Oil remains well above $90 per barrel amid looming prospect of war in Ukraine

Oil remains stable with prices hovering near the seven-year highs recorded last week amid continued concerns over supply and rebounding post-lockdown demand.

This is despite fresh diplomatic efforts to resolve tensions between Russia and the West over Ukraine, with reports this morning that US President Joe Biden and Russian President Vladimir Putin could meet for a summit later this week.

However, the Kremlin has since denied there is any immediate chance for a meeting, with Putin reportedly considering requests from two separatist-backed regions in Ukraine to be recognised as independent.

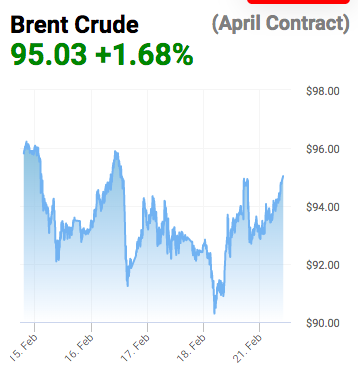

Brent Crude is up 0.59 per cent, following nine successive weeks of gains, $94.09 per barrel, while WTI Crude has enjoyed a 0.6 per cent boost – rising to $91.63.

Prices remain in close proximity to the $100 per barrel market, with analysts speculating the milestone could be breached later this year.

Meanwhile, talks between the US and Iran over reviving the 2015 nuclear deal are progressing, raising hopes of fresh supplies into tightening markets.

Iranian foreign ministry spokesperson Saeed Khatibzadeh said “significant progress” had been made in talks to revive Iran’s 2015 nuclear agreement on Monday after a senior European Union official said on Friday that a deal was “very, very close”.

Callum Macpherson, head of commodities at Investec, said: “Developments on Iran talks helped to undermine oil prices last week. There does seem to be a fresh impetus to reach a deal and diplomats suggest talks are going to be wrapped up by the end of this month. A deal to end sanctions could bring an additional 1m barrels per day of crude to world markets.”

Craig Erlam, senior market analyst at OANDA told City A.M. that rising tensions in Ukraine remained the key factor.

He said: “We’re seeing risk aversion across the board and oil prices are once again on the march higher. Talks between the US and Iran do appear to be progressing well and an agreement may not be far away which will certainly alleviate some of the pressures in the oil market. But whether that will be enough to offset the Ukraine risk premium is hard to say as Russia is a massive producer.”

European Commission President Ursula von der Leyen has warned Russia would be cut off from international financial markets and denied access to major exports needed to modernise its economy if it invaded Ukraine.

The supply crisis could be exacerbated further by OPEC+ which as failed consistently to reach raised output production targets.

Multiple members have missed production quotas with the organisation continuing to perform below expectations of adding 400,000 barrels per day to oil output each month.

Underinvestment is also driving prices higher, with NatWest the latest to reveal it has significantly cut lending to the UK’s oil and gas sector.