Listings fall trims profits at UK broker

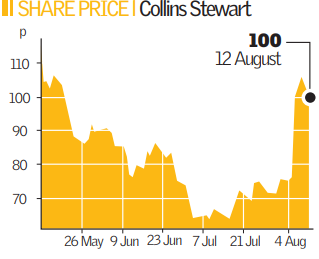

Collins Stewart, the British broker that is currently the subject of takeover discussions, reported an 82 per cent slump in first-half profits yesterday, which it blamed on poor performance from its capital markets unit.

Pre-tax profit nosedived from £52m to £9.6m and the interim dividend was slashed from 2.5p to 1.2p, as chairman Terry Smith pointed to challenging conditions which he said had impacted on the group’s capital markets division. A drought in new equity issues saw the unit post a loss of £10.5m.

Smith said: “We expect the difficult market conditions experienced in the first half to continue at least into 2009.”

He highlighted strong performance from the bank’s Hawkpoint, securities and wealth management divisions, which he said had offset losses elsewhere.

But all three saw their operating profits fall nonetheless. Profits in the bank’s securities division fell from £9.5m to £6.3m, while its wealth management division reported operating profits of £5.7m, down from £6.7m.

And Hawkpoint, the group’s M&A advisory arm, reported a fall in operating profits from £8.5m to £5.6m as the number of deals began to dry up.

The company also confirmed that it had received a takeover approach from a third party, although it declined to name the suitor. Japanese investment bank Nomura is strongly rumoured to be the interested party.