On a charge or out of juice – can EV charging infrastructure keep up with demand?

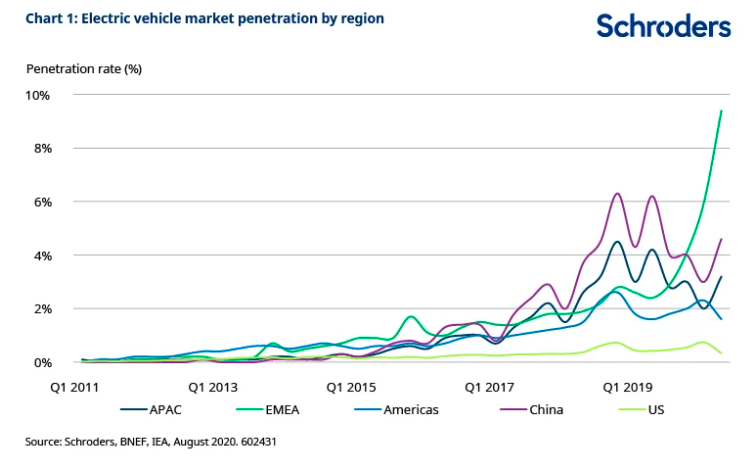

One of the most notable trends of the past 18 months has been soaring demand for electric vehicles (EVs). This is particularly the case in Europe, where the share of EVs as a percentage of overall car registrations has grown to almost 10% (chart 1). Other geographies are also now showing renewed signs of strength, helped by fresh government support.

The current EV market strength demonstrates the improving economics and growing consumer demand behind electrified transport. (Read more: Chasing Tesla: how traditional carmakers are revving up their EV production).

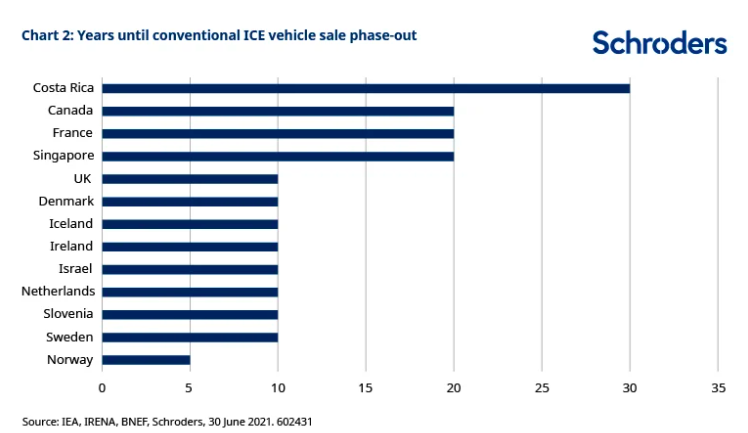

The surging popularity of EVs in Europe can partly be explained by government policy. Some countries, including the UK, have brought forward the deadline for phasing out the sale of new vehicles with internal combustions engines. For many European countries, those phase-out deadlines are now approaching rapidly (chart 2).

But while good progress has been made, the transition to electric vehicles is still at a very early stage and current adoption rates – aside from in Norway, Iceland and Sweden – still remain well below what is required to meet these official targets. As a result, we expect EV penetration rates to pick up significantly over the next few years, helped by both policy support and, perhaps more importantly, the falling costs and heightened technological capabilities of new vehicles.

Can infrastructure keep pace with EV demand?

One stumbling block that prospective EV owners face is charging infrastructure – either lack of it or slow charging time. In early August Allegra Stratton, the UK’s spokesperson for the upcoming Cop26 climate summit, made headlines by saying said she wouldn’t swap her current diesel car for an EV because she was worried about charging it for long journeys such as from London to Scotland.

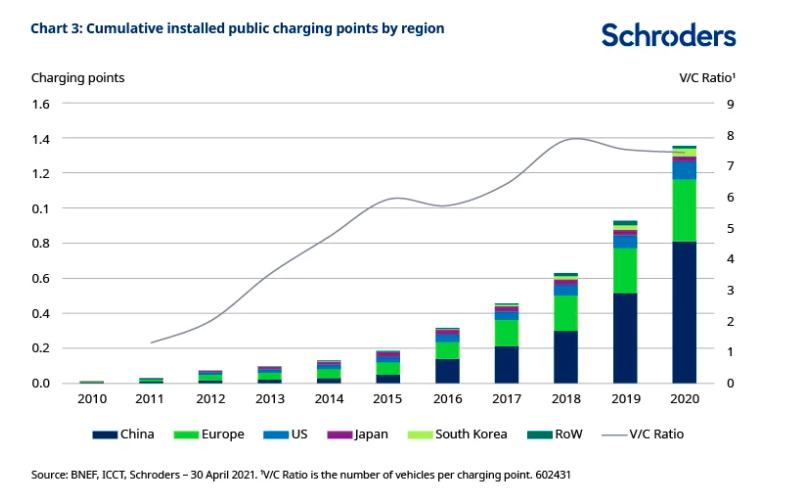

Clearly, in order to facilitate the widespread adoption of EVs across the globe, a substantial build-out of charging infrastructure will be required. Over the last 18 months, as EV demand has grown, we have started to see the necessary pick-up in charging investment. The cumulative installed base of public charging points has grown from just over 600,000 at the end of 2018 to reach over 1.3 million by the end of 2020 (chart 3).

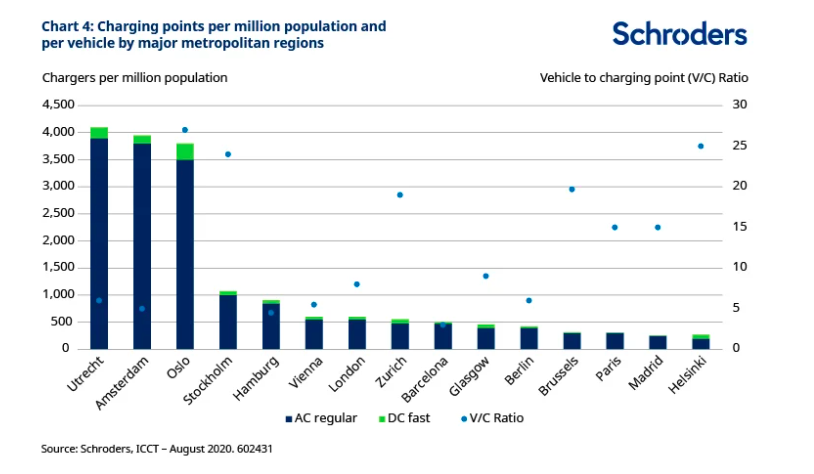

This acceleration is very welcome, given some concerns over lack of charging points. The ideal ratio of vehicles to charging points will likely vary by both country and locality. However, it is no coincidence that EV penetration is particularly high in Norway and the Netherlands when looking at charging point density in their major cities (chart 4).

Alongside the demand-pull associated with the need for increased infrastructure to match electric vehicle growth, the charging point market is also being given a large supply-push through government stimulus being directed at the space in order to meet climate targets.

Given these clear structural tailwinds behind the charging point market, we see companies active in this space as well positioned to benefit from new investment and earnings opportunities. However, in order to understand the scale of this potential, we need to consider the type of charging point hardware that will be required as well as wider installation and grid reinforcement.

Getting to grips with AC/DC

At present, charging points are classified according to the power they deliver. And the more powerful the charger, the faster the charging time.

Chargers with low power delivery use AC current, which is then converted into DC current by an invertor in the car and fed to the battery. In DC charging, AC current from the grid is converted within the charging station and then directly delivered to the vehicle. Because the invertor used to convert the AC current is located outside of the vehicle, it can be bigger, and thus more efficient at converting the power and charging the battery.

This means that the average DC charger can fully charge a typical electric vehicle in around 30 minutes, with AC chargers taking significantly longer. The fastest charger in the market to date, developed by ABB, can fully charge an EV for a range of 200km in just eight minutes.

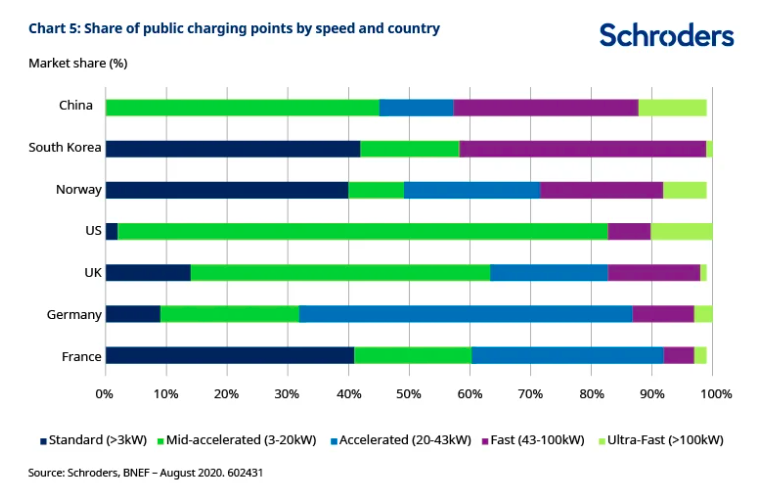

At present, mid-accelerated and accelerated AC chargers dominate the public market (chart 5). These chargers are typically found in parking bays and residential areas. Fast DC chargers, which at present are largely confined to motorway service stations, are not far behind but the relative mix varies by geography.

Home or away?

The market consensus is that the current installation trend will continue, with the majority of AC-based charging points in homes and public locations, and DC chargers only used in service stations. This is based on the idea that most people – who typically only travel short distances on a daily basis – will choose to charge their car overnight outside their home and then again at work or another local destination.

A challenge to this assumption would be a dramatic fall in costs for DC chargers, as well as solutions to issues around battery degradation from fast-charging. If this were to occur, then we could see a world in which the current vehicle refuelling paradigm – whereby individuals refuel at service stations when required – continues. This would be particularly true if electric vehicle driving ranges keep improving (the best in class EVs can already do close to 300 miles on a single charge).

This scenario would require a far more limited infrastructure change, as current refuelling stations could be turned over to charging. If it were to unfold, any large-scale investment in residential charging would potentially be a significant sunk cost. Watching how charger characteristics and consumer habits evolve going forward will therefore be crucial.

Discover more at Schroders insights or click the links below:

– Listen: a “code red for humanity” but a green light for investors

– Watch: what is natural capital?

– Read: On a charge or out of juice – can EV charging infrastructure keep up with demand?

How much investment is needed?

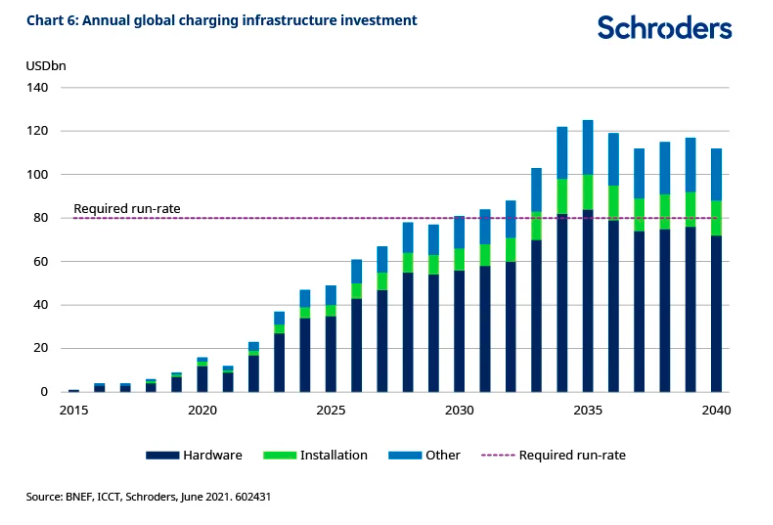

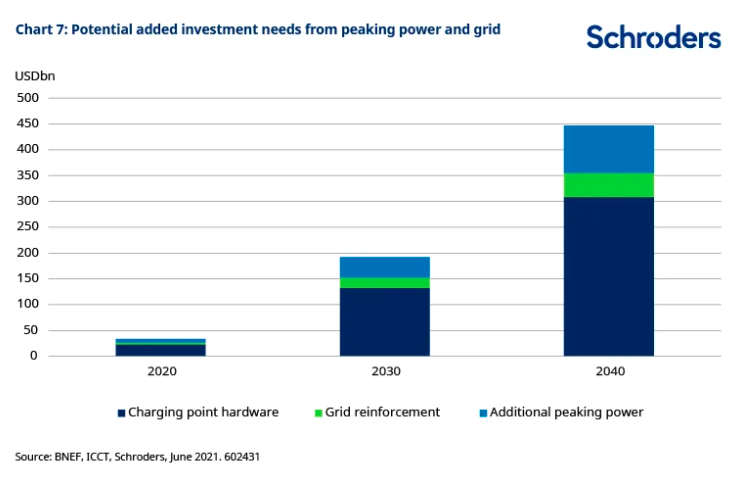

Based on the consensus view of how charging infrastructure will be rolled out, current hardware and installation costs, and an assumption that the vehicle to charging point ratio increases slowly over time, we project that investment in charging points will require an annual run-rate of $80 billion for the next 20 years.

On top of that, there will need to be additional investment to support the electricity grid. The switch to electric cars will require far more electricity given that one EV uses as much energy as the average house in a year. Reinforcing the grid so it can cope with extra demand, and potentially different peaks of demand, will be essential.

This substantial pool of potential investment will create significant new earnings opportunities for companies across the EV charging landscape, from companies providing the charging points, to those operating them and selling power to consumers. Our estimates of the potential gross profit pools from these activities are currently far higher than the current market capitalisations of most players in the space. The opportunity for value creation is clear.

Keep a close eye on valuations

We remain hugely excited about the potential growth of the charging infrastructure market and the strong associated earnings and returns opportunities for companies operating in this space. This market is still in its early stages, and we continue to closely follow competitive dynamics and developments.

It can be tricky to find focused exposure to the sector. Providers of EV charging hardware include automakers, utility companies and oil & gas majors, for whom it represents only a small part of their overall business. One large industrial company that has growing exposure is ABB which has installed more than 14,000 DC fast-chargers to date globally. A smaller, pure-play option is Alfen, which provides high quality AC charging points as well as offering smart grid and energy storage capabilities.

Competition within the industry is rising with the entry of large numbers of new companies, some of which are in SPAC form (i.e. special purpose acquisition companies). This increased competition could potentially put pressure on returns in the long run. This means we are extremely cognisant of the need to be disciplined on valuations, especially in an area of such rapid growth which could lead to valuations becoming stretched.

Not every company that operates in this space is attractive from an investment point of view. Investors may want to focus on high quality companies with best-in-class sustainability profiles and who generate cash today. We see the future investment opportunities here – and in the wider electrical equipment market – as very interesting indeed.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.