Can Volkswagen catch Tesla in the electric vehicle race?

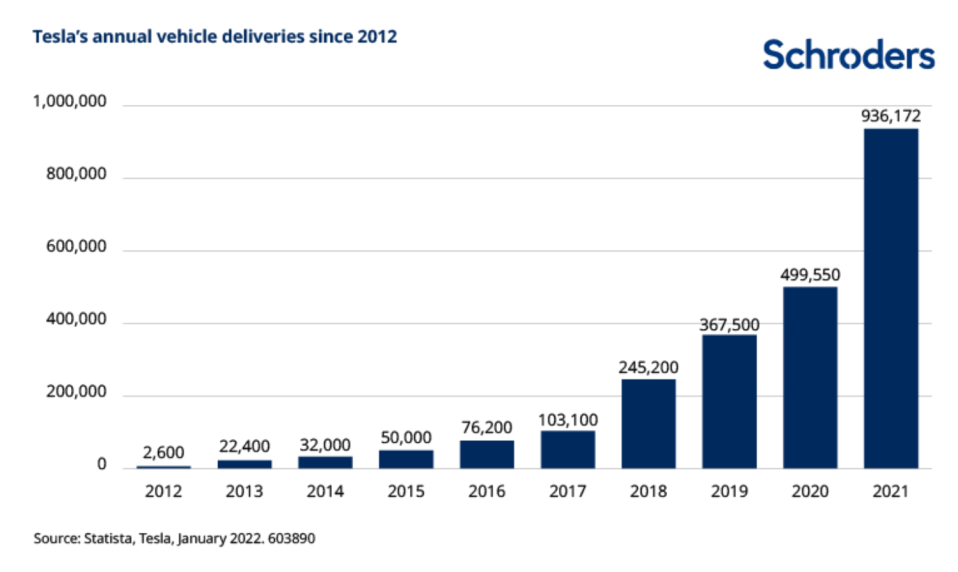

Tesla raised some eyebrows last month as it unveiled an 87% year-on-year rise in vehicle deliveries to over 936,000. In terms of battery electric vehicles (BEVs), this puts it some distance ahead of its European rivals, including Volkswagen AG with less than a half of Tesla’s deliveries (452,900).

There are three main reasons for Tesla’s significant outperformance versus its rivals when it came to the delivery of BEVs in 2021:

- A greater commitment to bringing important parts of the supply chain in-house. We see this at its most pronounced in Tesla’s early ambition to be both a user and supplier of battery cells. In doing so, the company gained a head start on managing what is (and will remain for some years) an incredibly tight supply chain, especially in regards to rare metals and minerals.

- Where Tesla’s supply chain does rely on external players, its early scale and ambitious products placed it at the front of the preference queue for suppliers. In simple terms, the company was better placed to buy chips during the 2021 shortage. This was because of bigger order volumes (1m units targeted vs 500k at VW last year) and content per vehicle (more advanced software functions like high level self driving require greater computing power and higher value chip content).

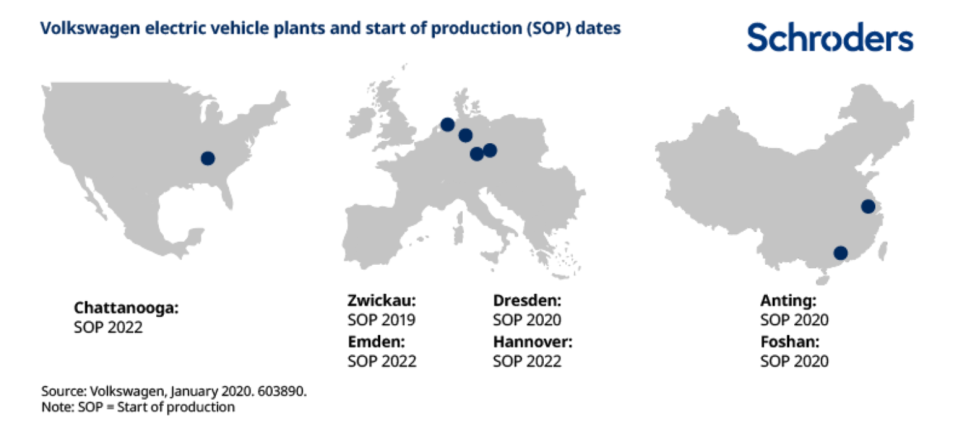

- Tesla was ready for the BEV transition because it is all it has ever planned for. By the end of 2019, Volkswagen was readying its first BEV plant (Zwickau) while Tesla already had three ‘Gigafactories’.

Meanwhile, with BEV demand soaring across Europe and China, Tesla’s established portfolio of Models S, 3 and Y offered choice to the consumer without compromising on performance. By contrast, most legacy European carmakers were only really moving towards their first serious next generation BEV launch (Renault’s ZOE, Stellantis/Peugeot’s e-208 and VW’s ID3).

Hurdles in Volkswagen’s path

Among the traditional automakers, Volkswagen can be considered an innovation leader when it comes to BEVs. However, it can’t hide from the fact it has a legacy cost base to manage. After all, those BEV deliveries of 452,900 come in the context of total vehicle deliveries of nearly nine million.

For Volkswagen, the production of internal combustion engine (ICE) cars has to be managed down carefully so as not to drop volumes below the profit breakeven point. There are also staff who need retraining on electric vehicle production.

Perhaps most importantly, Volkswagen has a shareholder base that could be spooked by any dilution in profit margins. A faster switch to BEV production last year would certainly have brought about a fall in profit margins. Despite an accelerated drop in battery cost, the most profitable BEVs are still only at breakeven operating margins.

So far, the stock market has been willing to reward Tesla for the future profitability of its BEVs, but hasn’t done the same for the traditional carmakers.

Volkswagen wants to produce more BEVs than Tesla but has set 2025 as the deadline for this. This seems realistic given the budget: Volkswagen has €52 billion of BEV-related investment coming over the next five years and a total budget relating to BEV, hybrids and software of €89 billion. On research & development spend alone, Volkswagen’s annual spend of €15-20 billion p.a. dwarfs Tesla’s current $1.5 billion.

Discover more by visiting Schroders’ insights or click the links below:

– Read: Central banks diverge in the face of spiking inflation

– Listen: In search of the next generation of mega caps

– Watch: Why now’s not the time to be making big bets

It’s not all about the BEV race

Other companies have different strategies and are not competing in the same BEV race. Stellantis, formed by the merger of Fiat Chrysler with Peugeot, is one such example.

Despite a very successful roll-out of early BEVs, Stellantis is now one of the few carmakers that believes a mixed powertrain strategy of BEV, PHEV (plug-in hybrid EVs) and MHEV (mild hybrid EVs) is the most efficient way to achieve both industry-leading profit margins and compliance with emissions regulations.

The key thing with Stellantis is that mass market products dominate the brand portfolio. As BEV profit margins improve, government subsidies for purchases will taper off. This means that the process of BEV adoption for the less wealthy consumer will be far more gradual, leaving companies like Stellantis to continue to service their needs via hybrids.

A highly cost efficient platform approach is required for this, so good execution of such a strategy is crucial. That said, if CEO Carlos Tavares’ record on improving profit margins at Peugeot is anything to go by, Stellantis stands a good chance of being the carmaker to pull this off.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.