Stamp duty taper triggers dip in mortgage approvals

Mortgage approvals declined over the last month as the tapering of the stamp duty holiday deterred Brits from pushing ahead with homepurchases, according to official data published today.

Data from the Bank of England shows there were 75,152 mortgage approvals in July, the first full month after the stamp duty taper, down from 80,272 in the previous month.

Since July last year, property purchases under £500,000 have not been caught by the stamp duty levy. However, this changed after 30 June, with the threshold dipping to £250,000.

The lower threshold likely deterred Brits from buying homes due to the added tax charge making transactions more expensive. Latest data from the Office for National Statistics shows house prices rose 13.2 per cent annually in June to a record high £266,000.

Demand in the property market may also be contracting as a result of people being on holiday or enjoying their newfound freedoms after so-called “Freedom Day” on 19 July.

Imran Hussain, director of mortgage broker Harmony Financial Services, said: “July… [is] typically quieter than the earlier months of the year due to school holidays, so many families’ attention is diverted away from house-hunting and mortgages to keeping children entertained.”

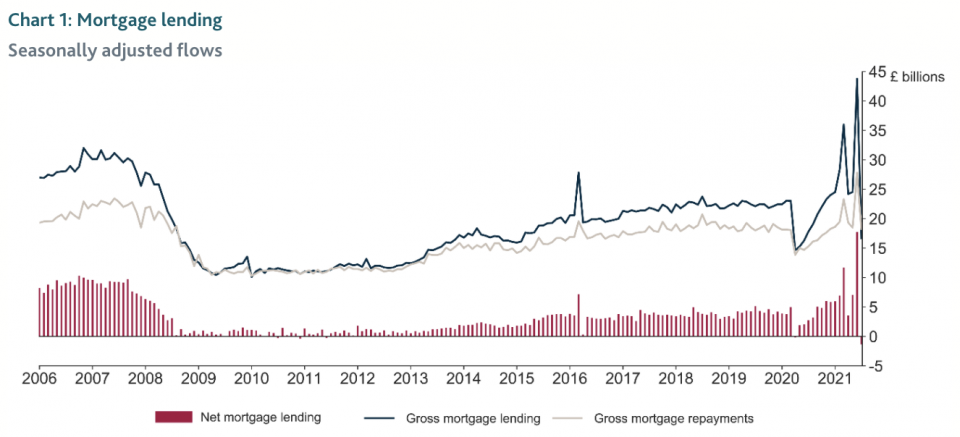

Meanwhile, consumers repaid £1.4bn in mortgage debt in July, driven by the historically low interest rate environment in the mortgage market.

Sandra Horsfield at Investec said: “There is little to suggest the outlook for the housing market is poor.”

“First and foremost, house prices should continue to receive support from the strong recovery in the labour market, which stands to benefit homebuyers’ incomes as well as confidence.”

Consumers repaid £100m on net in credit card debt, continuing a trend seen throughout most of the pandemic as a result of households’ taking the opportunity to pay off debts amid reduced spending during lockdown periods.

Households’ savings swelled £7.1bn in July, despite interest rates paid on deposits falling to a historic low.

Martin Beck, chief economic advisor to the EY ITEM CLUB, thinks consumers and firms will eat into the pile of savings amassed during the pandemic as the second half of this year progresses.