What does a €50 carbon price mean for European companies?

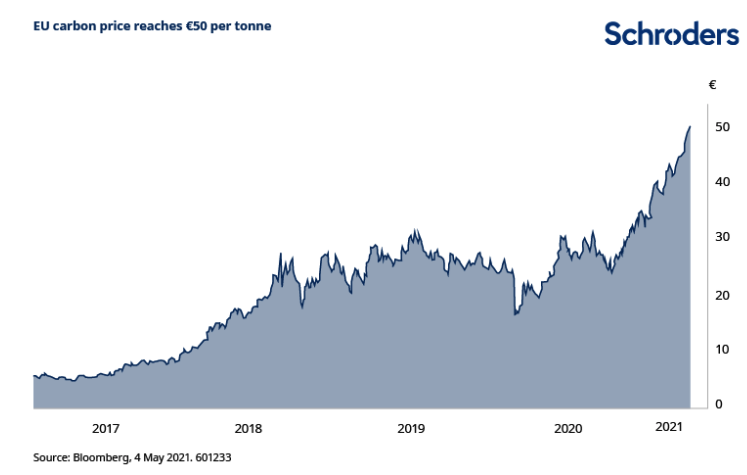

Earlier this month, the EU carbon price moved above €50 per tonne for the first time ever. The price is now more than double its level prior to the pandemic, with a sharp rise in recent months.

What is the EU carbon price?

The EU Emissions Trading Scheme (ETS) is designed to put a price on the greenhouse gas emissions of polluting industries. Right now, the ETS covers 40% (around 1.6 billion tonnes) of European emissions.

The scheme aims to limit emissions from around 10,000 installations. A cap is set on the total amount of certain greenhouse gases that can be emitted by these installations. The companies who own or run these installations buy or receive emissions allowances, which they can trade with one another. The limit on the total number of allowances available ensures that they have a value and caps the absolute level of emissions.

Which sectors does it affect?

Currently, the scheme covers power generation and some industrial sectors (i.e. energy-intensive industry including oil refineries, steel works and the production of metals and other materials).

However, free emissions allowances to specific companies in these industrial sectors mean that some companies currently don’t feel the full impact of the carbon price rise.

The power generation sector is much more affected. As carbon prices have been rising, this makes power from fossil fuel sources more expensive. At the same time, it makes green energy – such as wind or solar – more competitive, which should encourage a change in consumer as well as supplier behaviour.

The impact differs by country too. There is still a lot of scope for the power sector in Germany and Poland to be decarbonised. That means a high carbon price is very important in those countries because firms reliant on fossil fuels, like coal, to produce electricity will see their costs rise. By contrast, the power sectors of the Nordics, Spain and France are already close to being fully decarbonised.

How will the EU’s new climate targets affect the ETS?

Since the ETS came into effect, the free allocations for industrials have been reduced every year but not very meaningfully. This is set to change, however, as Europe now has more ambitious targets to reach net zero emissions by 2050. The current reduction plan for emissions allowances is in line with a 40% cut in emissions by 2030, whereas the EU’s new targets are more ambitious, requiring a 55% cut.

This means that while the path of allowance reductions is broadly set for the period to 2025, we could see a step change take place thereafter. There are likely to be far fewer free emissions allowances, although whether there is sharp initial reduction or a more phased withdrawal remains to be seen. There could be developments on this in June when the EU Commission discusses phase 4 of the ETS (2021-30).

While 2026 may seem far away, the prominence of ESG (environment, social, governance) factors on the investment agenda today means any changes could impact share prices much earlier. In particular, investors will need to take into account the potential impact on long-term valuations.

Discover more from Schroders:

– Learn: How do you measure impact?

– Read: Can companies really balance the needs of all stakeholders?

– Watch: The telecoms business which pioneered a payment system lifting thousands out of poverty

Could other sectors be included?

Outside of the power generation sector, the real impact will not be from rising carbon prices but from more activities being covered by the ETS. After all, a high carbon price doesn’t matter if you are exempt from paying it or if you have sufficient free emissions allowances.

While a swifter reduction in allowances looks likely, and would have a large impact on energy-intensive industrials, another possibility is the inclusion of new sectors altogether in the ETS.

The transport and building sectors could potentially be included. The issue with these is that, generally speaking, the emissions lie with the consumer, not the corporate, and so the emissions are more difficult to measure and monitor.

What are the pitfalls of making the ETS stricter?

The main issue with expanding the EU ETS is the concept of “carbon leakage” whereby raising costs for our domestic industries will lead to a reduction in competitiveness, forcing companies to close or relocate their installations. The emissions would continue; they just wouldn’t be in Europe.

A much-debated solution to this is a carbon border adjustment mechanism, also known as a “carbon border tax” in Europe. This would, in theory, protect industries from carbon leakage by increasing the price of imports in line with the carbon footprint of those imports.

The problem is, how do we monitor the individual footprints of these imports? How do we avoid rerouting, which could see coal-based aluminium from China stamped with a natural gas footprint in Russia before coming to Europe, for example? Will this act as a consumer tax? These are questions that need to be answered before we see a border tax come in January 2023 as planned.

Do other countries have similar schemes?

A lot of the obstacles for the ETS in Europe would be solved by a global carbon price. However, while many countries now have carbon schemes, they are not as mature as the European system.

China is a key market to watch as it is the source of a lot of coal-based industry. With China’s new target of net zero emissions by 2060, we should expect a significant improvement in their system. This would reduce the burden of potential carbon border taxes in Europe.

From an investment perspective, improvements to the global carbon system would benefit companies who are cleaner producers than their competitors in other markets.

Let’s take Norwegian aluminium producer Norsk Hydro as an example. The company uses hydro power to produce its aluminium whereas its competitors in China, who account for around 50% of global aluminium production, largely use coal. A carbon border tax would push up the price of this coal-based aluminium when it is sold into Europe and this would allow Norsk Hydro, with its clean, lower cost base, to benefit from the higher market price.

Another example is fertiliser company Yara, another Norwegian firm. It produces nitrogen fertiliser using natural gas, whereas again many Chinese producers use coal.

The Chinese carbon price today is around US$3 per tonne, which is well below the level needed to incentivise real decarbonisation.

Monitoring carbon costs

As we have seen, the EU carbon price does not affect every company in Europe. But carbon emissions, whether in Europe or elsewhere, have a real cost in terms of their environmental impact.

Schroders has developed a model, Carbon Value at Risk, which helps us see how company profits and investor returns could be at risk from tougher climate policies and higher carbon prices.

Read more about Carbon Value at Risk here.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.