Which stock markets look cheap?

The last time I wrote an update of stock market valuations was back in January.

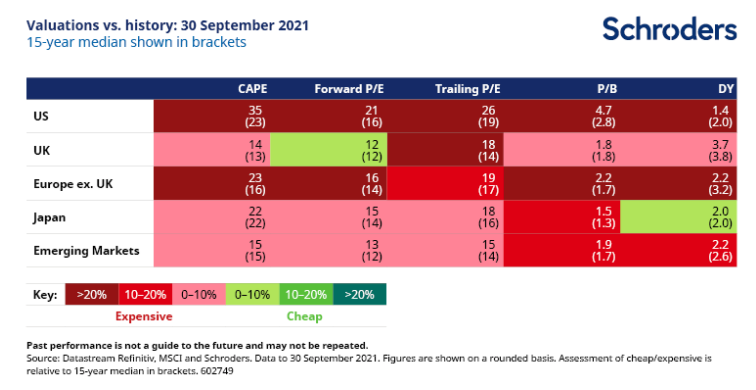

A great deal has happened in the world since then, but from a valuations standpoint, precious little has changed. Nothing is cheap. And the markets which were most expensive in January are still the most expensive. And those which were relatively cheap are still relatively cheap. Plus ça change.

The US remains outrageously expensive when compared to history. But, with the exception of the first few months of 2020, that sentence could have been written at pretty much any time in the past few years. Very recently, US stocks have struggled, but this has been spurred more by the sensitivity of this market to a sharp rise in bond yields than something which could be attributed to a valuation-driven sell off.

It is true that the two markets to perform best in September are also those which hint at offering some reasonable value – Japan and the UK. Japan was up by 4.5% and the UK flat, while US stocks fell by 4.7%. If you were feeling generous, you could possibly argue that valuations may have played a part. But I wouldn’t overdo it. The UK benefited from having a relatively large exposure to the energy sector, against a backdrop of soaring energy prices. And Japan gave up most of September’s outperformance in only the first few trading days of October.

Plus, as all sensible investors should know, valuations are useless at predicting short term moves in markets, even if hindsight sometimes tempts us to explain them that way.

Discover more at Schroders insights and click the links below:

– Read: Can UK handle a rate rise as economy rebounds?

– Listen: The “stag” party no one wants an invite to

– Watch: How Covid-19 has affected the Inescapable Truths

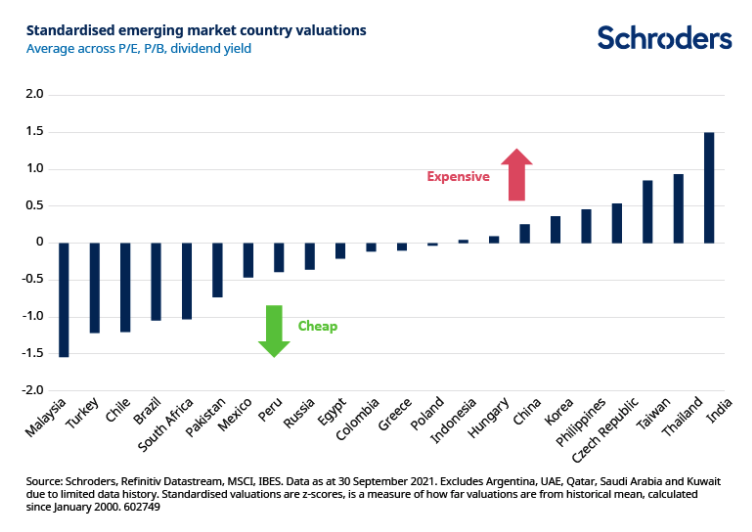

One change that is worth highlighting is that emerging market equities have cheapened a fair amount recently – mainly because of tumbling Chinese stocks. Relative to developed markets, they are cheap – not ridiculously so, but better value than they were.

This highlights an important point about emerging market equity investing. China makes up over 30% of the market, and the combination of China, Korea and Taiwan more than 60%. They completely dominate headline performance and valuations. But this downplays the great diversity on offer.

Emerging markets in Europe, the Middle-East and Africa (EMEA) have returned more than 20% this year, while Asia and Latin America are both down. And, even within Asia, India is up almost 30% and Taiwan almost 20%. In Latin America, Argentina has soared (+20%) while Brazil struggled (-12%).

On the valuation front, there are similarly lots of differences between emerging markets. Asia is the most expensive region, though not to the same extent as it was, as stock prices in expensive sectors have fallen sharply this year. Latin America is the cheapest region, driven by a marked increase in earnings expectations in the materials and energy sectors. In EMEA, some countries are very cheap, while others have more neutral valuations.

I’m increasingly convinced that we do emerging markets a disservice by lumping them all together and talking about them as if they were a homogenous block. To be clear, I’m not suggesting that everyone should build a portfolio of individual countries. The effort to work out the right mix and manage it on an ongoing basis is too much for most people to want or be able to do. But we should at least think more about what’s going on beneath the bonnet.

And, if you do want to take advantage of this diversity, an active fund can be one way to do it (yes, I know, I work for an active manager so of course I would say that, but I also believe it).

The pros and cons of stock market valuation measures

When considering stock market valuations, there are many different measures that investors can turn to. Each tells a different story. They all have their benefits and shortcomings so a rounded approach which takes into account their often-conflicting messages is the most likely to bear fruit.

Forward P/E

A common valuation measure is the forward price-to-earnings multiple or forward P/E. We divide a stock market’s value or price by the earnings per share of all the companies over the next 12 months. A low number represents better value.

An obvious drawback of this measure is that it is based on forecasts and no one knows what companies will earn in future. Analysts try to estimate this but frequently get it wrong, largely overestimating and making shares seem cheaper than they really are.

Trailing P/E

This is perhaps an even more common measure. It works similarly to forward P/E but takes the past 12 months’ earnings instead. In contrast to the forward P/E this involves no forecasting. However, the past 12 months may also give a misleading picture.

CAPE

The cyclically-adjusted price to earnings multiple is another key indicator followed by market watchers, and increasingly so in recent years. It is commonly known as CAPE for short or the Shiller P/E, in deference to the academic who first popularised it, Professor Robert Shiller.

This attempts to overcome the sensitivity that the trailing P/E has to the last 12 month’s earnings by instead comparing the price with average earnings over the past 10 years, with those profits adjusted for inflation. This smooths out short-term fluctuations in earnings.

When the Shiller P/E is high, subsequent long term returns are typically poor. One drawback is that it is a dreadful predictor of turning points in markets. The US has been expensively valued on this basis for many years but that has not been any hindrance to it becoming ever more expensive.

Price-to-book

The price-to-book multiple compares the price with the book value or net asset value of the stock market. A high value means a company is expensive relative to the value of assets expressed in its accounts. This could be because higher growth is expected in future.

A low value suggests that the market is valuing it at little more (or possibly even less, if the number is below one) than its accounting value. This link with the underlying asset value of the business is one reason why this approach has been popular with investors most focused on valuation, known as value investors.

However, for technology companies or companies in the services sector, which have little in the way of physical assets, it is largely meaningless. Also, differences in accounting standards can lead to significant variations around the world.

Dividend yield

The dividend yield, the income paid to investors as a percentage of the price, has been a useful tool to predict future returns. A low yield has been associated with poorer future returns.

However, while this measure still has some use, it has come unstuck over recent decades.

One reason is that “share buybacks” have become an increasingly popular means for companies to return cash to shareholders, as opposed to paying dividends (buying back shares helps push up the share price).

This trend has been most obvious in the US but has also been seen elsewhere. In addition, it fails to account for the large number of high-growth companies that either pay no dividend or a low dividend, instead preferring to re-invest surplus cash in the business to finance future growth.

A few general rules

Investors should beware the temptation to simply compare a valuation metric for one region with that of another. Differences in accounting standards and the makeup of different stock markets mean that some always trade on more expensive valuations than others.

For example, technology stocks are more expensive than some other sectors because of their relatively high growth prospects. A market with sizeable exposure to the technology sector, such as the US, will therefore trade on a more expensive valuation than somewhere like Europe. When assessing value across markets, we need to set a level playing field to overcome this issue.

One way to do this is to assess if each market is more expensive or cheaper than it has been historically.

We have done this in the table above for the valuation metrics set out above, however this information is not to be relied upon and should not be taken as a recommendation to buy/and or sell If you are unsure as to your investments speak to a financial adviser.

Finally, investors should always be mindful that past performance and historic market patterns are not a reliable guide to the future and that your money is at risk, as is this case with any investment.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Past Performance is not a guide to future performance and may not be repeated.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.