Exclusive: Railsbank CEO on finance’s ‘iTunes moment’, ripping up the rule book and the might of Amazon

British fintech Railsbank is eyeing up ‘unicorn’ status as it looks to raise $100m funding which would value the firm at over $1bn.

It follows a $70m funding injection last year from backers including Anthos Capital and Outrun Ventures, which bosses had suggested had left the firm with a valuation of close to $1bn.

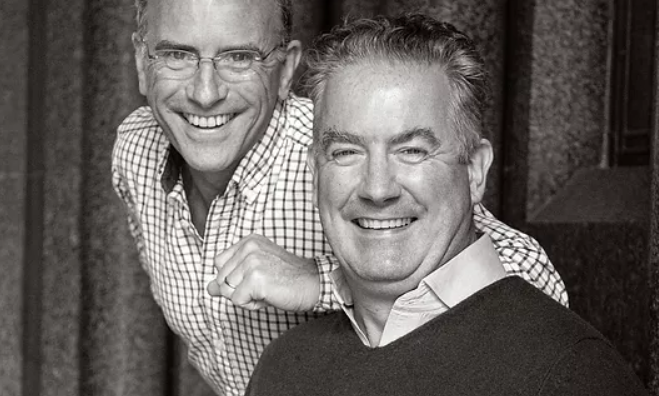

Time for City A.M. to catch up with Nigel Verdon, co-founder and the current CEO of Railsbank, which was founded in 2016 by Verdon and another fintech veteran, Clive Mitchell.

Headquartered in Liverpool Street, in the heart of the City, Railsbank recently announced a ramping up of its presence in APAC with new hubs in Singapore, Vietnam, Malaysia, and Australia.

The firm, which provides digital banking services to financial service and consumer companies, now has a presence across Europe APAC and the US and has grown to employ over 450 people worldwide.

According to new figures out this morning, UK fintech investments hit £27.5bn last year, a sevenfold increase in just twelve months. How do you stand out in this hyper-competitive market?

The world of finance is going through its ‘iTunes’ moment. The digital world has come for banking and companies like us are ripping up the established rule book. In the same way that music moving beyond hardware enabled whole new paradigms like music streaming, moving banking and financial products into the digital realm allows us to move quicker, innovate at a lower cost, and create whole new use cases.

“Companies like us are ripping up the established rule book.”

Nigel Verdon

Obviously we are not alone in recognising this, so one of the main ways we have stood out is to boldly place ourselves ahead of the curve and proactively lead the industry to the next big thing. So whatever stage the industry has been at – Open Banking, Banking–as-a-Service, or Embedded Finance, we have had one eye on the horizon, ensuring that we are ready to catch the next wave of innovation.

Give us an example of that.

Well, in 2021 we launched the ‘Embedded Finance Experiences’ category because we can see that that is where the technology and the market are going. So far Embedded Finance has been mainly deployed through stand-alone products. What we see coming is financial services being more deeply integrated in a whole customer journey. So we debuted the category and that gives us a leadership position that helps us stand out.

One report after the next reaches out newsdesk that you are raising fresh funds. What will you use this cash for, further international expansion?

We are looking at creating a framework that can let any company, of pretty much any size, in a matter of weeks start to offer financial services and become a ‘fintech’. The funding is there to help us expand as quickly as our customer base is, and to preach the good word to a wider range of verticals than before.

2016: Railsbank is founded by Nigel Verdon and Clive Mitchell

Nigel Verdon and Clive Mitchell are serial fintech entrepreneurs. Nigel previously established Evolution and Currency Cloud, among other successful and award-winning companies.

Originally founded in London, Railsbank has since expanded across Europe, SE Asia, Australia and the US.

Where do you see opportunities for growth?

One of the areas where we are seeing the strongest response is from sports teams. We talk about ‘the fan economy’, sports teams know that their fans have such a strong connection, be that football, motorsport or baseball, and they want to feel like they have a two-way connection with their team. Partly this is due to social media making sports stars so much more accessible, and that desire has evolved towards teams as a whole as well.

“There is a huge opportunity for sports team brands to leverage their position and become a bigger part of their fans’ daily lives.”

Nigel Verdon

Something like a team branded debit card which lets you collect loyalty points with every purchase is a really exciting prospect for fans, and for teams it means they can have more frequent positive interactions with their customers. And it’s all possible with embedded finance.

What are some of the main challenges your company and the wider fintech space are facing?

Across the fintech space there is a lot of consolidation, especially amongst the neobanks as some of them have set their sights maybe too high for the consumer appetite to leave traditional banks.

There is also the looming threat of some of the big tech players, the likes of Google and Amazon, making moves into the FS space, with their brand equity they pose a real threat to neobanks.

We have different aims, we want to work with the big tech players, we have the platform for them to plug into. Our challenge is making embedded finance and embedded finance experiences part of the lexicon of decision makers. The driver internally at our clients for adopting an embedded finance solution might be non-traditional, it could come from customer experience or from the marketing team, it doesn’t have to be CIO or CTO or even CEO. That’s an opportunity but it also means we need to be communicating across that many more channels because you never know who internally is going to see the light first.

So what is the next big trend in fintech?

This might surprise you but we think it’s Embedded Finance Experiences. What we are talking about is embedding financial services so deeply into brand interactions that they feel totally seamless. Whatever credit or BNPL service the customer needs is available directly from the brand they are interacting with and provides them with the experience they desire.

Think about how you approach buying a car. You don’t get excited about getting a loan, you get excited about the product, the loan then comes as part of that process. It’s that kind of customer journey more brands can embrace, thanks to embedded finance, product first, with finance supporting the acquisition.

Finally, let’s quickly touch on ESG,sSustainability is becoming an ever-increasing core concern for consumers. Do you feel that is a priority for many of your clients, too?

It is definitely a rising concern, especially amongst younger consumers. We did some research earlier this year and found that 52 per cent of 18-24 year olds are interested in a credit card that would actively support sustainability and the environment with every purchase.

“Sustainability is still something that the financial sector is getting to grips with, but we are seeing the tide change.”

Nigel verdon

Mastercard has had some success with the launch of its sustainable credit card for example, and our client HearWorld lets customers work out the carbon footprint of their purchases, giving them the tools to make more sustainable choices.

Let’s look ahead, what can we further expect in twenty twenty two?

2022 is going to be a really exciting year, both for businesses but also as a customer. Embedded Finance is already allowing exciting new products to be launched, but the thing you’re going to notice the most is how many of the friction points around payment disappear. We’re talking about the same kind of difference as moving from having to queue at a till at a supermarket to going to one of Amazon’s grocery stores where you don’t need to pay when you leave, you just walk out. That level of change in experience is coming to most of your day-to-day and even special purchases, and it’s going to be great!