledges and protect 100 per cent of consumer credit balances.

The boss of British Gas owner Centrica has urged market regulator Ofgem to speed up the process of enacting reforms across the energy sector.

Chief executive Chris O’Shea argued it was vital that the customer’s money was protected by suppliers, and used only for the purchase of energy supplies – not to fund commercial ambitions at the company.

O’Shea said: “We welcome this consultation but we are worried at the length of time it is taking to make the changes necessary and we urge Ofgem to work with greater urgency to protect customers fully and to prevent the events of last year ever happening again.”

Ringfencing is already a company policy at Centrica, with the firm protecting £300m in credit balances and deposits in a separate account from its business activites.

It has consistently pointed to polling showing the concept of ringfencing is highly popular among domestic consumers.

Meanwhile, energy specialist Cornwall Insight unveiled gloomy forecasts yesterday – outlining that the consumer price cap is likely to exceed £3,000 per year in January – when energy demand is at its peak.

This places more pressure on Ofgem to reform the energy sector heading into the cold winter months, to ensure the crisis does not escalate again.

Earlier this week, it faced fresh criticism from the National Audit Office over its handling of the energy crisis – which accused the watchdog of failing to properly scrutinise the financial credentials of firms entering the market.

When approached for comment, an Ofgem spokesperson told City A.M.: “As our plans have set out, we want to ensure that energy suppliers protect customers’ money and it is only right that suppliers bear the appropriate cost of risk-taking so that they are more resilient to market shocks. The impact assessment indicates that these proposals should lead to a net benefit to customers in the long term. We welcome all views and encourage Octopus and others to submit any concerns and ideas as part of our robust consultation process.”