Exclusive: Yü Group boss hopes to pick ‘low hanging fruit’ from Big Six suppliers

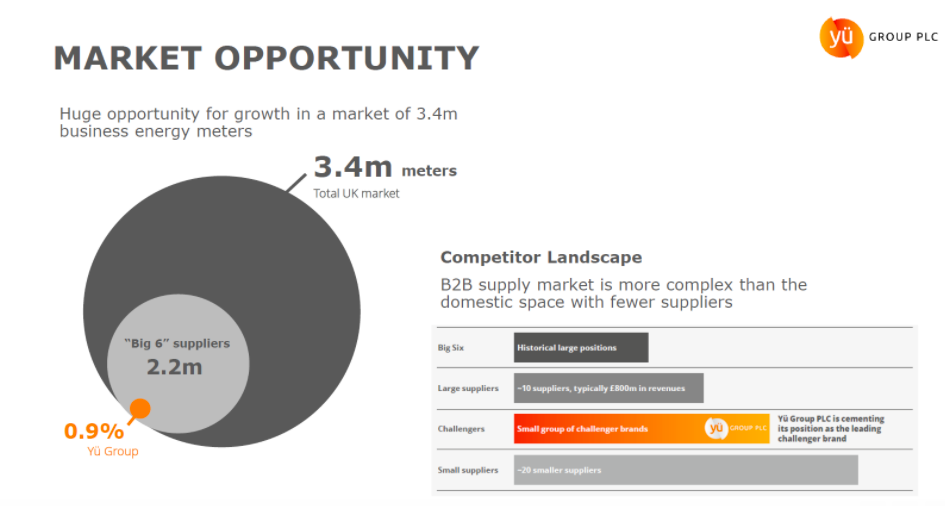

Big Six energy firms are “asleep at the wheel”, meaning challenger suppliers have a great opportunity to pick “low hanging fruit” amid market volatility, revealed Bobby Kalar, group chief executive of Yü Group.

He told City A.M.: “They are so bloated in terms of their response, and their ability to move in changing market conditions. I think for years and years, we will enjoy poaching contracts from the bloated underbelly of the Big Six.”

The Big Six – which enjoyed a 97 per cent market share at its peak – no longer exists in its most recognised form, with Npower becoming a subsidiary of Eon in 2019, while Ovo Energy acquired the retail arm of SSE last year.

Instead it is now used as a broader term to define the biggest players in the market – which Kalar believed had become complacent.

He argued Yü Group would continue to thrive in a market place where it could operate more nimbly than its larger more established counterparts, turning around attractive contracts for potential customers at speed and with a consistent hedging strategy.

The company provides energy to businesses across the UK via its supplier group Yü Energy, which has grown from 4,200 metre points to over 30,000 in the past six years.

Yü Group is listed on the FTSE AIM All-Share, and while its share have dropped 7.2 per cent today – its published full-year results are encouraging.

The supplier has seen revenues rise 53 per cent from £101.5m to £153.4m, with a healthy profit of £4.5m.

Expanding the business in an escalating energy crisis

The escalating domestic energy crisis has seen dozens of suppliers’ collapse over the past six months but Yü Group has managed to survive and thrive – scooping up customers from three fallen firms through the supplier of last resort process.

This includes 2,500 from AmpowerUK last November, and a combined 550 from Xcel Energy and Whoop Energy earlier this year.

The chief executive attributed Yü Group’s success in navigating the market’s stormy seas to the company’s vigorous protection of its gross margin, which he described as “the lifeblood of the business.”

It has also not been constrained by the price cap – which limited the ability of consumer-focused suppliers to pass on soaring wholesale costs this winter to customers.

He also criticised the strategy of fallen firms, suggesting that many of the collapsed energy suppliers did not enter the market with sustainable hedging strategies, instead focusing too much on rapid expansion.

Kalar said: “What you’ve seen in terms of the exits over the last year or so are businesses that thought they could either play the wholesale market or carve out their gross margins in order to generate scale. Obviously, they’ve been caught out.”

Meanwhile, Kalar did not rule out a play for Gazprom Energy’s customers – which currently supplies 20 per cent of the energy needs for UK businesses.

The company is reportedly chasing buyers after a mass exodus of clients following Russia’s invasion of Ukraine, with the government fearing it could fall into special administration.

When questioned over its current situation, he confirmed Yü Group would be interested in their clients.

He said: “I see no reason why we shouldn’t be. These customers are publicly-listed companies, shopkeepers, NHS hospitals or local councils, district councils. They all need gas and electricity.”

Higher energy bills are here to stay

As for potential headwinds facing energy suppliers, he suggested managing customer behaviour was key – with consumers set to face elevated energy prices with soaring wholesale costs baked into the market.

Prices are currently hovering at £2.26 per therm, and while he expected this to ease– it was unlikely to fall to previously established rates, with wholesale costs at around 47p per therm this time last year.

As for potential tailwinds, he was optimistic that digital innovation in the business supplier world could be the gamechanger, giving the customer the ability to self-serve and self-manage.

He said: “It’s a world of millennials now. Forty five per cent UK businesses are small businesses operated by millennials. They want to operate their businesses on a tablet or phone – they don’t want to talk to people.”

Focusing on the future, he recognised there was always the possibility of interested parties making an offer for as a growing supplier in a difficult market.

Kalar concluded: “We’re a listed stock – so I can see that happen as we scale, as we create efficiencies as we establish our digital programmes, and as we fully transition to an automated business.”