How will Bitcoin recover from this latest correction?

One of the major forces in the metaverse was created in 2009 in answer to all past financial crises, spurred on by what happened in 2008.

Bitcoin has had numerous corrections of as great as -94 per cent since 2010. Each time its bubble burst, it was pronounced dead by mainstream media. 99bitcoins recorded each “death” which has run into the hundreds over the years.

The most recent correction has created the same broken record of mainstream media being used to spread FUD as whales can then go in and scoop up Bitcoin at lower prices.

‘V’ or ‘U’-shaped recovery?

Debate on whether Bitcoin reached a major low has been quelled, black swans notwithstanding, based on numerous metrics having hit major lows as they did in March 2020, mid-2017, and mid-2013. However, debate rages on about how Bitcoin will recover. A V-shaped recovery would be similar to the post March 2020 recovery. A U-shaped recovery would suggest more headwinds at hand. Let’s examine the metrics.

Stablecoins v Bitcoin

Bullish: $6 billion worth of stablecoin USDC hit exchanges. This provides buying power for buying back Bitcoin. Stablecoin USDT also continues to climb. Stablecoin flows are the most bullish since March. Stablecoin capitalisation, particularly USDT, actually increased during the correction, suggesting that overall, investors were using the pullback to buy Bitcoin.

Whale balances are also now at the same levels last seen before the crash when BTC was at $55k. They are using their stablecoins to buy back their sold Bitcoins.

Bearish: The amount of BTC hitting exchanges still is at high levels which suggests more BTC selling pressure ahead. Whales are trying to make up their mind given the tug-o-war between stablecoins used to buy back BTC and BTC being added to exchanges. Of course, BTC could be used for other purposes such as buying ETH or in the case of futures such as on Binance or the options market, using it for those purposes, in which case it is not a bearish event. Indeed, current exchange flows show BTC and ETH moving off exchanges while USDT is moving onto exchanges.

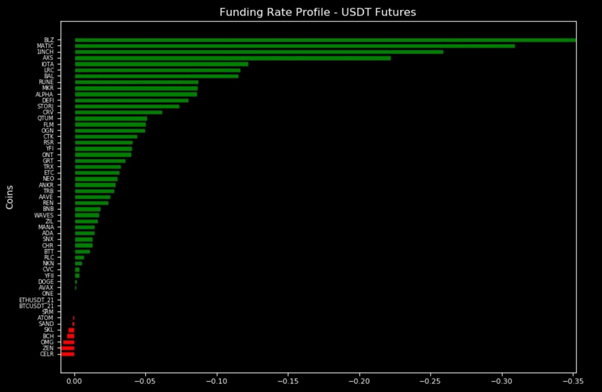

Funding Rates

Bullish: Funding rates are mostly negative which suggests a bottom in cryptos. When shorts have to pay funding fees to longs, that suggests an overly crowded space for those who hold short positions. Whales dont just shoot down FOMO in the form of too many long positions, but do the same for FUD in the form of crowded short positions. This could create a short squeeze.

Whale Maps

Whalemap charts show resistance at $40,000 and $42,000 but big support at $33,000. So it is possible Bitcoin bounces around in this zone before breaking to the upside. The length of time it does this is predicated on the other metrics discussed here.

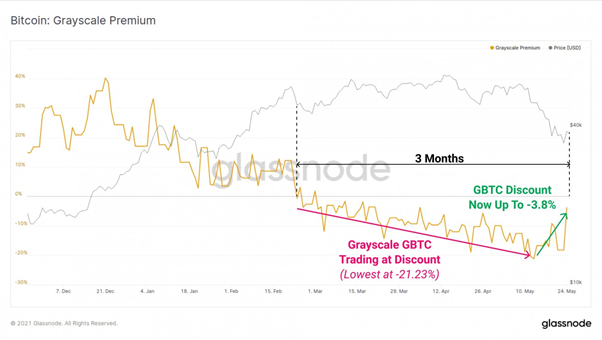

Grayscale GBTC

The Grayscale GBTC discount has risen from a peak low of -21.23 per cent to a smaller discount of -3.8 per cent. GBTC has sustained a discount to spot BTC prices for three months. Positive price momentum started on May 12, early in the current correction. There is also a large unlocking ahead. Keep in mind that GBTC correlates with BTC so odds favour GBTC having made a major low, but could back-and-fill for a time before definitively moving higher. The current price/volume action in GBTC as discussed in the Focus List Report over the weekend should be heeded.

New Users

As the number of users of Bitcoin continues to double every year, during this two week dip down to $30,000, the new user growth on the network accelerated suggesting users are taking this opportunity to enter for the first time.

The number of new wallets with less than one BTC soared during the correction. While there are whales with more than 1,000 BTC, these are labelled as shrimps.

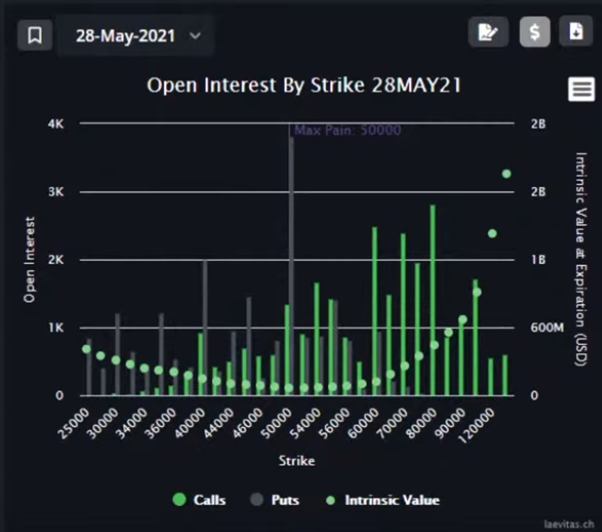

Bitcoin options

Bitcoin options expire this Friday – May 28 – at 8 am UCT. The maximum pain point is at $50,000. This means the largest number of bulls (calls) and bears (puts) lose at this price level. In the past two monthly options expirations, Bitcoin’s price magnetically moved close to prior pain point price levels by the date of expiration.

Miscellaneous

Ray Dalio now has joined the fray of HNWIs who own Bitcoin.

V > U

Many of the metrics look very similar in structure to the COVID white swan recovery in March 2020 when we had a V-shaped recovery. NVT (network value to transactions ratio) puts BTC at $55k while S2F (Stock-to-Flow) puts it at $60k if Bitcoin is to continue its multiyear pattern with respect to these metrics. While odds given the above favour a V-recovery, odds are odds. This means the odds maybe around 75 per cent for a V-recovery which still means 25 per cent for a U-recovery. All it takes is some additional FUD or actual negative news to push Bitcoin down at least for a short while.

Certainly over the last several years, mainstream press has been used to spread FUD to drive prices lower at critical levels. It doesn’t take much for an institution to pay off some writer to publish something negative on a major platform, then go in and buy Bitcoin on the reaction sell off.

Market manipulation is as old as the hills.

Dr Chris Kacher, nuclear physicist PhD turned stock+crypto trading wizard / bestselling author / blockchain fintech specialist / top 40 charted musician. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first bitcoin at just over $10 in January-2013 and attended early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/