Oil prices tumble as China lockdowns cut into demand expectations

Oil prices have plummeted with forecasts of weak economic growth in China, lowering demand expectations and overriding fears of supply shortages as the European Union (EU) weighs up a ban on Russian imports.

Brent Crude prices have slipped 3.60 per cent to $103.50 per barrel, while WTI Crude has dropped 3.61 per cent to $100.90.

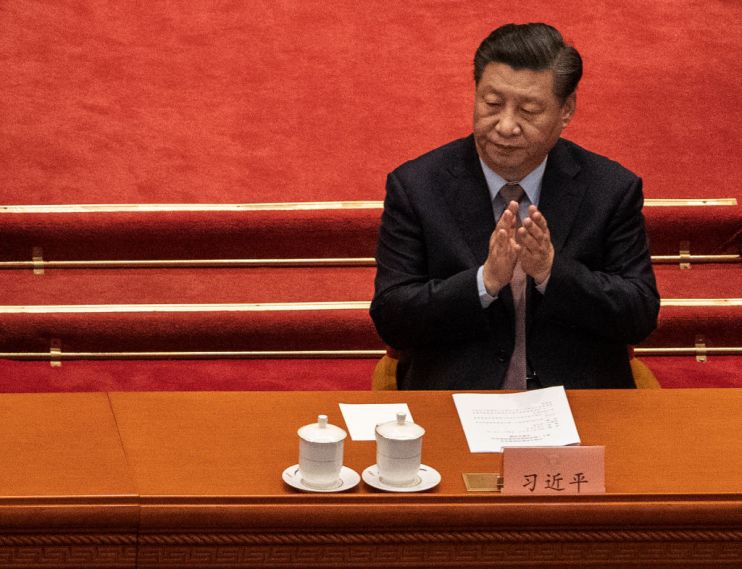

China released data last weekend, revealing factory activity in the world’s second-largest economy contracted for a second month to its lowest since February 2020 due to Covid-19 lockdowns.

The country has imposed oppressive lockdowns on millions of citizens living in Shanghai, China’s business hub and home to the world’s largest port.

Meanwhile, markets in the UK, Japan, Britain, India and across Southeast Asia were closed for public holidays on Monday, which also weighed down demand.

This has deepened market disruption, plaguing industries from carmakers to technology groups, while also cutting expectations of oil demand.

There is little expectation China will ease off its zero-Covid approach, with mass testing now rolled out in capital city Beijing.

Nevertheless, prices remain elevated above the $100 milestone, with OPEC+ persistently missing pledged output targets this year – despite only committing to modest increases of 400,000 extra barrels per day.

Meanwhile, the EU is leaning towards phasing out Russian oil imports by the end of the year, in line with measures rolled out by the UK in March.

This follows talks between the European Commission and EU member states over the weekend, with Germany dropping its opposition.

The European Commission may spare Hungary and Slovakia from the embargo due to their strong dependency on Russian oil, as the bloc finalises its sixth batch of sanctions.

Around half of Russia’s 4.7m barrels per day (bpd) of crude exports go to the EU, supplying about a quarter of the EU’s oil imports in 2020.

Other countries have taken advantage of the escalating economic conflict between the West and Russia, with India targeting heavily-discounted Russian cargoes to meet its massive consumption demands.

However, Rystad Energy has questioned how much the Kremlin can redirect supplies to global markets beyond Europe.

They said: “Russia’s ability to redirect all unwanted cargoes from the West to Asia is limited. In the case of embargoes, Russia will be forced to cut production further as it lacks storage capacity for extra crude volumes.”

Separately, Libya’s National Oil Corp revealed last weekend on Sunday it would temporarily resume operations at the Zueitina oil terminal after it declared force majeure in late April on some shipments as political protesters forced a number of oil facilities to suspend operations.