Liberty surges on speculation over fierce bidding war

Liberty International saw its shares receive a welcome fillip yesterday as US mall owner Simon Property Group upped its stake in the UK shopping centre specialist to 4.22 per cent, prompting speculation of a bidding war.

Australian property group Westfield, the world’s largest shopping mall owner by market cap, also confirmed yesterday that it had built up a 2.96 per cent stake in Liberty worth around £91m during June and July, sparking rumours that the two were preparing a collaborative bid approach.

Simon, which is the largest US public real estate company, has worked with Westfield’s American arm on acquisitions before, when the pair joined with The Rouse Company in 2002 to buy real estate assets from Rodamco North America.

But a source close to Liberty International said it was highly unlikely a bid from Simon and Westfield, collaborative or otherwise, was on the cards.

“I would think that neither of them have strong enough capital bases to make an approach,” said the source, adding that any attempted bid would need the approval of Sir Donald Gordon, Liberty founder and life president, who owns 22 per cent of the company.

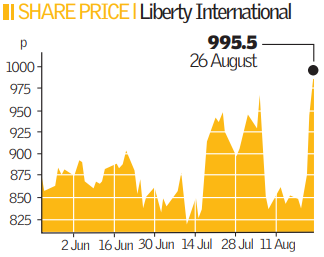

Liberty’s share value jumped 5.34 per cent on the speculation, reaching 995.5p on the London Stock Exchange at the close of trading yesterday.

The share jump was a much-needed boost for Liberty, which owns around £8bn of mostly retail assets, including London’s Covent Garden Estate. The UK’s third-largest real estate investment trust has seen its shares fall more than 16 per cent in the last year.