Rosemont suffers in Katrina’s wake

The fate of Goshawk’s subsidiary Rosemont Re was left hanging in the balance yesterday when its credit rating was cut.

Ratings agency AM Best downgraded the insurer from A excellent to B fair, severely impairing the company’s ability to write new business. Rosemont Re has been severely hit by hurricane claims and shares in Goshawk have plunged to 11p from 43p prior to Hurricane Katrina in late August. The specialist property and marine reinsurer was set up in 2001 and was hit by a net loss of $60m (£34m) from both big hurricanes.

Yesterday’s announcement came just a week after its parent company said discussions over a significant cash injection or sale of Rosemont had ended.

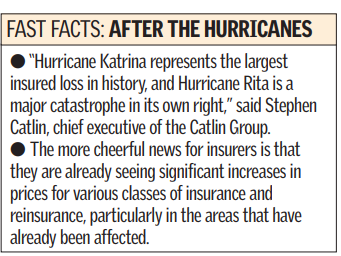

The hurricane season has wreaked havoc on the insurance industry. Bermuda-based Catlin Group said yesterday that its combined losses from Rita and Katrina are likely to be around £185m net.