UK unemployment rate shrinks faster than expected to 4.7 per cent

The UK jobless rate shrank faster than expected over the last quarter as employers hired workers rapidly to cope with soaring demand triggered by the lifting of Covid restrictions, according to official figures published today.

Latest data from the Office for National Statistics shows the unemployment rate dipped 0.2 per cent over the last quarter to 4.7 per cent.

Economists polled by Reuters had expected the unemployment rate to hold steady at 4.8 per cent.

Rishi Sunak, chancellor, said: “Today’s figures show that our Plan for Jobs is working – saving people’s jobs and getting people back into work.”

“I know there could still be bumps in the road but the data is promising – there are now more employees on payrolls than at any point since March 2020 and the number of people on furlough is the lowest since the scheme launched.”

Jonathan Athow, deputy national statistician for economic statistics at the ONS, said: “The world of work continues to rebound robustly from the effects of the pandemic.

“The number of people on payroll was up again strongly and has now grown over half a million in the past three months, regaining about four-fifths of the fall seen at the start of the pandemic.”

The number of job vacancies in the UK soared to a record high over the last quarter as employers were plagued by severe worker shortages.

The ONS revealed there were 953,000 job vacancies between May and July of this year, a record high.

Although the number of payrolled employees jumped 182,000 over the last month to reach 28.9m in July, the tally is still 201,000 below its pre-Covid level, highlighting that the labour market still has some way to go in its recovery from the pandemic.

Mims Davies MP, minister for employment, said: “There are positive signs of recovery in today’s jobs figures with the number of young people and older workers on payrolls up on the quarter and the employment rate increasing to 75.1 per cent.”

“There is still work to do and we’re focused on helping employers fill roles through our Plan for Jobs – giving people of all ages the skills, support and experience needed to confidently land that next opportunity.”

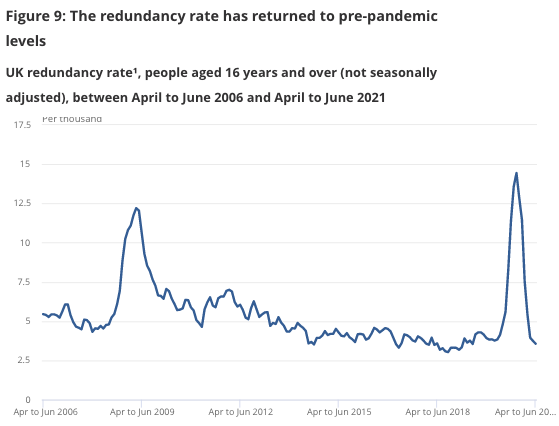

Encouragingly, there were no signs of redundancies picking up ahead of the end of the furlouh scheme, the ONS said. Many have predicted a surge in job losses as the end of the furlough scheme approaches as a result of firms attempting to pre-empt shouldering a higher wage bill.

However, experts were cautious to interpret the figures as a sign that the labour market has averted a wave of layoffs.

Yael Selfin, chief economist at KPMG UK, said: “For some sectors, the ending of the furlough scheme in September could come before a significant recovery in demand, threatening to create a wave of redundancies later this year.”

Martin Beck, senior economic adviser to the EY Item Club, said: “Looking ahead, the jobless rate could feasibly creep up in the short-term: an easing of restrictions has made searching for a job easier, and this could result in people moving from inactivity to seeking a job and therefore being picked up in the numbers again.”

“But the risk of a serious increase in joblessness when the furlough scheme closes in September looks low.”

The economic inactivity rate, which measures people’s engagement with the labour market, dipped 0.2 per cent over the last quarter to 21.1 per cent, but is still 0.9 per cent higher than pre-Covid levels.

Average earnings fly

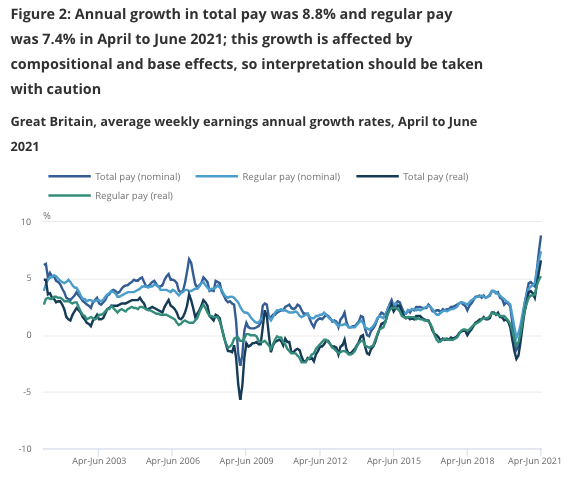

Average earnings flew over the last quarter, driven by a large proportion of the workforce coming off furlough and having their pay restored to pre-Covid levels.

Average total pay shot up 8.8 per cent over the last quarter, the ONS said, higher than the 8.5 per cent forecast by the Bank of England.

However, the sharp rise can be mainly attributed to comparisons between the last quarter and the same period last year being skewed as a result of the furlough scheme arificially reducing people’s wages.

A large proportion of job losses have been concentrated within low paying sector, which has exacerbated baseline effects.

Thomas Pugh, UK economist at RSM, thinks underlying pay growth is closer to three per cent.

The sharp rise in earnings will intensify pressure on ministers to assess the appropriateness of the state pension triple lock.

Under the policy, the state pension rises by whatever is highest out of average earnings growth, inflation or 2.5 per cent.

Laith Khalaf, head of investment analysis at AJ Bell, said: “The high rate of headline earnings growth does hem the government into a tight little corner on the State Pension triple lock.”

“The Conservative manifesto commits to maintaining the triple lock, but an 8% rise in the state pension would raise questions of intergenerational fairness, as well as fiscal sustainability.”