Lehman and KDB ready for lengthy talks

Speculation surrounding Lehman Brothers reached fever pitch yesterday as Korea Development Bank (KDB) confirmed it was in talks to buy a stake in America’s fourth-largest securities firm.

The CEO of KDB, Min Euoo-Sung, formerly head of Lehman’s Seoul branch, confirmed yesterday that the state-run bank was in talks with Lehman, led by CEO Dick Fuld.

But discussions could take some time to reach a conclusion after Min told local journalists that the two companies had yet to agree on price, due to “differences over the scale of Lehman Brothers’ potential liabilities”.

And a source familiar with the talks said that reports of an imminent deal were premature. He said the bank would need to consider selling $24.9bn of its residential property portfolio and $39bn in commercial and real estate before reassessing its capital position in advance of any deal with KDB.

He added that Lehman was not desperate for a capital injection after raising £13bn this year and said a tie up with KDB would advance the bank’s access to key Asian markets by several years.

Conflicting reports have emerged about the scale of KDB’s interest in Lehman, with speculation ranging from a full buyout to a $6bn purchase of 25 per cent of the company.

KDB would look to team up with a consortium of Korean lenders to help finance an investment after the country’s top financial regulator, Jun Kwang Woo, warned last month that a state-run bank should be wary of investing in overseas banks alone.

A spokesman for Woori Bank, one of the institutions thought to be targeted as a joint investor by KDB, said the bank would need to wait before making a decision on whether to take part in a bid.

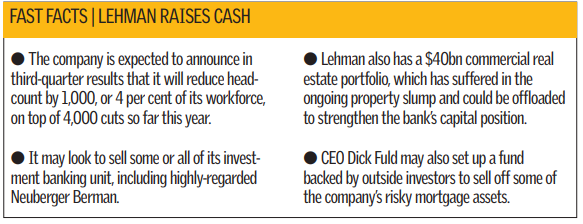

Fuld, 62, has been weighing up various capital-raising measures recently, with rumours persisting that the bank will sell its investment banking arm, including showpiece unit Neuberger Berman, led by George Walker. The company is also continuing efforts to reduce its headcount, with 1,000 jobs expected to go when the company announces third-quarter results, expected to include new write downs of up to $4bn. Shares in Lehman rose 3.2 per cent today on the speculation. Its shares have fallen more than 70 per cent since the beginning of the year, valuing the bank at around $11bn.