P&O bidding war hots up

Shares in P&O Ferries surged yesterday as the prospect of a bidding war for the group intensified after it confirmed Dubai Ports World had made a takeover offer.

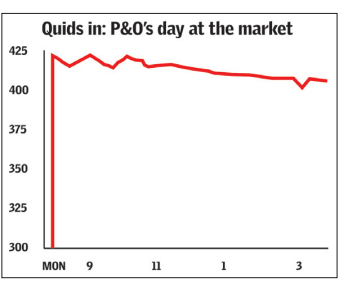

P&O shares rocketed to 425p in early trade and ended the day 30 per cent up at 404p. It is understood UAE government-owned Dubai Ports will face stiff competition from rival bidders including Denmark’s AP Moeller Maersk, Hong Kong conglomerate Hutchinson and Singapore government investment agency Temasek Holdings.

Of the three, Hutchinson is the most likely to face competition problems.

P&O issued a short statement on Sunday confirming the approach and insisting the contact was “very preliminary” and “may not lead to an offer”. The takeover bid could value P&O at as much as £3bn.

The London-listed ferry company has been vulnerable to a takeover since it announced poor first-half profits in August. Pre-tax profit dropped to £30.6m on £53.4m in the same period last year.

P&O warned investors that its European business had lost market share and was under-performing. It launched a defensive cost-cutting programme that has involved slashing jobs, selling off ports and cutting lossmaking routes.

The company has just appointed four non-executive directors, including BAE chief executive Mike Turner, in a bid to appease shareholders.

Dubai Ports was formed several weeks ago when the UAE government merged the Dubai Ports Authority and DPI Terminals. The new company, led by chief executive Mohammed Sharaf, is said to be acquisition-hungry.

Talks between Dubai Ports and P&O could get started as early as this week; the Middle Eastern company has already appointed Deutsche Bank as its financial adviser.