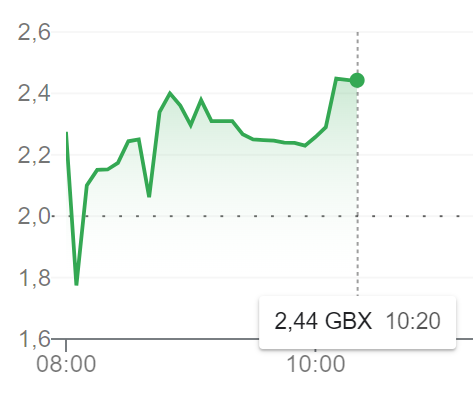

Live to fight another day: Amigo Loans’ stock makes much-needed 22 per cent comeback after two days from hell

Amigo Loans share price is climbing this morning, recording a 22 per cent increase after two dramatic days.

Yesterday, the lender’s stock dropped nearly a third after the company said late on Monday night that its chief financial officer, Mike Corcoran, will step down immediate effect.

“The Company anticipates it will be able to announce the appointment of a replacement Chief Financial Officer, in the near future,” Amigo said in a statement sent to City A.M. “Corcoran will continue to support the business through an appropriate handover period.”

Amigo warned on Monday that the company will collapse if a new scheme to pay back customers and restart lending is not approved.

The embattled lender announced plans to raise £97m to compensate customers and £15m to restart lending, warning that the company will enter a wind down scheme or insolvency if it does not receive approval.

Amigo Holdings shares tumbled by 41.9 per cent in the wake of fresh details about its proposed compensation scheme which will see 19 new shares issued for every existing company share as part of plans to repay customers.

Dispute

The lender is facing a drawn out dispute with the High Court for offering irresponsible guarantor loans with an interest rate customers would never have been able to pay back.

“The Board is fully committed to providing the maximum amount of redress possible for qualifying creditors,” said Gary Jennison, the chief executive of Amigo.

“Should creditors vote for the New Business Scheme and the Court subsequently approve it, these provisions provide additional protection for creditors and address certain of the concerns raised by the Court above the previous scheme. They are necessary for Amigo to survive and avoid insolvency.”

Amigo Loans’ previous scheme to repay customers was rejected by the High Court as it could have seen successful complaints receive as little as five per cent to 10 per cent of any successful claim, and capped the compensation pool at £35m and 15 per cent of profits over the next four years.

The court called for higher payments to customers and for equity holders to lose their economic stake in the company if customers were not able to be paid in full.

Addressing these concerns, Amigo Loans’ current plan involves the company issuing at least 19 new shares for every existing share in the company, leaving existing shareholders with less than five per cent of share capital.