“DinoBanking”- Prehistoric U.S. Legacy Banking

U.S. banking is primitive. It forces some to write checks in this day and age. Yet some politicians and paid lobbyists are doing everything they can to kill off the vastly superior platforms of DeFi through onerous regulations. Typical banks and credit unions offer no ACH transfer, no automatic payroll.

The check can’t be too large either. If it’s over $5k, the Wells Fargo mobile app can’t deposit it. Over $5k and one must show up in person and present their ID and pay onerous fees. Why not just use a bigger bank? Because some of these banks remove any customer directly or indirectly involved in crypto.

Meanwhile, the rent-seeking banking system falls further behind while politicians try to block DeFi innovators who could modernize it because it’s supposedly too dangerous. And the internet was also considered too dangerous back in the mid-1990s having been built on pornographic citadels along with credit card fraud and human trafficking.

In reality, traditional finance consists of centralized, vertically-integrated banks which end up provided very costly services because they require physical presence, manual/paper-based processes, and complex/siloed infrastructure.

Crypto, on the other hand, enables serverless financial microservices. Instead of middle-man vendors providing infrastructure and services, a distributed network of computer-based “nodes” provide the same functions where protocol tokens are earned and, in effect, become partial owners of that network. Specifically, massive cost savings result from replacing siloed transaction processing and banking systems by a global blockchain and its associated smart contracts and node infrastructure.

So when Jerome Powell said in July 2021 that cryptocurrencies failed as a payment system, that’s what they said about the internet back in the mid- to late 1990s about numerous platforms from video streaming to credit card payments. Sure, video streaming was nearly unworkable and clunky back then. But things improve. While technological growth is exponential, it does not evolve in a day.

Even so, one can already send vast sums for a few dollars anywhere in the world using BTC or ETH. With ETH, settlement is in seconds, light years ahead of the U.S. banking system. ETH is on track to settle $8 trillion in value this year.

By contrast to the U.S., China has let digital eat its banking system. It now processes $52 trillion in annual mobile payments alone through WeChat and AliPay. Apple and GooglePay did a scant 1% of China’s total.

DeFi Orders of Magnitude Superior

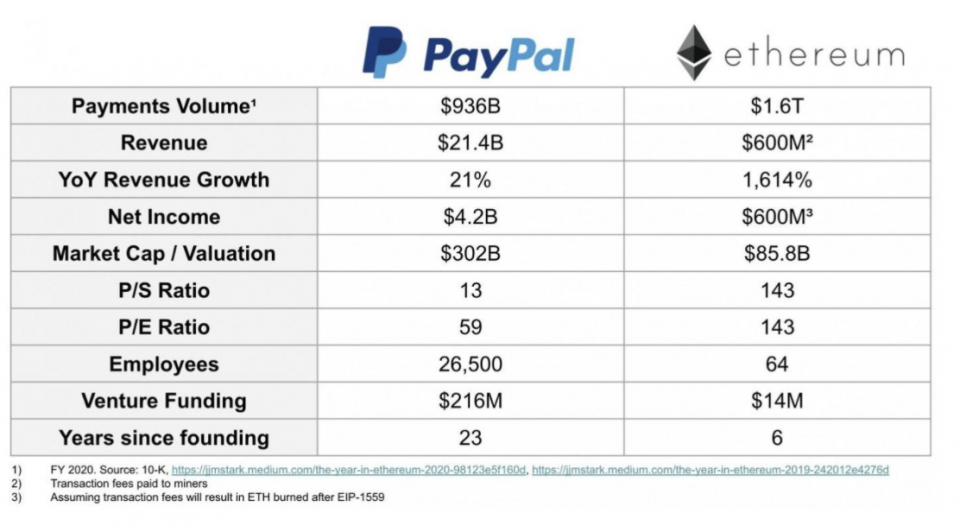

DeFi applications are meta-evolving financial services from the ground up by rendering many jobs obsolete. Humans are replaced with machines, paperwork with code, and traditional security with cryptographic enforcement. As a result, DeFi platforms operate orders of magnitude cheaper than their analog counterparts. Compare the number of employees between ETH and PayPal at 1:400 and costs at 1:36. Massive savings to the customer. So when Elon Musk tweeted he knows blockchain because he started PayPal, he evidently does not. He’s also very late to the party having finally woken up to the powers of crypto and Bitcoin in 2021.

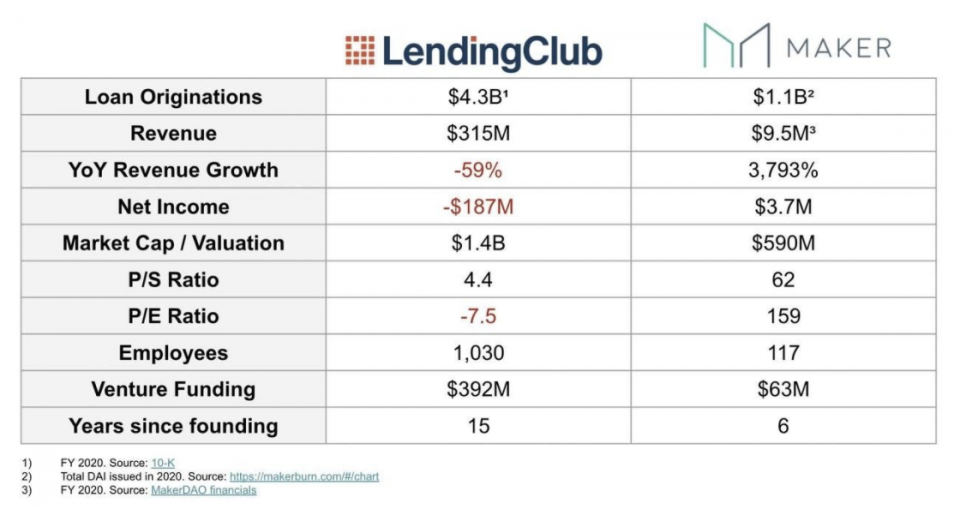

Similar holds true for MakerDAO vs. LendingClub. MakerDAO’s operating expenses are a tiny portion of overall net income, resulting in a profit margin of 99% vs. Lending Club which is still not showing a profit. While MakerDAO’s costs will increase as additional costs from oracle operations and token-based compensation are transferred to the DAO, it will still remain monumentally superior across all metrics compared to the traditional, centralized LendingClub. Likely more than half of Lending Club’s operating expenses were due to headcount and hardware, software, and maintenance costs. The company would have likely been profitable if it had a leaner cost structure that utilized DeFi.

Ethereum’s EIP-1559 Launch

As EIP-1559 launches on August 4, some are concerned it will be a sell on the news event. Others are concerned that the miners will not be happy about making less. But the fundamentals driving Ethereum remain as robust as ever. While fees will still remain high depending on network congestion until ETH 2.0 (PoS) is launched, EIP-1559 will reduce Ethereum’s inflation from 4% to 3%. It will only issue enough tokens to ensure network security. Big banks are also recognizing Ethereum as a store-of-value (SoV). German funds will be able to buy up to 20% of their funds in Ethereum starting next week. There’s also a 16% supply hit to Ethereum due to EIP-1559. With a $400 trillion addressable market, there is massive headroom for Ethereum as well as others such as Solana (SOL) to co-exist.

Ethereum is the gorilla when it comes to bleeding edge technologies such as NFTs and DeFi. Its powerful network effect can send its price soaring in the coming months while other viable technologies such as SOL and MATIC can also soar as we head into a multi-chain cryptoworld. Indeed, since the price of high quality alt coins remain highly correlated with bitcoin and ethereum, expect the space to reach a valuation of $15-20 trillion at the next market peak in this bull cycle.

Black Swans?

But this begs the question on how long it may take to reach the next bull market peak given both the powerful tailwinds and headwinds at hand that I have discussed in prior articles. While the macro picture along with prime metrics look very bullish, the bearish side depends largely on the winds of regulation. Janet Yellin has called for swift regulations on stablecoins which could hamper or even cripple DeFi in the U.S. not to mention the over-regulated EU which is looking to block DeFi. Also, Blockfi has been hit with a cease and desist from various states, and a growing number of countries are limiting the services Binance provides such as in the derivatives markets. People in the U.S. should write to their congressperson to make them aware that damaging DeFi will be bad for the U.S. as DeFi would just exit and thrive in the more welcoming countries, much as China’s miners did a mass exodus to other parts of the planet and are already recovering nicely. The fact that Bitcoin’s hash rate plummeted then rebounded without issue shows the robust, decentralized nature of Bitcoin. Ethereum which was also deemed decentralized by the SEC even though it technically is not completely decentralized should continue to become more deeply decentralized over time as it expands its reach.

Dr.Chris Kacher, bestselling author/top 40 charted musician/PhD nuclear physics UC Berkeley/Record breaking audited accts: stocks+crypto/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr. Kacher bought his first bitcoin at just over $10 in January-2013 and participated in early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

TriQuantum Technologies: Hanse Digital Access

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/