So much going on in the fast-moving world of Bitcoin

The week in review

With Jason Deane

As Bitcoin’s network effect continues to accelerate, trying to condense a week’s events into one short Friday review becomes increasingly difficult – but it’s a challenge I’m happy to face!

Aside from the fact that Bitcoin’s price has increased by more than 13 per cent in US dollar terms since my last update and the outlook remains incredibly bullish, it’s also worth noting that Bitcoin’s mining difficulty – the measure by which it is easiest to see how much computing power is coming into the network – also increased this week by more than four per cent.

More importantly, it was the seventh increase in a row – a feat not achieved for some years.

Frankly, with the enormous (and really quite frantic) developments in the mining sector, this is not surprising and it may well be some time before we see a downward adjustment again, if at all. All of this is great for Bitcoin’s underlying security.

But on the non-technical side, things continue to unfold just as quickly.

President Nayib Bukele of El Salvador announced this week that almost 50 per cent of his country’s citizens are now using Bitcoin following the implementation of the law on September 7. Meanwhile, further south, there have been increasingly loud murmurs about Brazil’s proposed cryptocurrency bill which will apparently be presented in the next few days. This will allow the purchase of everything from hamburgers to cars and, since Brazil’s economy is currently ranked 13 in the world according to the IMF, this is a significant move.

Right now, of course, it’s nothing more than a proposal, but this is definitely worth following as the story unfolds.

Hot off the press last night came the news that the SEC in the States approved a new ETF provided by Volt Equity entitled “Volt Bitcoin Revolution ETF”. This may not seem that significant at first, but the companies included in that product all carry significant Bitcoin holdings as part of their balance sheet, so think Tesla, Microstrategy, PayPal, Twitter, Marathon etc.

Many, including myself, view this a natural step towards the long-coveted pure Bitcoin ETF that some believe may actually be approved in the next month or so. Personally, I’m still sceptical about that, but I’m really quite happy to be proved wrong.

In the meantime, have a fabulous weekend!

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $2,293,072,697,464.

What Bitcoin did yesterday

We closed yesterday, October 7 2021, at a price of $53,805.99, down from $55,361.45 the day before. The daily high yesterday was $55,338.62 and the daily low was $53,525.47.

This time last year, the price of Bitcoin closed the day at $10,915.69. In 2019, it closed at $8,228.78.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $1.02 trillion. To put it into context, the market cap of gold is $11.169 trillion and Facebook is $928.21 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $35,449,337,148, down from $48,942,194,223 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 58.66%.

Fear and Greed Index

Market sentiment today is 74, in Extreme Greed.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 43.95, down from 44.87 yesterday. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 67.22, down from 69.18 yesterday. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

Institutional investors see Bitcoin as “better inflation hedge” than gold.

JPMorgan report

What they said yesterday

Ahead of schedule…

And it’s just the beginning…

Up, up, up we go…

Fair trade…

Crypto AM: Editor’s picks

El Salvador begins mining Bitcoin using volcanic energy

Bitcoin booms but Hong Kong listed crypto stocks slide in wake of China crackdown

Cardano promises ‘industry-defining announcements’ at its biggest ever summit

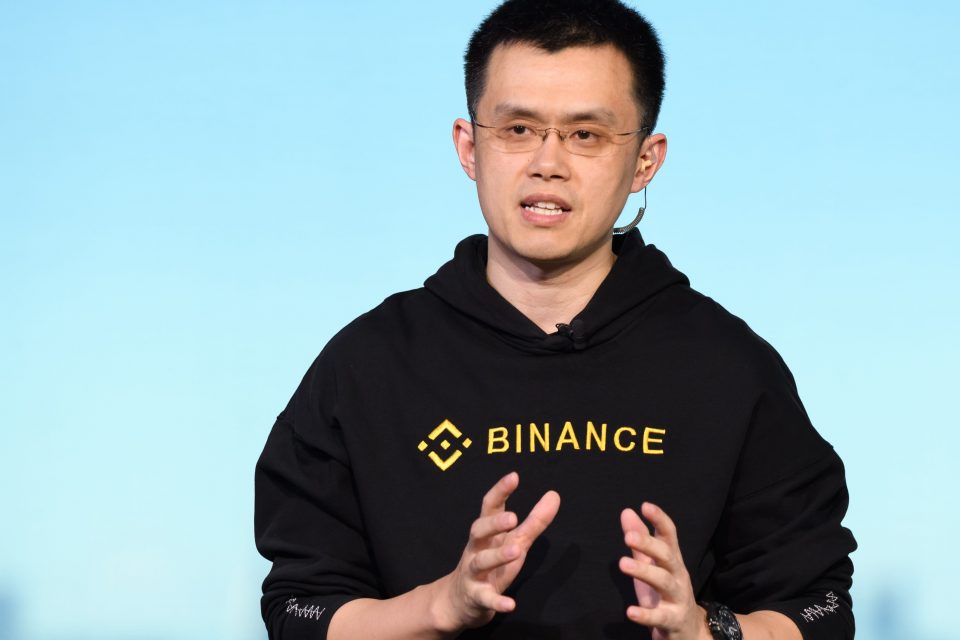

Binance probed over suspected insider trading

Cardano Alonzo upgrade sees 100 smart contracts in first 24 hours

Morgan Stanley to launch new research team led by Sheena Shah

Bitcoin can now be purchased using the Post Office app

Simon Nixon tells Seek Ventures to ramp up Bitcoin investment

Crypto AM: Features

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto AM: Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five-part series – March 2021

Day one…

Day two…

Day three…

Day four…

Day five…

Crypto AM: Events

Cautionary Notes