FTSE 100 sinks to five-week low while tech shares drive Wall Street higher

London’s FTSE 100 dropped sharply this afternoon, giving up yesterday’s gains amid fears of a rise in inflation and weak performance from heavyweight stocks.

London’s premier index was down by 0.7 per cent in afternoon trading, dropping to 6,953.60 points – its worst price for almost a month.

The FTSE 250 of midcap companies was also down 0.2 per cent at 22,065.43 points.

Elsewhere, Wall Street’s main indexes opened higher today, with the tech-heavy Nasdaq in the lead with a 1.4 per cent jump.

The rise came after data showed fewer Americans filed for weekly claims and investors shrugged off a surge in producer prices.

The Dow Jones Industrial Average shot up 1.1 per cent, while the S&P 500 gained 1.2 per cent.

Before the Open: Get the jump on the markets with our early morning newsletter

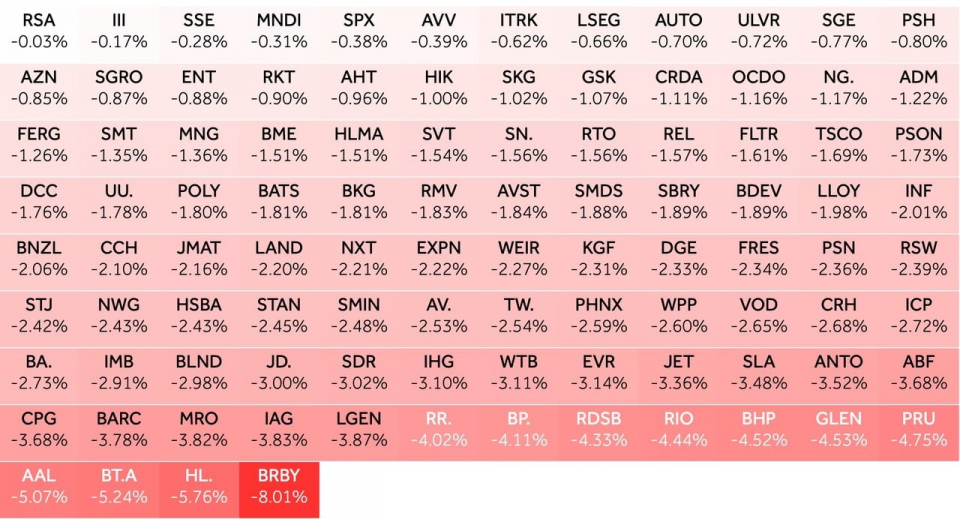

Market movers

BT led this afternoon’s slide, falling 7.2, followed by Hargreaves Lansdown’s 5.7 per cent drop.

Commodities giants BP, Rio Tinto, BHP and Anglo American all fell by two per cent or more.

Risers were few and far between this afternoon, with investment manager M&G rising by almost four per cent and Ashtead up 1.8 per cent.

Around the world

Investors dumped shares today after a bigger-than-expected rise in inflation spooked US stocks.

Asian markets were already on the backfoot amid a tech sell-off on Wall Street, and nerves were further jangled yesterday when Taiwan stocks plunged on lockdown fears.

Shares in the continent slipped to seven-week lows, with Japan’s Nikkei falling 2.5 per cent and Chinese blue chips losing 0.9 per cent.

In Europe, the FTSE’s main rivals the DAX and the CAC were both down 0.1 per cent.