Cyber firm Darktrace confirms plans for London float in early May

UK cybersecurity company Darktrace today confirmed it will float on the London Stock Exchange in the coming weeks as it looks to build on a successful pandemic year.

The firm’s offer price will be determined following a book-building process, with the listing expected to take place early next month. The company is understood to be seeking a valuation of up to £3bn.

Darktrace will aim to raise proceeds to speed up new product development as well as expansion overseas.

The announcement comes a week after the firm announced that its revenue had surged to almost $200m during the pandemic.

The listing will be a major test of investor appetite for tech floats in London after Deliveroo’s disastrous debut last month.

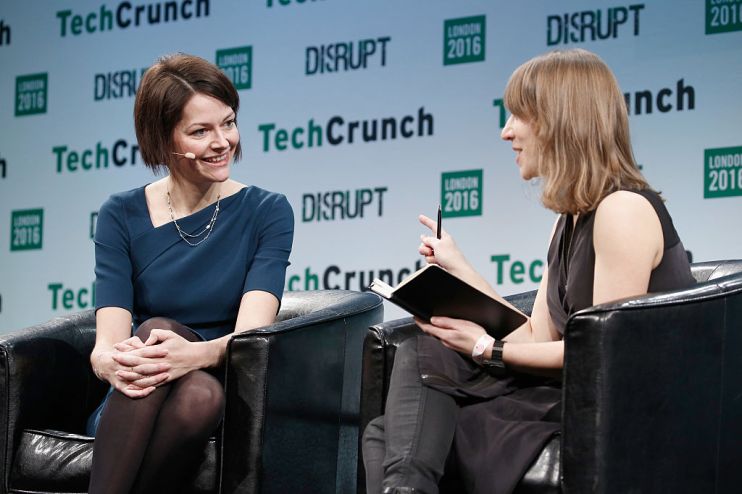

The cyber firm, founded in 2013 and led by Poppy Gustafsson, has profited from higher demand for its services due to the shift to home working throughout the Covid crisis.

Darktrace, which makes most of its revenue from subscriptions, has more than doubled its customer base in the last two years.

The company’s float plans suffered a setback earlier this year after UBS resigned from its position as one of the lead investment banks on the IPO.

However, since then the firm has made several high-profile appointments to bolster its board, including former BT chief executive Sir Peter Bonfield.

Lynch links

The process has also been complicated by Darktrace’s links to billionaire tech entrepreneur Mike Lynch, an early investor in the company who has been charged with fraud in the US.

Lynch is currently fighting extradition and Darktrace has warned it could become caught up in his legal battle.

However, a source close to the company insisted there had been “no distancing” from Lynch, who invested in Darktrace through his company Invoke.

“If it wasn’t for him we wouldn’t be where we are today,” the source told City A.M.

The Autonomy founder stepped down from Darktrace’s advisory council in 2017, but is understood to have continued giving ad hoc advice since then.

Darktrace’s float will also be a further major test of appetite for tech IPOs in London after Deliveroo flopped during its eagerly-anticipated listing last month.

It is understood that the cyber firm will not be using the dual class share system employed by the food delivery platform. The method is common in the US but less often used in the UK and sparked concerns among some Deliveroo investors.