On top of the world

Retail may be struggling, but Philip Green has just taken a £1bn dividend. Is he embarrassed? Not much.

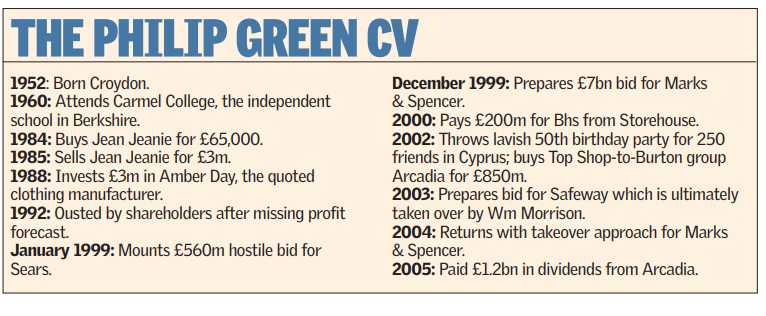

Displaying the timing for which he has become famous, retail entrepreneur Philip Green paid himself a whopping £1.2bn dividend from his retail chain Arcadia. At a time when retailers nationwide are struggling, Arcadia announced a 10.1 per cent jump in operating profits to £326m, on a 6.8 per cent increase in sales to nearly £1.8bn. Operating margins rose to a healthy 18.4 per cent, up from 17.9 per cent last year.

That’s allowed Green and his co-investor, HBOS, to draw a dividend of £1.3bn, with Green and his family, who hold 92 per cent of Arcadia, taking the lion’s share.

Yet other retailers are struggling, and many fear a bloodbath in the run up to Christmas, particularly if a much-expected reduction in interest rates doesn’t materialise. The Bank of England poured cold water on hopes of a rate cut earlier this week, revealing that its rate-setting Monetary Policy Committee didn’t even discuss a rate cut at its meeting earlier this month.

“It could be a real nightmare scenario [for retailers] if interest rates are going up,” said Nick Bubb, retail analyst at Evolution.

Green himself attests to the difficulty on the high street. “It is very tough,” he told CityA.M. But he believes that the unseasonably warm autumn has kept shoppers away from the stores. “The most recent business has been influenced heavily by weather,” he said. “I don’t think interest rates are going up and I don’t think rates are the key factor (in slowing retail sales).”

But insiders deny the timing of the dividend payment has anything to do with fears of a sharp slowdown in spending. “Green isn’t like that; he’s not a venture capitalist who flips businesses,” said one, pointing out that the dividend was announced at Arcadia’s financial year end. Analysts were shocked at the size of the payment, which will add to 53-year-old Green’s already considerable fortune. According to Forbes Magazine, Green and his wife Christina held assets worth £3.5bn, good enough for 68th place in the rankings of the world’s wealthiest people.

“It’s way too much money,” said Evolution’s Bubb. “I have no idea how he justifies that. People were surprised when he took out £500m last year.”

But Green insists the pay out is less “aggressive” than the return demanded by venture capital investors. Insiders acknowledge that the dividend is a lot of money but stress that the windfall is actually rather conservative when compared with Arcadia’s “financial structures”.

Richard Ratner, retail analyst at Seymour Pierce, agreed. “He is simply leveraging up, like a (venture capitalist), except that a VC would probably have sold most of the property and taken a bigger dividend,” he said.

The payment to Green and HBOS, which stands as a £1.3bn debt on Arcadia’s balance sheet, is just three times EBITA of £375m. American department store Neiman Marcus, for example, was sold to investors at a price 10 times greater than its EBITA earlier this month.

Furthermore, the business generated net cash of more than £400m in the latest financial year, which covers the interest on the £1.3bn debt by seven times over, insiders point out. A rival retailer, Debenhams, holds £1.9bn in debt, but generates operating profits of £275m, according to an industry source.

Arcadia has come a long way since Green took over the business in October 2002.

The group was earning just over £100m a year before he stepped in. Now Arcadia maintains 2,200 outlets nationwide, adding 95 stores over the past year, including the acquisition of the Etam chain in Britain. The Arcadia empire now encompasses Dorothy Perkins, Burton, Wallis, Miss Selfridge, and the fashionistas’ favourite, Topshop. The former downmarket Top Shop (now one word under Green) chalked up a first for a high street retailer last month, showing at London Fashion Week, attended by the great and good of the fashion world. Arcadia plans to open 48 stores next year.

But analysts were scratching their heads yesterday, attempting to discern which divisions of Arcadia are driving the company. “One assumes Topshop is the key driver, but it can’t just be Topshop,” said Bubb. Five or six years ago, when Arcadia did provide numbers for its individual retail chains, all divisions accounted for fairly similar-sized chunks of total income, he added.

Green insists that his customer-centred approach is driving growth across all sections of his business. “Hopefully, if we provide the right merchandise, the customer will buy it,” he declared. “We’re focused on the product, on execution and delivery, not on a lot of procedure, like meetings and delivery,” he added.

Observers believe Arcadia is much better at buying than its competitors, and is also more skilled at managing its supply chain. “They have found more efficiencies” among their suppliers, said one.

Some analysts question whether the £65m in capital expenditure announced yesterday is large enough for a business the size of Arcadia. “We need comfort that every division is getting the necessary investment,” said one.

In his typical bombastic fashion, Green rubbished such suggestions. Demanding to know which analysts questioned his methods, he referred to such financial observers as analysts, emphasising the first two syllables. If all the analysts were to go away “there wouldn’t be jokers telling people to buy stocks” that have low yields, he said.

With that settled, questions remain over what Green intends to do with his windfall. Last year, Green had a high-profile go at taking over Marks & Spencer. While he never made a formal offer, many shareholders were supportive of his indicative bid of 400p a share.

Last week, M&S popped above the 400p mark for the first time since Green circled in the summer of 2004, following a surprise 1.3 per cent rise in second quarter sales (following a 5.4 per cent slump in the previous quarter). Marks shares finished at 402p yesterday, up 4.5p on the day.

Early this year, Green ruled out another bid for Marks & Spencer — now run by his old friend Stuart Rose — but most observers believe Green could be tempted again should M&S shares settle significantly before the 400p mark; M&S has had many false dawns in the past. Ironically, it was Rose who sold Arcadia to Green three years ago, for £850m. Based on last year’s profits, the chain was worth £2.5bn, but that valuation is likely to rise in the wake of yesterday’s results.

But other struggling chains could also catch his eye. Aides say there are no retailers on Green’s shopping list at the present, but “when he is ready to move, he can move very quickly” with the cash he has taken out of Arcadia.

Of course, Green is facing a challenge with his Bhs chain, which he took over six years ago. Full year operating profit fell nearly 6 per cent to £105m, while same-stores slipped 3 per cent in the year ending in April. More ominously, turnover has fallen by 4 per cent this year. The “middle market” of the retail sector is struggling, Green admitted.

Those disappointing results from Bhs last week prompted many to speculate that perhaps Green has lost a bit of his retailing wizardry. That may have been premature. With Arcadia in fine shape and £1.2bn in his pocket, Green’s influence over the British high street is likely to grow.