Redesigning the global financial infrastructure for the digital-age

Since the ‘DeFi Summer’ of 2020, the DeFi market has grown by 40 times, with the Total Value Locked currently standing at $61B. Stablecoins, one of the major pillars of DeFi, almost quadrupled in the first half of 2021 to $112 billion.

Novum Insights’ latest report Decentralized Finance: Re-designing the global financial infrastructure for the digital-age, looks at the building blocks of DeFi that redefine how individuals interact with money and exchange value.

Decentralized Finance, or DeFi in short, is a new financial infrastructure powered by blockchain technology that functions without any intermediaries. DeFi brings about a paradigm shift in the financial services industry posing a threat to legacy systems in every possible way – from everyday banking, borrowing and lending, trading, engineering sophisticated financial instruments, to asset management.

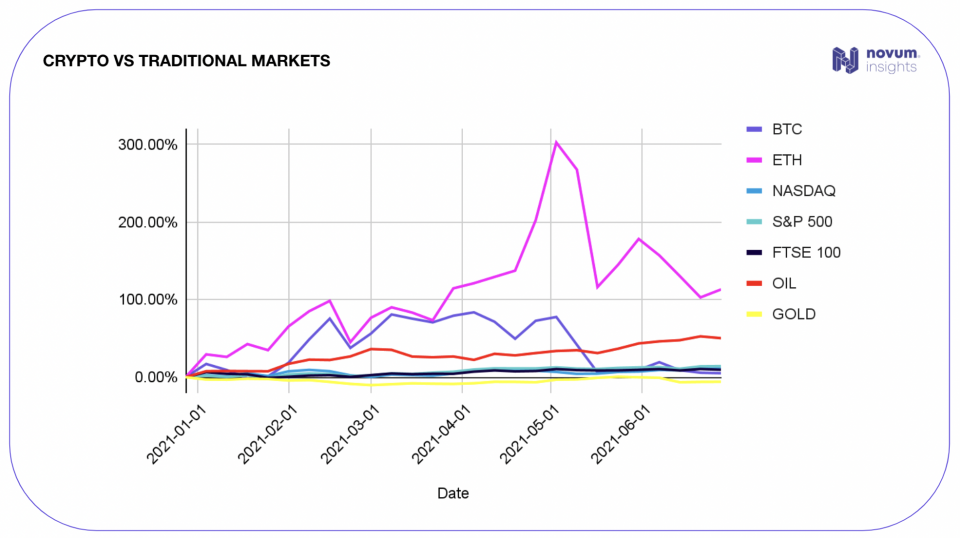

Accelerated by the Covid-19 pandemic, failures of leadership and wide-ranging political unrest, the faith in institutions has been put to the test. In the finance sector, the distrust in Wall Street came into sharp contrast with the GameStop(GME) saga. Digital native younger generations were turning to decentralized protocols to manage their funds. Below Novum Insights charted price movements of major cryptocurrencies and traditional markets in the first half of the year.

In the traditional markets, oil has performed well registering a 50% growth. This is propelled by the resurgence of the travel industry thanks to vaccination progress across Europe and North America. Major indices such as NASDAQ, S&P 500 and FTSE 100 all recorded a positive growth of 12.5%, 14%, and 9.48% respectively. In contrast, gold is down 6%.

A parallel trend seen in both crypto and traditional markets is the popularity of meme assets. Designed as a joke after a famous shiba inu meme, DOGE coin skyrocketed 55x. Popular on Reddit as meme stocks, GME and AMC stocks have seen 11x and 25x growth respectively.

BTC’s gains since the beginning of the year had been wiped out in May and June. ETH, the main driver of the DeFi boom, recorded a hyper growth of 300% between January and early May. Since then, ETH has lost its value since the crypto market crash but is still up more than 2x compared to January 2021.

DeFi opened up new avenues for crypto investors to make money besides speculating on volatile prices of their crypto assets leveraging a strategy called ‘yield farming’. Yield farming uses automated marketing, decentralised exchanges and lending protocols as two main pillars and this can entail staking cryptocurrencies, providing liquidity to a pool in a decentralized exchange, staking the LP tokens, or providing liquidity to lending protocols. Users are incentivized to lock in their tokens or to provide liquidity and this behaviour is rewarded with attractive APYs and sometimes with fresh new tokens, thus “yield farming”.

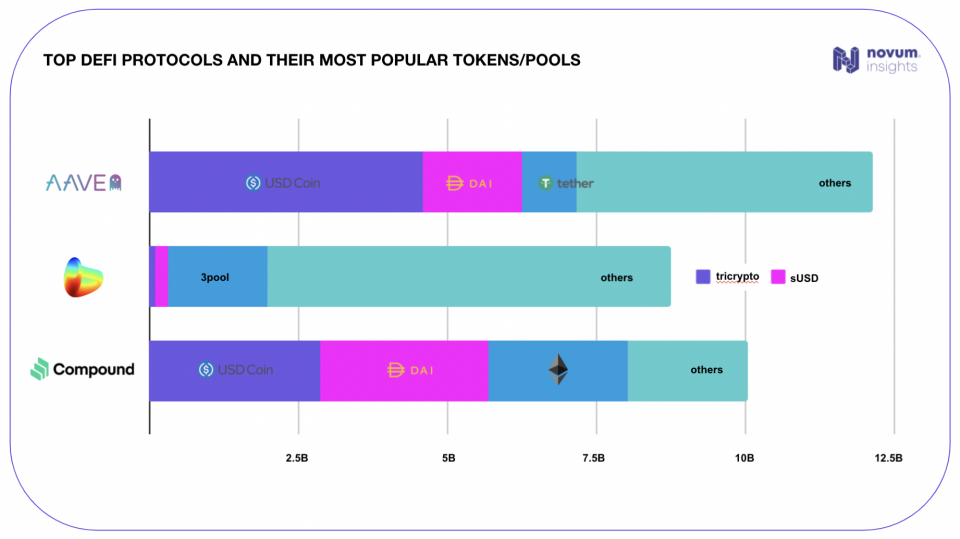

Below Novum Insights look at major tokens lent out in household DeFi lending protocols – Aave, Curve and Compound.

Source: Novum Insights up to Jun 23

The most lent out coins in Aave V2 – USDC, DAI and USDT – take up about 60% of total market size of Aave V2. Curve’s entire protocol is based on facilitating swaps between stablecoins with minimal slippage, and the top 2 tokens in Compound – USDC and DAI – take up about 60% of total market size of Compound.

Here, we see how stablecoins play a pivotal role in DeFi. USDC, USDT and DAI are the most demanded coins on the above platforms. According to the FDIC, the average interest rate for savings accounts in the US stands at 0.04% APY. Compare this to stablecoins’ 2-3% APYs!

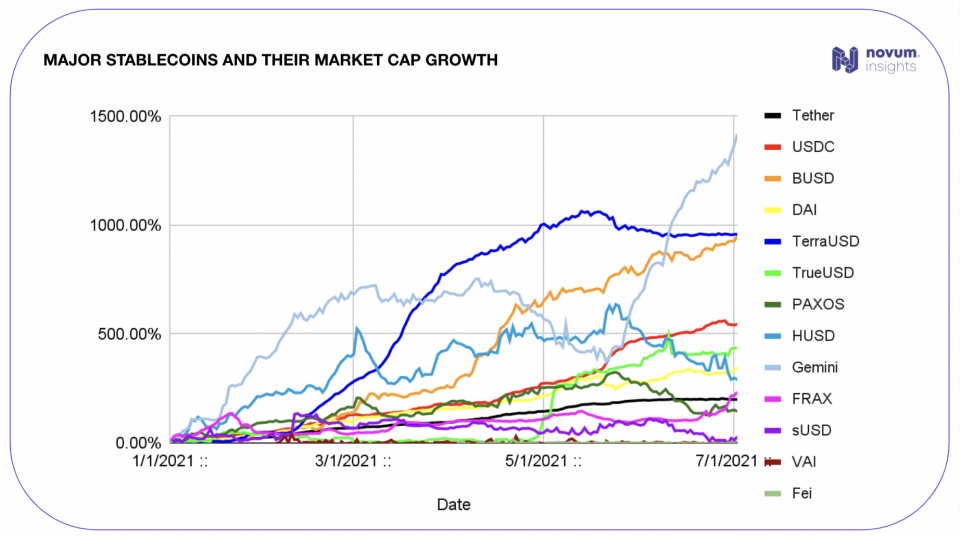

In the DeFi report, readers can learn more about how stablecoins are performing so far. We take a sneak peek at the stablecoin chapter. Credit rating agency Fitch noted last month that the growth of stablecoins not fully backed by safe assets could pose risks for the financial markets. As the stablecoin market experiences a fast-paced growth, they are grabbing more attention from the regulators. A fresh round of debate around Tether’s reserves sprung once again since its March 2021 reserve breakdown that revealed cash accounted only for 2.9% of the reserves. Despite rising concerns around the market, stablecoins have quadrupled in the first half of the year.

Below charts the supply growth of the stablecoin market since the beginning of the year.

Stablecoin projects growing at a faster pace than Tether have an eye on its throne. Gemini’s GUSD grew by more than 1400%! However GUSD had also indicated the most severe dip during the crypto selloff in May. Terra’s UST and Binance’s BUSD have also shown a stellar growth of almost 1000% in the same period. Tether’s growth rate stands at 200% and Tether has shown the most stable growth pattern. Along with Tether, stablecoins that exhibited “stable” growth patterns include BUSD and USDC launched by Circle and Coinbase.

The advancement in the novel blockchain technology will never slow down and Novum Insights will be commenting on all the major trends, as they launch a series of products targeting the decentralized finance sector and much more.

In the full report, Novum Insights shares an in-depth analysis of Polygon(MATIC), and explains new concepts such as AMM, yield farming, stablecoins, NFTs and more.

Download the report here. Part 1 of the full report is out today. Part 2 and 3 will be released in the next two days.