Thiel warns on China as markets trade sideways

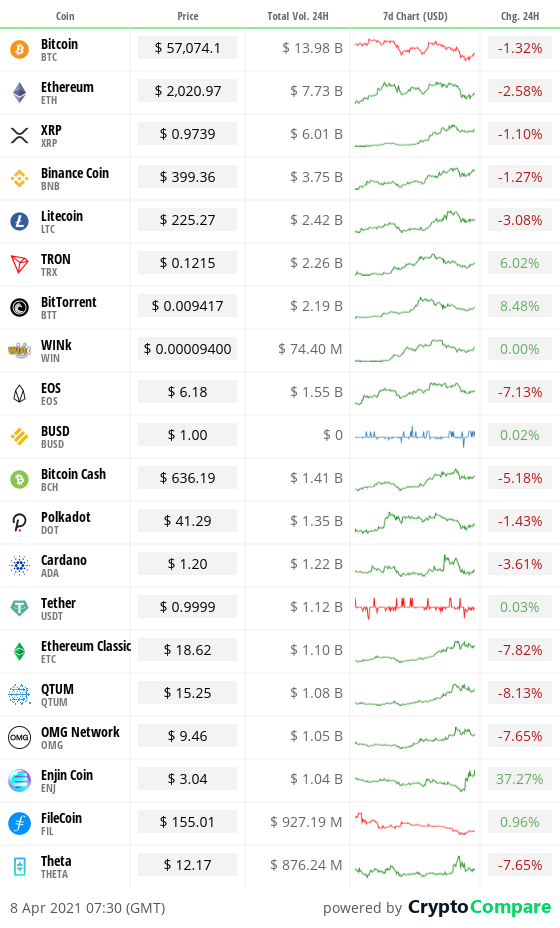

Crypto at a glance

The crypto markets took another hit yesterday, but continue to look strong and the total market cap remains over $1.9 trillion. Will it now continue to drift downwards after the weekend’s gains, or can bulls regain the initiative?

The Bitcoin price is down slightly for a second day running, though it’s still trading in the corridor between $56k and $60k, where it’s struggling to break through. It’s currently sitting at just over $57,000. Resistance is currently looking strong at $60k, but equally support is also strong at $55k. What will it take for a big move in one direction or the other?

It was a similar story elsewhere. Ethereum yesterday shed more than seven per cent of its price to a low of $1,945.44, erasing a week’s worth of gains and sending it under $2,000 for the first time since April 3. It’s since recovered that level and is again changing hands at over $2,000. Can it hold?

There is a sea of red across the boards today, though losses are largely in the low percentages and a tiny dent in recent gains. This is particularly impressive given the deluge of FUD from mainstream media so far this week, primarily surrounding China and regulation.

Much of this was the usual combination of misinformation and speculation surrounding its environmental impact in China, as well as calls from the likes of JP Morgan CEO Jamie Dimon calling for increased speculation.

More interestingly, there was also tech entrepreneur and self-proclaimed Libertarian and Bitcoin maximalist Peter Thiel, who yesterday suggested Bitcoin should be treated as a ‘Chinese financial weapon’ and subject to stricter US scrutiny.

The comment has largely been taken as a suggestion that the US government should get more involved with crypto and use it themselves. Will they heed his warning?

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

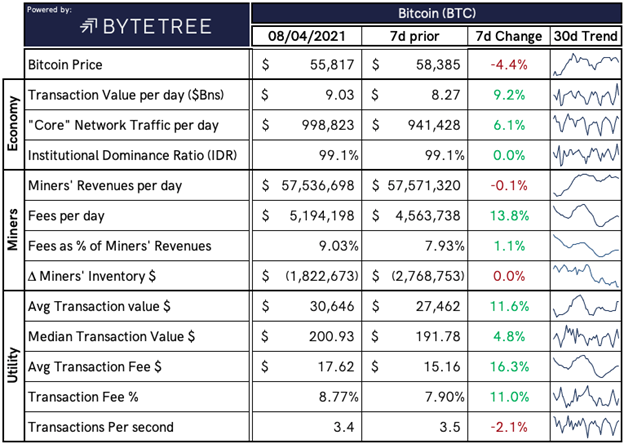

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,929,987,559,189, down from $1,957,412,306,515 yesterday.

What Bitcoin did yesterday

We closed yesterday, April 7 2021, at a price of $56,048.94 – down from $58,192.36 the day before.

The daily high yesterday was $58,731.14 and the daily low was $55,604.02.

This time last year, the price of Bitcoin closed the day at $7,176.41. In 2019, it closed at $5,198.90.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is $1.065 trillion at time of writing, down from $1.080 trillion yesterday. To put that into context, the market cap of gold is $11.074 trillion and silver is $1.386 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $72,681,346,978, up from $69,942,635,501yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 49.53%.

Fear and Greed Index

Market sentiment remains in Greed at 73.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 56.81. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 53.61. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The mobile wallet’s coming to everybody on the planet whether we like it or not. And if it doesn’t sit on Bitcoin controlled and owned by American investors and American companies running on American technology, spreading American values, spreading the US dollar, it’s going to sit on the Chinese yuan… Either US technology and fintech is going to be built on top of [the] 21st-century crypto asset network Bitcoin. Or, we’re not, and the six billion people on the planet that need such a thing are going to go to somebody else. I mean the truth of the matter is, they’ll probably go to Bitcoin, but… instead of US dollars on Bitcoin, they’ll be running Chinese yuan, renminbi on Bitcoin.”

Michael Saylor, bull of bulls

What they said yesterday

What Peter Thiel said…

What he really meant…

Evidence?

A shame…

Crypto AM Editor writes

Intelligence dossier finds Bitcoin is outperforming gold but Ethereum is outshining Bitcoin

Ethereum on a roll as it keeps racking up all time highs

Ziglu makes Tezos and digital coin Tez available to customers

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with Zumo

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special Five Part Series

March 2021

Part Five

Part Four

Part Three

Part Two

Part One

Crypto AM: Recommended Events

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

And…

Crypto AM Awards 2021

Announcement soon!

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.