Weekend read: Britain’s buy-to-let landlords claim £18.5bn in tax reliefs despite mortgage interest changes

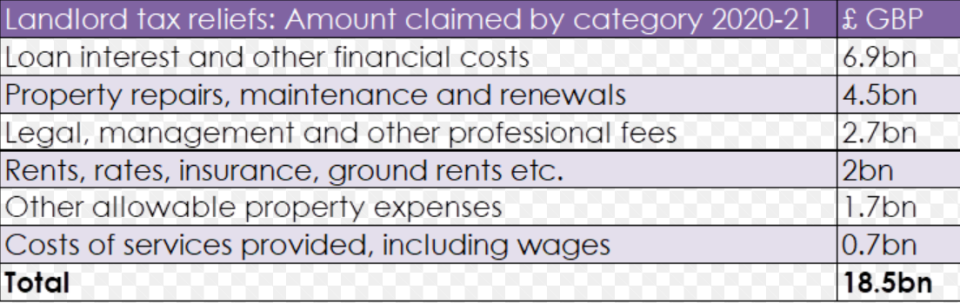

The amount UK buy-to-let landlords claimed in tax reliefs increased to £18.5bn in the last year, up from £18.1bn the year before, according to new research shared exclusively with City A.M. this morning.

The amount claimed increased despite a reduction in the amount of relief that landlords can claim on the interest that they pay on their mortgages.

Loan interest still made up the largest proportion of tax relief claimed by landlords at £6.9bn, 37 per cent of all tax reliefs claimed by buy-to-let landlords, according to London estate agent ludlowthompson.

Property repairs, maintenance and renewal made up the second largest area where landlords claimed back costs from the tax man, at £4.5bn, 24 per cent of the overall figure.

In addition to repairs, maintenance and renewals, tax relief can be claimed on a wide range of costs, including mortgage interest payments. professional fees (e.g. lettings agents and accountants) as well as insurance.

With the tax year coming to an end, ludlowthompson says landlords should make sure they are making full use of all available tax reliefs to prepare for upcoming changes to Energy Performance Certificates.

All rental properties will have to achieve an energy efficiency rating of grade C or above, a jump of two grades from the current minimum of grade E. The required energy efficiency improvements will apply to new tenancies from 2025 and to all tenancies from 2028.

The firm added that care must be taken to ensure that improvements related to energy efficiency do not count as capital improvements, which would not be eligible for tax relief.

However, improvements such as installing double glazing and up-to-date boilers would be allowable under repairs, maintenance and renewals.

Stephen Ludlow, Chairman of ludlowthompson, shared with City A.M. this morning: “There are currently no specific reliefs available to help landlords improve the energy efficiency of their properties in time for the deadline.”

He added: “Landlords may be able to make careful use of the repairs, maintenance and renewal allowance to replace fixtures such as boilers with more energy-efficient models.”

“There is a strong argument that the Government should provide more generous tax benefits for property improvements. This would incentivise landlords to make upgrades which would improve the overall quality of UK housing stock.”

Stephen Ludlow, Chairman of ludlowthompson

Ludlow added that landlords benefitting from an increase in rents may wish to use the additional income to make their properties more energy efficient.

“Despite changes to tax reliefs, buy-to-let landlords claimed back an increased amount from the taxman in the last year.”

“Within an inflationary environment, buy-to-let remains an attractive investment because landlords have the opportunity to increase rents in line with wage growth.”