Savers predict double-digit investment returns: is that a danger sign?

Savers today are more optimistic than at any point in the past five years, expecting their future investment returns to average more than 11 per cent per year. They are more likely to invest further, and to check up on their investments more frequently – but most striking of all they expect higher future returns.

The findings are part of the Schroders Global Investor Study 2021, the bellwether annual survey which highlights trends based on the answers and opinions of more than 23,000 savers around the world.

This latest forecast – showing what savers reckon they will get each year between now and 2026 – represents the most upbeat view since 2016, when the survey began.

Investors’ optimism set against rollercoaster background

All the more surprising is that this optimism comes at a time of extreme uncertainty, as global economies continue to recover from the seismic shock of the pandemic. Previous studies in this series have shown annual return expectations creep up by around a tenth in four years, from 10 per cent in 2017 to this year’s 11.3 per cent, as shown in the chart below. This is despite the fact that actual investment values have followed a much rockier path.

As the orange data series shows, real-life stock market returns during this period proved highly volatile, ranging from 28 per cent growth in 2019 to a drop of 8 per cent in 2018.

Last year encapsulated this volatility in an even shorter timeframe: spooked by the spread of Covid-19, global share prices fell 34per cent, but regained – and then exceeded – their previous level all within nine months***.

Discover more at Schroders.com/GIS or click the links below:

– Retirement planning? Sorry, we’re too busy watching Netflix

– Chasing “financial independence retire early” (FIRE): is it possible?

– The inescapable truths faced by investors

Professional forecasts are far more modest

Forecasts by Schroders’ in-house economists, who regularly revise their annual investment return predictions, are much lower than investors’.

In January 2021 Schroders’ economists put annual long-term stock market returns for major markets such as the US, the eurozone, UK and Japan at 5.3 per cent, 5.6 per cent, 6.8 per cent and 3 per cent respectively****.

This is less than half the hoped-for returns of investors whose responses make up the Global Investor Study. And the economists’ predictions relate only to shares, which typically return considerably more than other components of a saver’s portfolio such as bonds and cash.

Similarly, while the surveyed investors’ expectations of returns have been rising year after year, Schroders’ economists’ predictions for returns in most developed markets have fallen over the past 12 months.

What could account for the divergence in these views?

Stuart Podmore, behavioural investment insights specialist at Schroders, suggests one explanation lies in investors’ emotional response to recent events and market movements. He reckons the pandemic’s upheaval has created anxiety, resulting in a less long-term mindset among investors, which is manifest in our need to monitor holdings’ performance more frequently.

“The pandemic, the lockdowns and all the associated disruptions might also have affected investors’ ability to process risk,” he says – with the potential result that “expectations of future returns become less realistic”.

The “expert” effect: have strong overall returns boosted investors’ confidence?

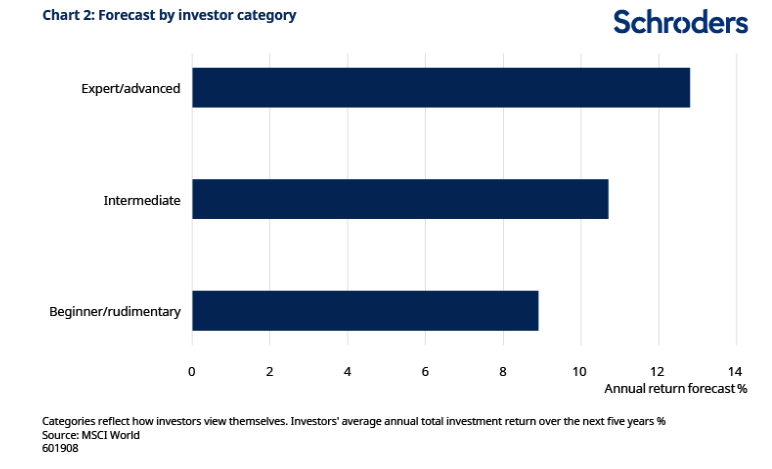

One fascinating aspect of this year’s study is that those investors who categorise themselves as “expert” or “advanced” in financial knowledge also have the highest expectations of future returns.

Those identifying as “expert” investors expect on average 43 per cent higher returns each year than investors classing themselves as “beginners”, or having “rudimentary” knowledge.

Interestingly, playing into Stuart Podmore’s theory, the proportion of investors classifying themselves as “expert” has also grown over recent years.

Looking back to earlier versions of the study shows that in 2018 – the first year in which investors were asked to categorise their knowledge – just 7 per cent termed themselves “expert” and 26 per cent “advanced”. By 2021, of the tens of thousands of respondents, the proportion self-identifying as “expert” had grown to 12 per cent and “advanced” to 29 per cent.

“What we may have here is an illustration of ‘hindsight bias’ and over-confidence,” said Stuart.

“Markets have been volatile in recent years but overall returns have been unusually strong. Because the outcome has been good, in that investors’ portfolios have risen in value, it’s only human to make the assumption – incorrectly as it happens – that all your personal decisions have been good, too. You start to feel that it’s your judgment calls which have worked out so well, rather than external factors which you can’t control. This in turn encourages people to feel more confident both about their own knowledge and to believe they will outperform others in the future.”

What is the danger? By succumbing to a cognitive error, such as hindsight bias, the risk is that savers lose sight of the long-term goals and plans which should underpin their investing. If circumstances change and outcomes appear less favourable, there is then a risk of responding irrationally.

“A positive trend arising from the pandemic and its uncertainty is a stronger interest by investors in the state of their finances,” Stuart said. “But the past 18 months have taught us that the future is difficult to predict. A measured approach to investing based on long-term objectives is likely to stand investors in better stead.

“We need to be cautious over investment return expectations. The outlook shared by many investors – in particular those who see themselves as experts – is exceptionally optimistic.”

***Refinitiv, Schroders

**** Schroders 30-year return forecasts: 2021-2050

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.