Using CFDs to jazz up a DIY pension

New rules on Sipps mean that there are even more ways to plan for the future, says Katie Hope

Last week, the government announced that as of October, the estimated 10 million people holding money in protected rights pension pots will be able to transfer it into a Self Invested Personal Pension, otherwise known as a Sipp.

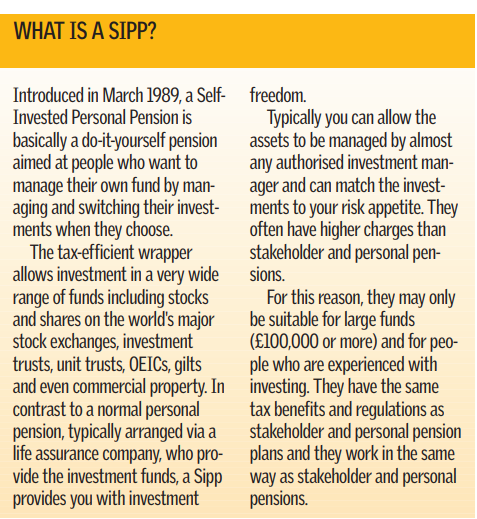

A Sipp, a kind of do-it-yourself personal pension, is basically a wrapper which allows you to invest in a variety of different assets from standard shares to gold bullion and works of art, and also CFDs. The main stipulation is that the CFDs are linked to shares traded on a recognised stock exchange.

There is an estimated £100bn currently in protected rights funds, made up of the accumulated money that the government paid to savers from 1988 onwards as an inducement to opt out of the State Earnings-Related Pension Scheme (Serps), later known as the state second pension. Up until now this has largely been left to dwindle in a narrow range of pension funds run by insurance companies offering investors little choice. But the changes Contracts For Difference Using CFDs to jazz up a DIY pension New rules on Sipps mean that there are even more ways to plan for the future, says Katie Hope mean that from October, savers are likely to switch at least some of this money into Sipps and consequently into CFDs.

But aren’t CFDs a risky way to save for your future retirement? The restrictions on protected rights investments were created in the first place because the government believed that rights intended to replace state benefits should not be subject to the same risk as self-invested pension money.

Sufficient safeguard

But the government believes that the guardianship of the Financial Services Authority (since April last year, personal pensions have been part of its remit) is a sufficient safeguard.

There are also other restrictions. As a CFD trade can result in a loss greater than the amount originally invested, the losses are not permitted to exceed the portion of the fund allocated to CFDs.

Setting up stop-losses, meaning the CFD position will be automatically closed once you hit a certain pre-set level, a standard risk management tool for most investors, is a simple way to ensure that you don’t break this rule.

Some providers also have additional requirements. At CFD and spreadbet provider IG Index the margin requirement for CFD trading within equity Sipps is double that of normal CFD investments. So for a FTSE 100 equity position, for example, the margin is 20 per cent rather than the normal 10 per cent.

In spite of this extra protection requirement, Yusuf Heusen, senior sales trader at IG, says it is really only more risky if the investor trades in a more risky way.

Full control

“If you buy £100,000 of BT shares and the shares go down, then you will lose money, whether you have bought a CFD position or the actual shares. “But obviously if you are too gung ho, over-gear yourself and go crackers then it’s not a clever way of saving for the future,” he says.

But for those who know what they’re doing, the control a Sipp offers over your future savings is very appealing.

“We saw a huge take-up when the Inland Revenue first changed the rules. For people working in the financial arena who are confident in their trading ability, it gives them full control of their investment,” Heusen says.

The other obvious advantage is the tax element. There is no capital gains tax to pay on any profit. In addition, as the investment is part of your pension it benefits from tax relief, meaning tax relief of 40 per cent for a higher rate taxpayer.

Another bonus is that, compared with normal share trading, CFD commission payments to open and close a trade will typically add up to less than the 0.5 per cent stamp duty requirement on equity transactions.

Ability to hedge

But the key appeal is the same as it is for normal CFD investing, and that is the ability to hedge. If you have shares in Barclays in your Sipp, say, which you see as a good long term investment but expect to suffer short term in the aftermath of its current capital raising, you can hedge this via a CFD holding.

To do this you need to sell an equal number of CFDs at the current market price to offset your share investment and create the hedge.

If the share price then goes down you will gain on your CFD trade, which will be offset by the loss on your share. Regardless of what the share price does, you will keep any profit from the point at which you establish the hedge.

“This ability to protect your portfolio from suffering in a downturn, by selling CFDs as a hedge, is a key advantage. Previously the only thing available was a long only portfolio and simply underweighting certain stocks, but you couldn’t short them,” says Dave Norman, an ex-trader who now manages professional equity traders.

Obviously, the technique is not for everybody. “It is a useful trading tool. But the caveat is that it should be used by a market professional who understands the nature of the leveraged product,” warns Ken Kennison, a CFD trader at CFD and spreadbet provider WorldSpreads.

So pensions and CFDs are not an obvious pairing, but for the savvy CFD investor who in October may get a lump sum of money from a protected rights fund that he can now invest more flexibly, it could be an extra string to the investment bow.