UK households to be saddled with heaviest tax burden since 1940s

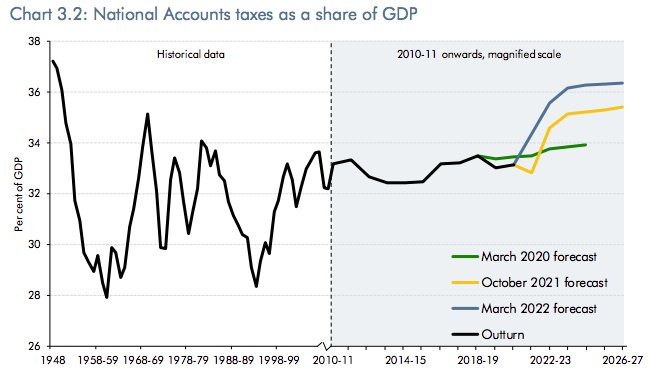

UK households are set to be saddled with the heaviest tax burden since the 1940s even when Chancellor Rishi Sunak’s income tax cut and national insurance tweaks are baked in.

Britain’s fiscal watchdog is forecasting the tax burden to hit 36.3 per cent in four years’ time, it said in fresh forecasts published today.

The damning forecasts come despite Sunak announcing today the threshold at which workers start paying national insurance contributions will rise £3,000 in July to bring it in line with the income tax allowance of £12,570.

Sunak promised to cut the basic rate of income tax by one percentage point to 19 per cent by the end of this parliament in 2024, in what is being seen as a bid to boost the Conservatives’ chances of winning the next election.

A combination of the freezing of income tax thresholds and elevated inflation pushing Brits into higher tax brackets will offset the giveaways.

“The cuts to income tax and national insurance are effectively paid for by increasing revenues as a result of fiscal drag,” Paul Johnson, director at the Institute for Fiscal Studies (IFS), said.

Fiscal drag occurs when workers who receive a pay rise as a result of inflation are subjected to paying more tax for each additional pound they earn due to tax thresholds not rising in line with inflation.

“The freezing of the income tax personal allowance and higher rate threshold turn out to be much bigger tax rises than first intended,” Johnson added.

“As a result, almost all workers will be paying more tax on their earnings in 2025 than they would have been paying without this parliament’s reforms to income tax and NICs, despite the tax cutting measures announced today.”

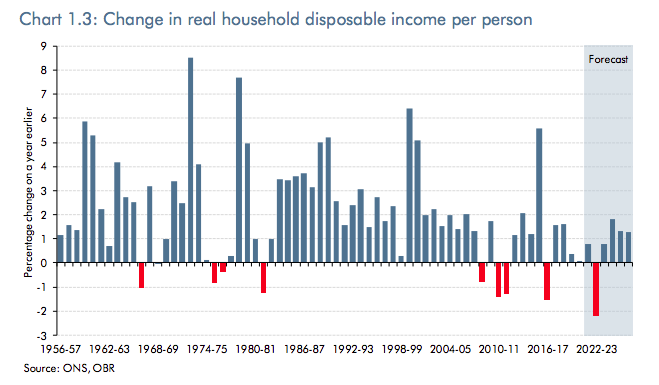

A combination of historic high inflation, swelling energy bills and tax hikes will erode living standards at the sharpest rate since record began in the mid 1950s, the Office for Budget Responsibility (OBR) said.

“The rise in inflation to a 40-year high this year is expected to reduce real household disposable incomes on a per-person basis by 2.2 per cent in 2022-23, the biggest fall in living standards in any single financial year since ONS records began in 1956-57,” it said.