Nervous fund managers flee equities

Fund managers are stockpiling cash as the volatile market conditions force them to flee equities, according to a new report.

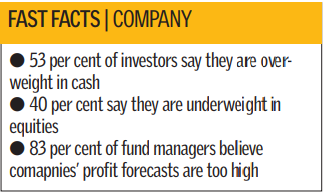

The survey of 191 fund managers, commissioned by investment bank Merrill Lynch, found that 53 per cent were now overweight in cash with 40 per cent underweight equities as investors’ risk appetite neared record lows last seen in March.

In spite of the equity sell off, only 16 per cent of respondents considered equities cheap. The majority, 83 per cent, said consensus earnings forecasts were still “too high,” with a third saying they were “far too high”.

The findings suggest that the the threat of recession is now stronger than inflationary risks, with a quarter of fund managers believing that slower economic growth will put the brakes on inflation.

These fears over the economic outlook are pushing many investors into the healthcare and pharmaceutical sectors, seen as defensive areas that tend to perform regardless of what the wider markets are doing.

The survey found that one third of European fund managers had an overweight position in healthcare and pharmaceuticals compared to zero in June.

“What investors are looking for right now is immunity from the ills of the market place and the healthcare sector provides that,” said Karen Olney, chief European equities strategist at Merrill Lynch. “Healthcare companies might have their own industry risks, but they do offer immunity from the three horrors that are bugging investors: a rising oil price, the slowing economic cycle and the credit crisis.”