Punch scraps its dividend as declining beer sales hit

Pubs group Punch Taverns is scrapping its dividend, the group said yesterday.

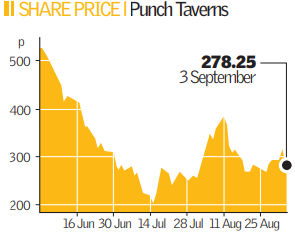

The move comes in the wake of reports of declining sales, which led to a plunge in the company’s share price. Punch shares closed down 12 per cent at 278.25p.

Punch Taverns said the move was prudent given the “challenging market conditions”. The pubs industry has experienced decreased sales figures after the smoking ban and increased competition from supermarkets through aggressive pricing on alcoholic beverages.

Additionally Punch Taverns says funds are needed for further investments and for keeping the balance sheet strong.

Richard Hunter, head of UK equities at broker Hargreaves Lansdown, commented: “Quite apart from the negative connotations, which normally accompany the scrapping of a dividend, there will be extra selling pressure on the shares from funds, which had previously held Punch as an income play.”

“This news is likely to lead to downgrades and put further pressure on a share price cent,” Hunter added.

Blue Oar Securities analyst Mark Brumby said Punch may have been forced into scrapping its dividend to avoid the risk of breaching bond conditions. But Punch maintained its cash flow remains strong.