Announcing the Crypto AM Policy Forum

As I bid a fond farewell to Gibraltar it seems only fitting to formally announce the formation of the Crypto AM Policy Forum which will be made up of industry and support service representatives.

The aim is singular – to engage with the government and regulatory policy makers to help find a fast but considered solution to the current crisis of confidence in the U.K. blockchain, crypto and digital asset space.

I’d therefore like to use this opportunity to invite volunteers (from from all sides of the divide) to get in direct contact with me via email James.Bowater@cityam.com.

This week in crypto with Jason Deane…

They say a week in politics is a long time, but a week in crypto could sure as hell give it a run for its money!

This week has seen the death of one of crypto’s most enigmatic and colourful characters, John McAfee, in what can only be described as mysterious circumstances, something that will keep the tin hat wearing conspiracy theorists busy for some time to come. I, for one, will miss seeing his off the wall tweets. RIP John.

READ MORE: John McAfee found dead in his Spanish prison cell

At the same time, the continued (and now confirmed) exodus of miners from China as a result of their latest clampdown has forced the current network hashrate down to levels not seen since this time last year. Of course, the network remains utterly secure and continues to run perfectly as designed, but many in the market still link hashrate to price – incorrectly in my view – which has undoubtedly been one of the factors in subdued price action over the last few days.

As a result, it seems that all week I have been asked the question ”Are we in a bear market?” and my view remains the same; almost certainly not. The fundamentals remain as solid as ever. Markets, however, are often driven by emotive decisions rather than fundamentals and right now that seems to be the more important factor.

In any case, it won’t be long before those miners are back online and hashrate will resume its upward trajectory. This time, however, the hash power will come increasingly from countries like Kazakhstan and the US, decentralising the network further and removing the ever present (but eternally incorrect) “But China controls Bitcoin” objection for good.

So, as one of the largest countries on the planet tried to remove itself from the Bitcoin network, one of the smallest, El Salvador, continues to embrace it fully, racing to install knowledge and infrastructure before Bitcoin becomes fully legal tender on September 7. Not only that, but it now seems persistent rumours of other Latin American countries joining them are coming to fruition. Last night Paraguay’s Carlos Rejal, one of the country’s lawmakers, announced that a draft bill proposing just that would be ready by July 14, although the path forward may not be as clear cut as its predecessors.

One thing’s for sure, the next few months are going to be incredibly exciting!

Have a great weekend!

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit – you can now watch the event in two parts via YouTube…

Part one…

Part two…

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

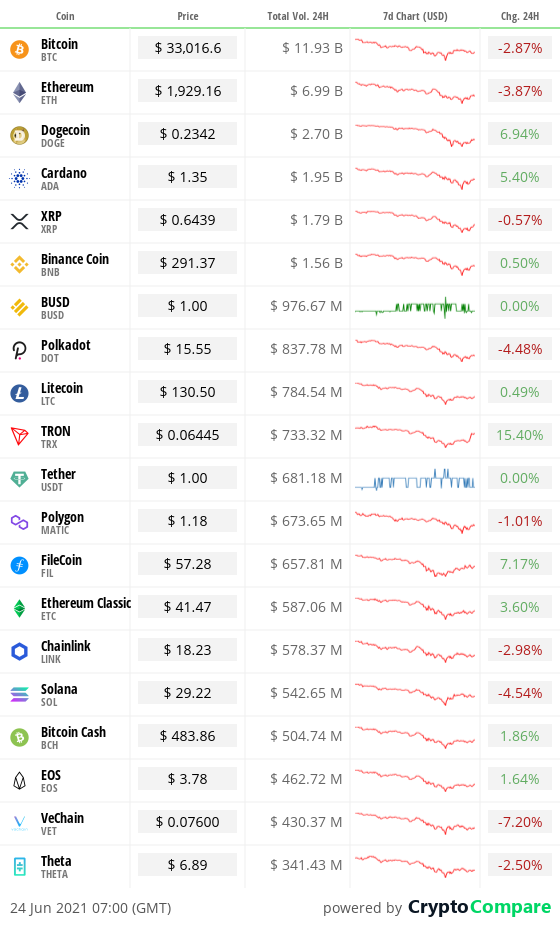

In the markets

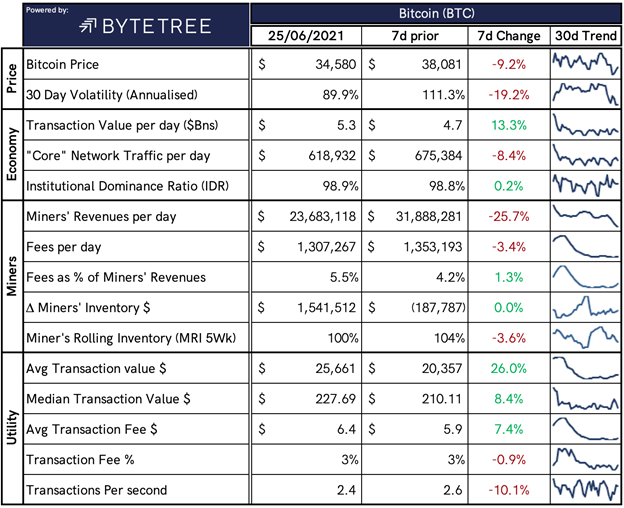

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,386,205,703,353, down from $1,339,157,124,126 yesterday.

What Bitcoin did yesterday

We closed yesterday, June 24 2021, at a price of $34,662.44, up from $33,723.03 the day before.

The daily high yesterday was $35,228.85 and the daily low was $32,385.21.

This time last year, the price of Bitcoin closed the day at $9,313.61. In 2019, it closed at $11,011.10.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $646.58 billion, up from$619.31 billion yesterday. To put it into context, the market cap of gold is $11.299 trillion and Tesla is $654.89 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $33,167,852,489, down from $35,955,372,295yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 77.62%.

Fear and Greed Index

Market sentiment today is 27, in Fear. That’s up from 22 yesterday.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 47.22, up from 46.83 yesterday. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 43.83, up from 39.75 yesterday. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“I’m pretty sure this is going to work, not only for us but for humanity, because it is a leap forward for humanity.”

– Nayib Bukele, President of El Salvador on the country’s Bitcoin plans

What they said yesterday:

Nice…

Niiiice…

Niiiiiice…

Crypto AM Editor picks

John McAfee found dead in his Spanish prison cell

Anonymous say video message to Elon Musk over Bitcoin meddling isn’t theirs

Bitcoin investors are growing weary of Elon Musk’s tiresome tweets

Google slowly opening its doors to cryptocurrency advertising

Cardano bridges the gap to China by teaming up with Nervos Blockchain

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five-part series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM Events

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.