Guinness gears up to offer retail fund

Guinness family wealth-management office Iveagh yesterday announced the launch of its first retail fund, the Iveagh Wealth Fund.

The fund’s objective is wealth preservation, rather than rapid growth, and it is aimed at families seeking to pass wealth on to future generations. In a statement, Iveagh said the fund had been launched to meet demand from wealthy families for a flexible, multi-asset product which can weather volatile markets yet remain relatively liquid.

Minimum investment is £50,000, or the currency equivalent, with expected annualised returns of 9.5 per cent.

In contrast to traditional fund management, the new fund’s open-ended investment company (OEIC) structure means that clients can move in and out of the fund over a shorter timeframe, whilst benefiting from a broad range of investments.

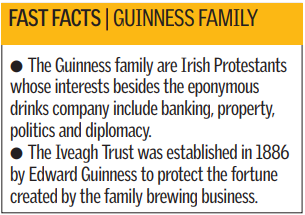

Managed by John Ricciardi, Cambiz Alikhani, and the Iveagh Investment Committee, the Iveagh Wealth Fund aims to replicate returns obtained by the Iveagh wealth management portfolio – which represents, among others, the Guinness family and Italian aristocrat Count Nicolo Sella di Monteluce.

James Higgins of financial advisors Chamberlain de Broe, said: “Of particular appeal is Iveagh’s predictive modelling, which has been so consistent and helpful over the recent very difficult years.”