THG boss to surrender ‘golden share’ after share price collapse

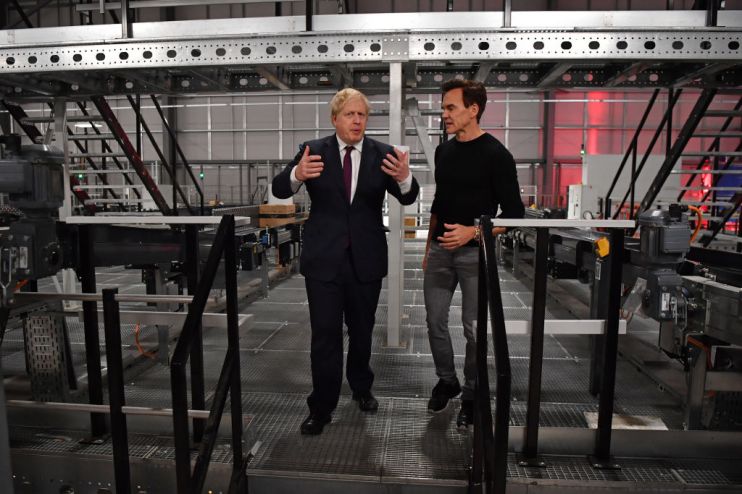

Matthew Moulding, the founder of The Hut Group (THG), is poised to ditch his controversial “golden share” in the company in a bid to regain investor confidence after a shareholder presentation backfired last week and caused the group to lose a third of its value.

Shares in UK e-commerce business THG, which owns brands such as Lookfantastic, Cult Beauty and Zavvi, nosedived as much as 36 per cent last week after investors were left disappointed by a “capital markets day” meeting Moulding held on Tuesday.

Although the presentation had been organised in an attempt to put the record straight on the company’s strategy and explain the valuation of the group’s white label business THG Ingenuity, Moulding’s attack on short sellers during the meeting had the opposite effect.

Now, Moulding is poised to give up his controversial “golden share”, or “founders share” in the business to get investors back on side, according to reports.

Golden shares are hotly contested in the City as they give founders a much greater say than the average shareholder. Moulding’s, for example, gives him the right to veto any takeover bid in the company for three years.

As the government examines listing rules to attract more tech companies to choose London over Wall Street for an IPO, recent major tech listings Wise and Deliveroo were defined by their founders insisting on the so-called “dual class” structure as a condition for choosing the UK market.

If Moulding gives his up, it would be a blow to those who support such a structure, which includes the vast majority of tech founders. It was also a central recommendation of Lord Hill’s review of the London market.

The company could announce the move as soon as tomorrow Morning, according to reports.

THG has been contacted for comment.