US suffers shock inflation increase

Inflation trends differed markedly on either side of the Atlantic yesterday, with the American producer prices (PPI) confounding analysts with their biggest gain in 15 years, but Britain got off lightly with a consumer price index (CPI) level of just 2.5 per cent.

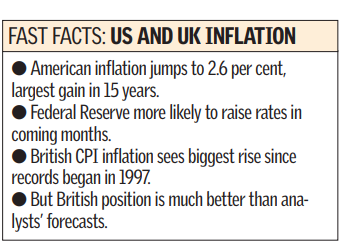

The American PPI shot up by 1.9 per cent on last month, raising real fear that increased energy prices will feed through into the American economy. This was the largest month on month gain in 15 years and confounded the predictions of analysts who had forecast a rise of 1.2 per cent. This leaves American inflation at an annual rate of 2.6 per cent making it likely that the Federal Reserve Board will stick with its hawkish stance and raise rates with a series of 25 basis point cuts in the run-up to Christmas.

As the American stock market digested the news, stocks escaped a major fall because key companies announced better than expected earnings.

In Britain, the government’s CPI inflation indicator rose by 2.5 per cent a year from 2.4 per cent last month.

This was the biggest acceleration since Chancellor Gordon Brown switched to CPI from the old retail price inflation (RPI) measurement in 1997.

However, it was significantly below analysts’ predictions, which had forecast a rate of 2.7 per cent.

The impact of high oil prices was less than economists had predicted and the news has lessened concerns that energy costs will feed through into increased wage demands.

The Bank of England’s Monetary Policy Committee (MPC) is more likely to vote for a rate cut at November’s key meeting, but this still remains far from a certainty.