Record investment for private equity

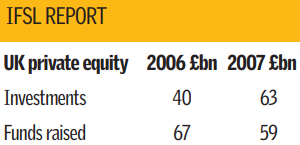

Private equity invested a record $686bn (£343bn) globally last year, over a third more than was invested in 2006, according to think tank International Financial Services London (IFSL).

The UK buyout market is the most developed in the world, outside the US, managing nine per cent of global investments and 12 per cent of funds raised in 2007. Over 70 per cent of investments made by UK private equity abroad were in Continental Europe, and around 20 per cent in the US.

The UK raised half of all funds secured by private equity in Europe, the IFSL found.

Private equity firms were most active in North America, which accounted for 71 per cent of all investments and two thirds of total funds raised last year.

Europe followed in second place, accounting for 15 per cent of all investments and 22 per cent of global funds raised.

Asia-Pacific and emerging markets were quickly catching up, particularly China, Singapore, South Korea and India.

Despite the credit crunch, which affected financial markets in the second half of the year, the IFSL found global activity was equally split between the first and second halves of the year.

However, it said that early indicators show activity dropped off in the first half of 2008 as it became more difficult for buyout firms to get hold of financing from banks to complete deals. This has allowed other sources of funding to enter the market, such as sovereign wealth funds.