Savills sales plunge fails to dampen mood

Property group Savills was buoyant yesterday, despite a 41 per cent slump in first-half underlying pre-tax profit to £19.2m, owing to ailing commercial and residential property markets.

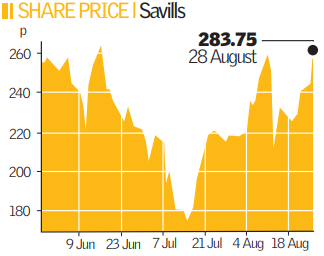

The company saw its shares soar 17 per cent to 283.75p yesterday, as an 88 per cent fall in profits to £2.5m at its residential and commercial sales division failed to dent investor confidence.

And Savills enjoyed good performance from units including its property management arm, where profits jumped 58 per cent, and its consultancy division, which enjoyed a 13 per cent rise. Group revenue fell from £284.2m to £278.1m.

A spokesman for Savills said: “This is a pretty robust set of results while our competitors are having a tough time. Yes, transaction volumes have fallen but that has been made up for by strong performance elsewhere.”

The company said cost-cutting measures were in full swing and it expects to meet its savings target of £20m in 2008 by cutting jobs and reducing costs in marketing, travel and property.

Savills’ financial services arm is also in line for cost-cutting measures, after reporting a 59 per cent drop in profits to £700,000. The company would not say how many jobs might be cut across the group.

However, deteriorating conditions in the housing market continue to cause Savills problems, with transaction volumes in London down 45 per cent on last year as the housing market continued to slow.

The group expects house prices to fall by as much as 25 per cent by the end of next year, before recovering to 2007 levels in 2012.