Octopus Energy locks horns with Centrica over market reforms as bidding war for Bulb lights up

Two of the UK’s biggest energy firms are at loggerheads over proposals to fix the crisis-ridden industry, following the collapse of dozens of suppliers.

Octopus Energy (Octopus) has rubbished Centrica’s push for suppliers to ringfence customer credit balances, describing the rival’s proposals as misguided.

A spokesperson told City A.M. : “Centrica’s proposals are financially illiterate – they would increase energy prices and supplier profits but would have virtually no impact on the causes and costs of supplier failure.”

The energy firm considers insufficient hedging and poor management to be the key drivers of the energy crisis, which has seen 29 suppliers exit the market since last September – directly affecting over four million households.

Octopus noted its customers are in debt to the company most of the year and owed the firm £670m at the end of winter – undermining the notion it could even use credit balances to fund wider commercial ambitions.

Instead of ringfencing, Octopus is in favour of an insurance protection policy, comparable to the kind provided to holidaymakers travelling via airlines.

Combined with hedging controls and management requirements, it believed this would provide more protections to customers without jeopardising the energy sector.

The spokesperson explained: “Octopus would like to see stringent rules on hedging and management, and if appropriate an ATOL-style insurance policy for credit balances. This would see greater protection for energy customers but cost 5-10 times less than Centrica’s profit-swelling proposals.”

Customers typically overpay for their energy use in the summer months – and the credit is then used over the winter to keep direct debits stable throughout the year.

Ringfencing balances could require energy firms to charge more, and could potentially benefit bigger firms with larger pools of cash at their disposal.

This follows Chris O’Shea, chief executive of Centrica, criticising “newer, larger, UK energy firms” in the firm’s annual general meeting last week, for failing to support his push for customer balances to be protected.

City A.M. understands O’Shea was referring to Octopus and Ovo Energy (Ovo) – the fifth and third biggest domestic energy suppliers, collectively serving over eight million customers.

Centrica warns ringfencing is key to protecting industry from supply failures

Centrica is home to British Gas, the UK’s largest energy firm, and is responsible for around nine million customers.

Its position is shared by regulator Ofgem – which is conducting a consultation on the issue – with an update expected in the coming weeks.

The energy watchdog has previously called for suppliers to place customer funds in a separate account, ensuring any overpaid credit would be preserved in the event of a collapse.

Protecting customer balances through ringfencing is already company policy at Centrica, which holds around £300m of customer deposits in a distinct bank account, which is only used to buy energy for customers when they use it.

A Centrica spokesperson told City A.M.: “When customers pay up front for their energy, they are trusting their energy supplier to look after their money and they would be appalled if they thought their money was being used to fund day to day business activities. We want our customers to know that their money is safe with us.”

The supplier highlighted that more than £400m of consumer’s money has disappeared during the current energy crisis.

| Supplier | Domestic consumers | New supplier |

| Bulb Energy | 1.7m | TBA |

| Avro Energy | 580,000 | Octopus Energy |

| Green Network Energy | 360,000 | EDF |

| People’s Energy | 350,000 | British Gas |

| Green Supplier Limited | 255,000 | Shell Energy |

| Pure Planet | 235,000 | Shell Energy |

| Utility Point | 220,000 | EDF |

| Igloo Energy | 179,000 | E.ON Next |

| Together Energy | 176,000 | British Gas |

| PFP Energy | 82,000 | British Gas |

Centrica added: “The current energy crisis has shown just how important it is that energy companies are financially resilient. Protecting credit balances is a vital part of a resilient energy market and we believe urgent action is needed to protect customers’ credit balances from further supplier failures.”

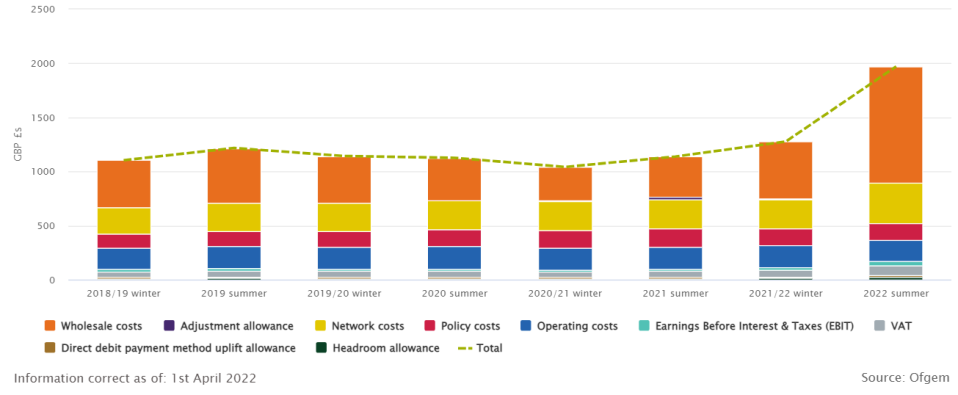

Reforming the energy sector has become a matter of increasing urgency, with energy bills spiking to nearly £2,000 per year in April.

Ofgem boss Jonathan Brearley warned last month that the price cap is set to rise to at least £2,800 per year in October.

Since then, Chancellor Rishi Sunak has unveiled a £15bn support package which could offer savings to vulnerable energy users of up to £1,200 per year.

Meanwhile, plans to ensure the sector can deal with future market shocks have continued apace.

In recent months, Ofgem has unveiled fit and proper person rules, financial stress tests and market stabilisation charges to ensure hedging is not financially penalised.

Nevertheless, the idea of ringfencing balances remains contentious and will continue to be the subject of debate in the industry.

Octopus enters race to buy Bulb with eleventh hour offer

The rivalry between Octopus and Centrica extended beyond regulatory disputes this week.

City A.M. understands from industry sources that Octopus has dramatically entered the race for Bulb Energy’s (Bulb) 1.7m customers, rivalling reported bids from Centrica and Middle-East energy giant Masdar for the UK’s seventh biggest energy supplier.

Earlier this year, City A.M revealed more than two bidders remained interested in the supplier, despite media reports the process had been whittled down to just two bids.

The bidding process is being overseen by US financial advisory group Lazard, which had also been pursuing financial backers for Bulb in the weeks prior to its collapse into de-facto nationalisation last November.

The supplier became the first energy firm to enter the special administration last November, where it has remained for the past seven months, propped up by the tax payer to the tune of £3bn.

A deadline of June 30 has been established for the process, and City A.M. understands an official decision could be announced as soon as next month.

Any potential deal remains remains complicated by the funds owed to creditors, including Sequoia Economic Infrastructure Income Fund (Sequoia), which is looking to claw back around £55m.

When the administrators were being designated last November, Sequoia swooped in at the last moment to force Simple Energy – the parent company of doomed supplier Bulb – to switch administrators from AlixPartners to Interpath Advisory.

There is also the possibility more bidders could enter the fray, with Ovo reportedly weighing up a late bid, according to The Financial Times.

EDF has also been linked with a bid for Bulb in the past, although there are no reports it has yet made an offer.

Octopus had previously hinted at its interest in Bulb, with chief executive Greg Jackson refusing to rule out a bid when interviewed by City A.M. earlier this year ahead of the latest price cap update.

At the time, he argued it was “critically important we get good value for taxpayers” with any deal for Bulb, and that there had to be a “transparent process.”

Jackson told City A.M.: “We need to make sure Bulb’s customers are well looked after. It’s fair to say there’s been a wide range of different experiences with customers that have been through these supply failures.”

Octopus’ bid for Bulb was first reported in The Financial Times.