S4 Capital hikes profit forecast after strong first quarter

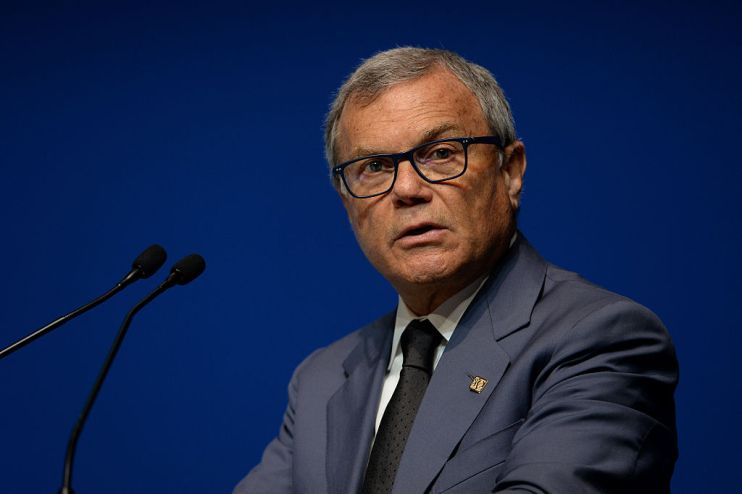

Sir Martin Sorrell’s S4 Capital today lifted its revenue and profit targets for the full year after posting another quarter of rapid growth.

The digital advertising firm reported revenue of £122m in the first three months of the year, up 35 per cent on the same time last year. Gross profit grew by a third to £104m.

As a result, S4 said it would target like-for-like revenue and profit growth of 30 per cent for the full year, up from 25 per cent previously.

The London-listed group said the figures showed an acceleration in profit growth from the final quarter of last year.

It credited strong performance by its two new major client wins —dubbed “whoppers” — with revenue of more than $20m per year.

Shares were up more than two per cent in morning trading.

S4, whose clients include Google and BMW, has also benefited from a shift to digital market during the pandemic.

The first-quarter figures also reflected signs of a recovery in the global advertising market, with strongest growth in Europe, the Middle East and Africa and Asia Pacific.

Sorrell’s company said cash balances were roughly £50m at the end of the first quarter following merger cash payments of roughly £95m.

S4 continued to pursue an aggressive merger strategy in the first quarter, merging with a string of ad firms including Decoded Advertising and Jam 3.

The firm today announced the acquisition of Brazilian agency Raccoon Group, which was founded by two ex-Google employees. S4 said the move would bolster its data and digital media practice in Latin America.

S4 said it was preparing a bond issue to bolster its debt capacity, which it said would give it roughly £500m for future acquisitions.

“We are extremely optimistic about our prospects for this year and next, given the huge global fiscal and monetary stimulus introduced to counter the impact of the pandemic and the subsequent increase in consumer savings ratios and stagnation of corporate capital investment,” Sorrel said.

“The chickens may well come home to roost in 2023, given the debt burden that most countries will have and the tax increases that will have to be implemented. But, digital marketing expenditure remains robust, even in a recession, as our results last year demonstrate, given its secular growth trend.”