RSA in $11m settlement

Insurer Royal & SunAlliance (RSA) has moved to extricate itself from legal action over the Student Finance Corporation (SFC) by agreeing to pay $11m (£6.19m) to Wilmington Trust.

The company revealed the latest payment yesterday as shares in the insurer spiked. City traders said that French rival Axa could be lining up a bid, although shares in RSA slipped back by mid afternoon as the talk died down.

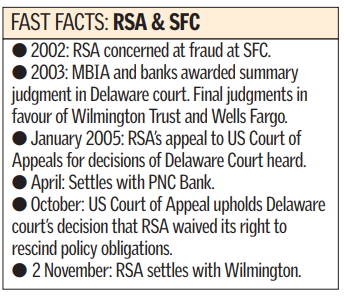

Yesterday’s announcement was welcomed in the City as it marked another step in a strategy to pull back from the American market following a series of damaging problems. One of the biggest concerns has been ongoing legal action related to the Student Finance Corporation which provided loans to students, primarily at some American truck-driving schools accused of fraudulent practices. In 2002 RSA became concerned about a cover-up and a large amount of defaulted loans that were being concealed. It tried to break credit risk insurance policies while various American insurers sued RSA’s subsidiary Royal Indemnity Company (RIC) to enforce the contracts.

Yesterday’s settlement will see RIC pay $11m to one such company, Wilmington Trust, which agreed to assign it all the related student loans for collection. Courts in America have so far awarded settlements against RSA related to the Student Finance Corporation debacle of almost $400m. The largest settlement was with MBIA Insurance Corporation and Wells Fargo for $381m. In April RSA also settled with PNC Bank, although the terms were not disclosed. The settlement with Wilmington is not going to impact on the group’s financial results.

Also yesterday RSA confirmed another move along the way to removing its ties with America. It has completed the sale of its American Nonstandard auto business to Sentry Insurance. RSA shares were up 1.7 per cent in early trading before slipping back to being up 0.25 per cent at close.