Russia’s Sibir Energy races towards FTSE

London-listed mid-sized Russian oil company Sibir Energy said yesterday its full-year pre-tax profit trebled to $344m (£172m) due to higher output at its Siberian unit and strong margins from refining and retail.

Sibir said its crude oil production rose 80 per cent in the year to 17.8 million barrels.

Most of the output, 15.3 million barrels, came from Salym Petroleum oil fields in western Siberia, which is Sibir’s 50/50 joint venture with Royal Dutch Shell.

Sibir, whose main shareholders include the City of Moscow and Russian billionaire Shalva Chigirinsky, expects to boost production to 25 million barrels in 2008.

Also, Sibir chief executive Henry Cameron said the company was days away from resolving its dispute with Russian gas giant Gazprom.

Gazprom inherited an ownership battle with Sibir over the control of a Moscow Refinery and the South Priobskoye oil field, also in western Siberia, when it bought Sibneft from Russian oligarch Roman Abramovich in 2005.

Cameron said the Moscow Refinery would in future be managed by an independent management team.

Meanwhile, Sibir is suing Abramovich over ownership of South Priobskoye and the case will be heard in an English commercial court during a two-week hearing, which began yesterday.

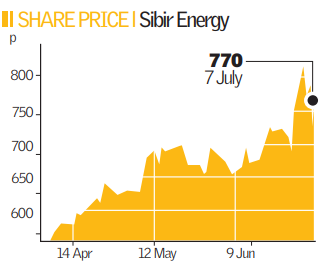

Sibir, valued at £3bn, intends to move from Aim to the main list next year and is tipped for the FTSE 100.