Coinbase (est 2012) $87bn market cap is ironically more than Barclays (est 1896)

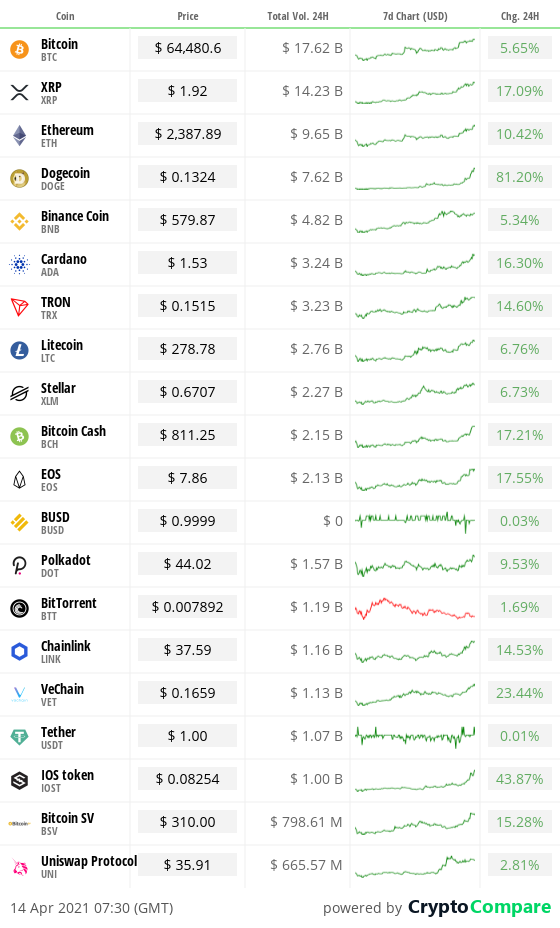

Crypto at a glance

It was a seminal day for cryptocurrency yesterday, with Coinbase becoming the largest business of its kind to list on the Nasdaq.

It opened shares at $381 – a steep increase on the $250 reference price. And it only grew from there, rising as high as $429 in its first few minutes of trading before stabilising.

It’s currently trading at $328.28, with a market cap of $87 billion at time of writing. This makes it bigger than BP and General Motors.

This is a huge moment for the crypto markets, bringing the kind of legitimacy and visibility to the space that many have been waiting for.

At $87 billion, its market cap is a lot higher than many major banks – including Barclays, which actually blocked Coinbase not too long ago. This is not an inflated valuation. It shows the promise of cryptocurrency and the belief in its potential, but also that we are still in the early stages.

The huge appetite among institutional investors for anything and everything to do with crypto shows the belief that we’re still at the beginning of this and there’s lots more to come.

This was also reflected in the cryptocurrency markets, with the price of Bitcoin soaring to a record of $65k in the hours before the listing. It has since dropped back to just below $63k, corresponding with a similar drop for Coinbase – suggesting a to-and-fro relationship that could continue into the future?

It was a similar story down the ranks too, with only Ethereum really holding its gains from yesterday. The second-largest cryptocurrency is up two per cent in the last 24 hours and changing hands at around $2,450.

Chainlink (LINK) and VeChain (VET) were the other big gainers, both seeing double digit rises. Will the Coinbase listing now spark now serve as a springboard for higher highs, or prove to be a temporary top as the market figures out what happens next?

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

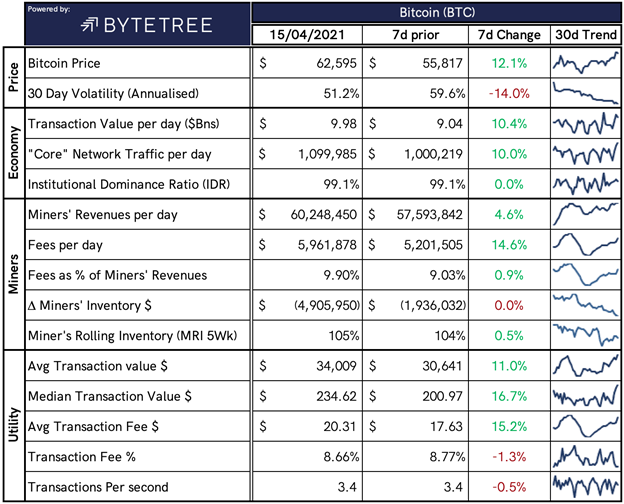

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $2,230,550,604,862, up from $2,254,752,578,166 yesterday.

What Bitcoin did yesterday

We closed yesterday, April 14 2021, at a price of $63,109.70 – down from $63,503.46the day before.

The daily high yesterday was $64,863.10 and the daily low was $61,554.80.

This time last year, the price of Bitcoin closed the day at $6,842.43. In 2019, it closed at $5,167.72.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $1.175 trillion, down from $1.204 trillion yesterday. To put that into context, the market cap of gold is $11.095 trillion and Alphabet (Google) is $1.516 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $74,622,762,225, up from $74,815,037,858 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 40.47%.

Fear and Greed Index

Market sentiment remains in Greed at 79.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 54.10. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 66.19. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Those who regulate … those who are in Government that make policy better start understanding what it means for the future because other countries are moving forward especially China. I want the next century to be ours. I do not want America to fall behind.”

Congressman Kevin McCarthy (R-TX) on government involvement in crypto

What they said yesterday

A seminal moment…

Saylor speaks…

Though not everyone’s impressed…

Not just Bitcoin that’s celebrating…

Crypto AM Editor writes

Intelligence dossier finds Bitcoin is outperforming gold but Ethereum is outshining Bitcoin

Ethereum on a roll as it keeps racking up all time highs

Ziglu makes Tezos and digital coin Tez available to customers

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with Zumo

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special Five Part Series

March 2021

Day Five

Day Four

Day Three

Day Two

Day One

Crypto AM: Recommended Events

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021 (announcement soon)

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.