EDF ramps up support for struggling households as energy crisis deepens

EDF has boosted its support for customers, following this month’s painful hike in energy bills and the cost-of-living squeeze which has put even more pressure on UK households.

The energy firm has topped up its customer Support Fund this year with a further £5m – bolstering its initial allocation of £1.4m to the fund this year.

The overall £6.4m package will be used to help customers in debt or facing financial difficulties maintain their energy supplies.

Alongside direct financial support, EDF will also bring forward £20m to spend on energy efficiency measures for fuel poor households this year to get as many homes as possible insulated against rising prices.

Philippe Commaret, managing director, Customers at EDF said: “We know more people are going to struggle to pay their energy bills, so we’re doing everything we can to try and help, through offering more direct financial assistance and by insulating more homes, protecting those in fuel poverty from volatile global energy prices now and in future.”

Cost of living crunch starts to bite

Despite the pledges, the reality remains the vast majority of EDF’s 5.2m customers will face elevated prices for the foreseeable future.

EDF analysis shows that a year ago, the 10 per cent of lowest-earning households in the UK spent £1 in every £12 of their budget on energy.

Since then, this has now increased to £1 in every £8 from April and could rise to £1 in every £6 from October.

The price cap spiked 54 per cent this month, with household energy bills rising to £2,000 per year.

There are now expectations of a further rise in the price cap this October – with estimates varying from £2,500 to £3,000 per year for average use.

This follows mass carnage in the energy sector that has seen 29 suppliers exit the market since September – crippled by the lethal combination of spiralling wholesale prices, insufficient and the limitations of the consumer price cap.

Bulb Energy, the UK’s seventh biggest supplier, has collapsed into de-facto nationalisation, propped up by £3bn in public money.

Ofgem has announced multiple measures this year to ensure the market is more resilient in the face of future market shocks.

New policies include requiring firms to pay rivals compensation if they persuade customers to switch, financial stress tests for suppliers, and a more accurate assessment window for determining the price cap.

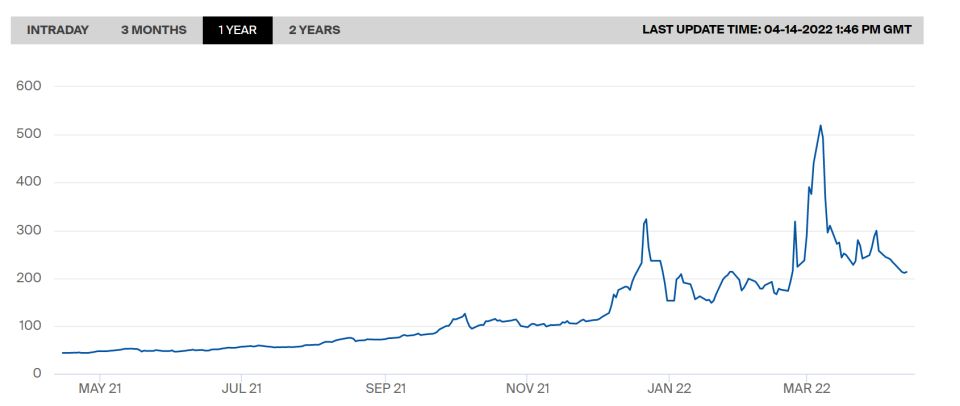

Nevertheless, gas prices remain historically high following the pandemic and Russia’s invasion of Ukraine, which have raised fears of supply shortages.

UK natural gas prices skyrocketed last month and peaked a record £8 per therm.

While markets have since calmed, prices remain high at £2.13 per therm – for context, prices were 44p per therm this time last year.

Household to suffer spiked energy bills into 2023

There are also growing concerns that markets will take longer to calm down next year, with the latest 2023 forecasts from Cornwall Insight suggesting a decreasing drop-off in prices.

Its predictions for the Summer 2023 and Winter 2023/24 periods have risen by 15 per cent in just two weeks.

The energy specialists now predicted household bills of £2,284 and £2,233 respectively for the two periods, well above the £1,277 tarrif over the previous six months.

With a return to pre-2021 energy prices looking increasingly unlikely, principle consultant Dr Craig Lowrey called for the government to ramp up energy efficiency measures such as insulation and reducing output.

He said: “The cheapest energy is that which you don’t use, so to reduce bills for consumers, the government really must look again at how to support reductions in energy consumption for all consumers, including those in fuel poverty. The exclusion of material new policies for energy efficiency in the Energy Security Strategy were a missed opportunity.”