Sport sees steep fall in gambling sponsorship as government considers ban and demand grows for social responsibility, says new study

Gambling sponsorship in sport has fallen sharply ahead of a possible ban, a new report has found.

The number of betting companies sponsoring sports teams in England has almost halved since 2019, according to the study by consultancy Caytoo.

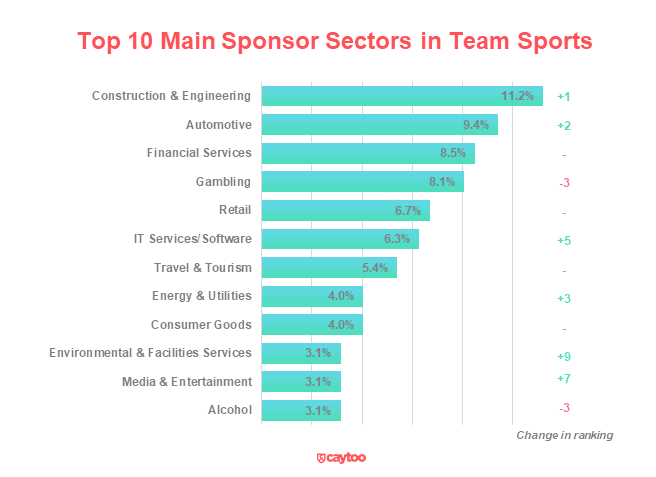

Gambling’s share of the market has dropped from 15.3 per cent to 8.1 per cent and has been overtaken by construction and engineering (11.2), automotive (9.4) and financial services (8.5).

“This change has been driven by the greater demand from society for professional sports to be more socially responsible when it comes to their fans and communities,” said Caytoo’s head of research and analysis Alex Burmaster.

Concerns about the wider impact of gambling sponsorship has led the government to launch a wide-ranging review that could see it banned.

Alcohol, airlines and aviation companies and the logistics and supply chain sector also saw a drop in market share.

The move to a more digital world accelerated by the pandemic influenced the fastest-growing sectors, IT and software, automotive – particularly online car sales – and telecommunications.

Caytoo’s biennial study examined the primary sponsor of 221 leading men’s and women’s sports teams from English football, cricket, rugby union and rugby league.

Football saw the biggest change in composition. Gambling remained the most prevalent sector, despite its share falling from 32.7 per cent to 15.2 per cent, while energy and utilities and IT and software had the biggest increases.

In cricket, financial services, previously the market leader, plummeted from an 11.7 per cent share to 3.3 per cent. Construction and engineering and automotive are now the most prevalent sectors for sponsorship in the sport.

With four sponsorships each, car maker Kia, airline Emirates and electricity and gas supplier Utilita are the brands with the most deals.