Tesla seal of approval gives crypto recovery another boost

Crypto at a glance

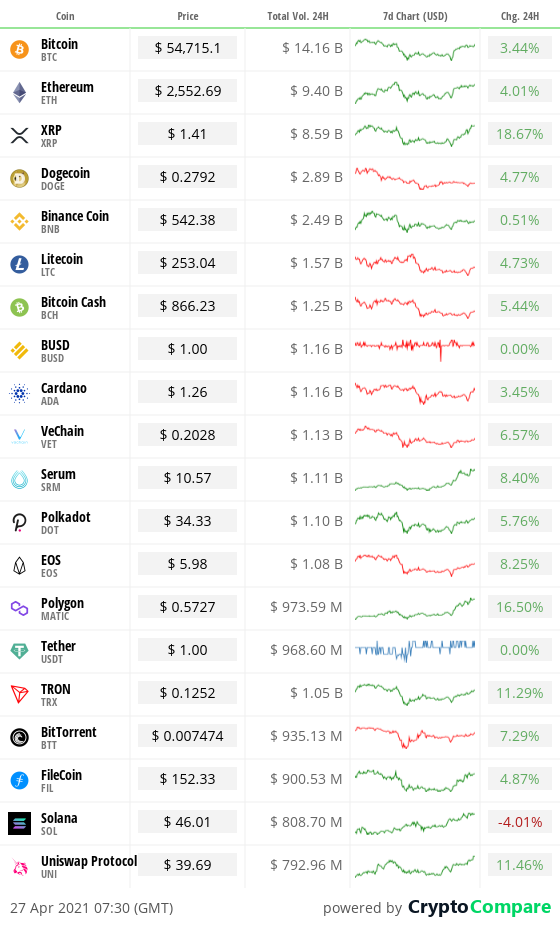

It’s another sea of green in the markets today, as cryptocurrencies across the board continue to turn last week’s losses into this week’s gains. Is it too early to talk about another run past the recently-set all-time highs over $62,000?

Bitcoin seems to have found its way back on course faster than a Canada goose with radar. It’s now back trading at just below $55,000, having fallen to a low of $47,000 on Sunday. Its market cap is also back above $1 trillion for the first time since last Thursday.

The leading cryptocurrency’s recovery received a further boost yesterday on news that Tesla had gained $100 million through its Bitcoin investment, which exceeded standard expenditure. The electric car giant’s CFO, Zachary Kirkhorn also noted that “there are lots of reasons to be optimistic” on the cryptocurrency.

And it seems it never rains but it pours in terms of bullish news, with sources today revealing that JPMorgan is preparing to offer their private clients an actively traded Bitcoin fund. The move would represent a seismic shift in position for the US mega bank, whose CEO, Jamie Dimon, has previously been a vocal opponent of the cryptocurrency. How many worlds are there left to conquer?

READ MORE: JPMorgan chief says ‘we will have to be involved in Bitcoin’

The positive price momentum is the order of the day, with the total crypto market cap also returning above $2 trillion since Thursday. Ethereum (ETH) is changing hands at more than $2,500 again, boosted in particular by news that average fees have dropped over the past seven days. The drop means there’s been an 18 per cent reduction in the average cost of using the network, which is commonly used by DeFi apps and should help make it more widely used.

The other big gainers yesterday were UniSwap (up 11 per cent), Stellar (up 11 per cent), and XRP, which is up 20 per cent to $1.41 at time of writing. The controversial cryptocurrency is continuing its rehabilitation after its recent legal troubles. Can it push back towards $2.00 again?

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

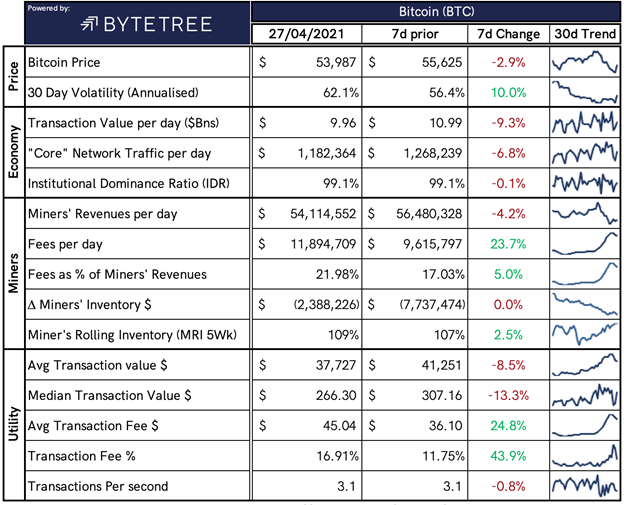

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $2,054,640419,958, up from $1,957,483,335,553 yesterday.

What Bitcoin did yesterday

We closed yesterday, April 26 2021, at a price of $54,021.75 – up from $49,004.25 the day before.

The daily high yesterday was $54,288.00 and the daily low was $48,852.80.

This time last year, the price of Bitcoin closed the day at $7,679.87. In 2019, it closed at $5,279.35.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $1.023 trillion, up from $982.71 billion yesterday. To put that into context, the market cap of gold is $11.31 trillion and Alphabet (Google) is $1.548 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $53,037,973,903, down from $58,884,766,713 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 52.34%.

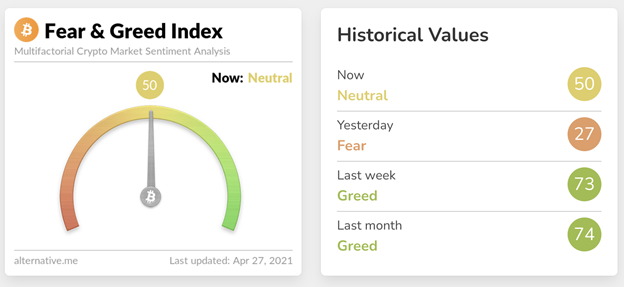

Fear and Greed Index

Market sentiment is already back up to 50.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 50.90, down from 51.35 yesterday. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 47.20, up from 41.28 yesterday. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“It is our intent to hold what we have long term and continue to accumulate Bitcoin from transactions from our customers as they purchase vehicles.”

– Zachary Kirkhorn, Chief Financial Officer, Tesla

What they said yesterday

A huge statement from the thinking man’s American footballer…

Elon shooting rumours down…

Proof is in the pudding…

Would be quite a comeback…

Crypto AM Editor writes

Bitcoin could pull back to $20,000 claims global investment boss

Bitcoin gets seal of approval as Baillie Gifford ploughs $100m into London crypto firm

API3 and Open Bank Project team up for decade-long blockchain venture

Intelligence dossier finds Bitcoin is outperforming gold but Ethereum is outshining Bitcoin

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two April 2021…

Part two of two April 2021…

Five part series March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM: Recommended Events

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021 (announcement soon)

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.