Activist challenges to energy firms lose momentum as investors focus on supply security

Motions pushing for energy giants to curb emissions to meet climate change targets have suffered drop-offs in support, with investors increasingly concerned about supply shortages following Russia’s invasion of Ukraine this year.

Dutch activist investor group Follow This has presented resolutions at Equinor, Shell and BP annual general meetings over multiple years, demanding they commit to the Paris Agreement.

This includes cutting emissions across all three scopes of emissions – consisting of the entire production and consumption process of fossil fuels.

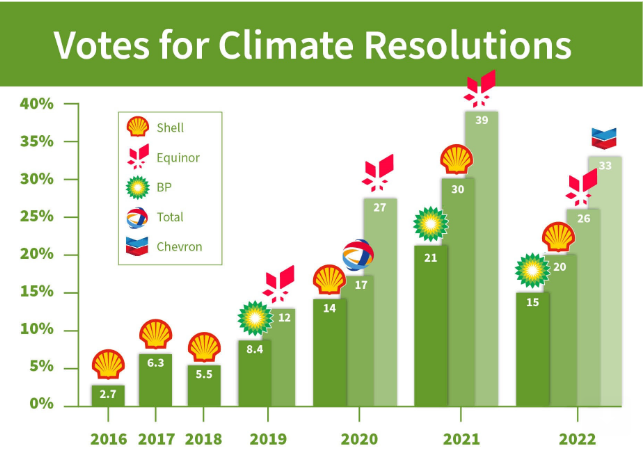

However, its motions have encountered sharp declines in support from investors this year, with Equinor dropping from 39 per cent to 26 per cent, Shell from 30 to 20 per cent, and BP from 21 per cent to 15 per cent.

It argued the primary reason for plummeting levels of support for its proposals reflects the change in calculus investors have made after the outbreak of conflict in Ukraine, with fears of sanctions and conflict-driven disruption hampering energy supplies.

This is also demonstrated in the shift of policy from Western governments, with Downing Street including a ramp-up of North Sea oil and gas in its supply security strategy published in April.

Nevertheless, the activist group believes stringent environmental goals remain necessary despite the current geopolitical uncertainty, warning that the effects of climate change will be even more significant.

Mark van Baal, founder of Follow This, said: “In general, it looks like the energy crisis and the windfall profits resulting from Ukraine war have eclipsed the climate crisis. Both crises must be dealt with simultaneously by shifting investments to renewables. The hardships of the current energy crisis will be dwarfed by the consequences of devastating climate change.”

All three firms have committed to reaching net zero carbon emissions by 2050 – with Shell’s transition plan being backed overwhelmingly by investors last month.

This is despite direct action from climate protestors, who stormed the meeting chanting slogans and raising banners, delaying the vote by nearly three hours.

The energy giants consider their plans aligned with the Paris Agreement, which pledges to limit global temperature increases to two degrees above pre-industrial levels.

However, Follow This has been calling on energy giants to announce short, medium and long-term targets, concerned that delaying emission cuts and relying too much on technological innovations could damage energy firms, forcing them to significantly alter their business in later decades to meet targets.

It also suggested investors took a softer stance on climate targets in return for capital returns to shareholders by way of dividends and share buybacks, with BP and Shell increasing their buyback schemes to $6bn and $8.5bn this year, respectively.

Meanwhile, there is a growing trend of investors which were known to vote in favour of climate resolutions divesting from stakes in oil majors – with pension group ABP offloading €15bn-worth of holdings last year.