Why China’s electric vehicle market is at full throttle

We get under the bonnet and look at what’s driving growth in China’s electric vehicle market

After a dip in sales in 2019 and the impact of the pandemic in early 2020, the market for electric vehicles (EVs) in China is recovering strongly.

Among the factors driving this acceleration in sales is the combination of more attractive and cost competitive models. What’s more, new government directives have given strong support for China’s auto industry to electrify.

At the same time, valuations of many of these companies have been driven up to extreme levels.

What’s driving China’s EV market?

The direction of travel was underlined by President Xi Jinping at the United Nations last September, when he pledged to cut China’s carbon dioxide emissions to nearly zero by 2060. Low-emissions transport, including EVs, will be one of the strategic industries helping the country achieve its climate goals.

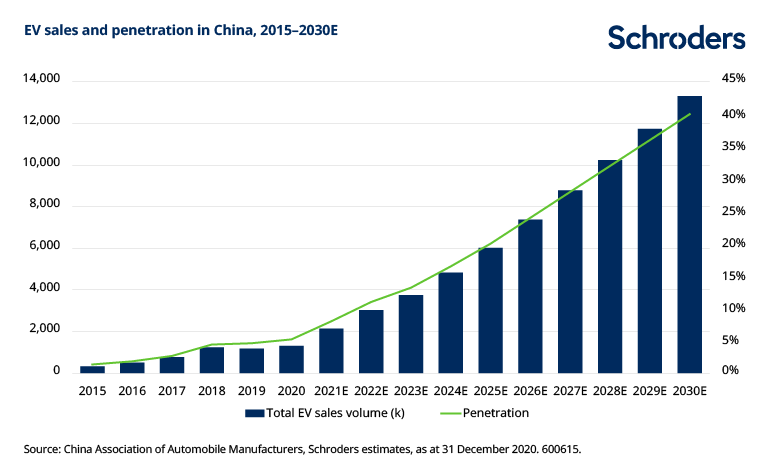

2020 also saw policy updates that will accelerate the adoption of EVs, even as vehicle price subsidies are phased out. Beginning this year, mandatory emission quotas for internal combustion engines (ICE) and EVs are being tightened to help EVs reach 20% of new car sales by 2025; this equates to around 6 million units a year, from 1.3 million in 2020.

A decade later, by 2035, EVs are expected to account for 50% of all new car sales, according to the government’s ‘Energy-saving and New Energy Vehicle Technology Roadmap 2.0’. This sets out how China’s automotive industry will be transformed into a largely electric and hybrid industry. The State Council, China’s cabinet, also set specific tasks for EV manufacturers to ensure they are fit for purpose by the time the ICE is phased out.

Of course, the government’s projections are not guaranteed to happen. Domestic economic growth and consumer demand might be lower than expected, particularly since global car sales, including those in China, peaked in 2017 and have been falling since. Meanwhile, the charging infrastructure for electric vehicles could fall short of what is needed and the price of EVs might remain too high for both consumers and manufacturers. At present, most car manufacturers are not selling EVs at a profit.

But China’s new policies do amount to a blueprint for the transformation of the automotive sector and are expected to boost sales of EVs after two stagnant years. Before the policy announcements, growth in EV sales in China had fallen behind other markets, notably Europe.

The end of China’s lockdown, coupled with the government’s strengthened policy frameworks, triggered a rebound in EV demand, which is now growing by 40% year-on-year (y/y). In December, EV sales reached a historic peak of 248,000 units, up 52% y/y.

Discover more from Schroders:

– Learn: What are the three ‘P’s of sustainable investing?

– Listen: Why the 21st century belongs to Asia

– Watch: Will 2021 be the time for investors to stop hibernating?

What other factors are driving the growth in EVs in China?

1. The price and driving range of EVs is improving

Chinese consumers have three main concerns about EVs: their high price, their limited driving range and the dearth of charging points.

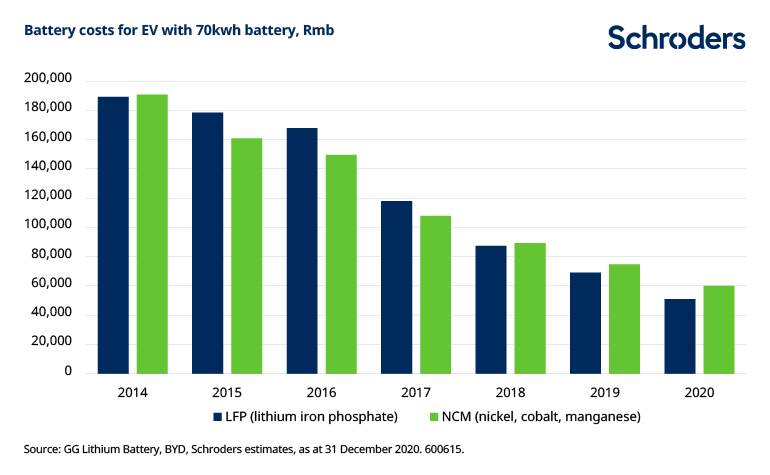

Price sensitivity remains high, as shown by the abrupt fall in EV sales in mid-2019 when the government cut price support levels. Until June 2019, subsidies could be as high as RMB50,000 (US$7,600) for a RMB250,000 (US$38,000) car. Price support has now been cut to RMB9-22,000 for 2020-2022, and will be abolished in 2023. The government is scaling back price support because battery technology is improving and costs are falling, reducing the need for subsidies.

As the chart below shows, battery costs have fallen by more than 70% since 2014, narrowing the price gap between EVs and conventional gasoline cars. We estimate that as little as RMB30,000 (US$4,500) now separates the cost of the powertrain for a conventional ICE from its more expensive battery-powered cousin.

Powertrains are the most expensive part of any vehicle, electric or ICE. So if battery costs continue to decline at annual single digit rates, EVs could achieve price parity with ICEs in the next five years.

In parallel, the efficiency and range of electric batteries have improved to the point where top-selling EV brands now have a driving range of 300km-700km. This is similar to that of an ICE.

2. New models have been a game-changer

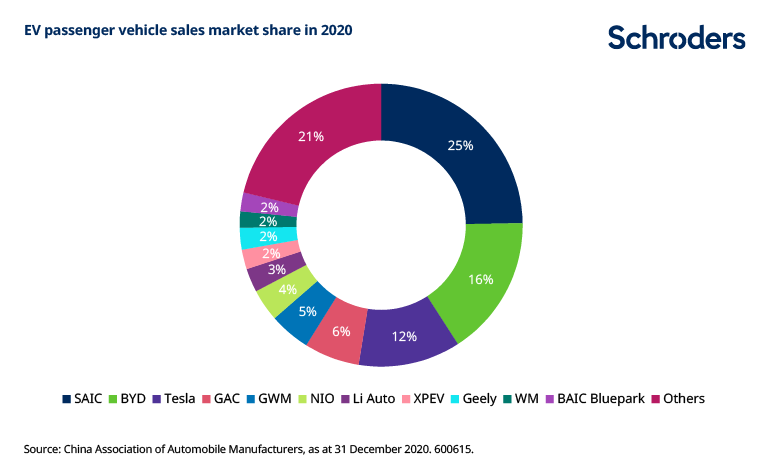

New EV models are being launched, including from traditional car manufacturers, increasing the competition between brands and also giving consumers more choice.

The entrance of Tesla’s Model 3, one of the best-selling electric vehicles in China, has been a game-changer for the industry. Until recently, most EVs on the market were converted from ICE cars. They had all the disadvantages of EVs – high price, low driving range, inconvenient charging – with none of the perks, such as smart driving features, more seating room and a better driving experience.

Tesla’s success bolstered the business case for domestic EV startups such as NIO, Xpeng and Li Auto, while sending traditional auto manufacturers back to the drawing board to design EVs from scratch.

Nio, founded in 2014, currently offers three premium electric SUVs. Li Auto sells hybrid EVs, with its Li ONE SUV, ranking as the top-selling SUV in the EV segment in China in September 2020. Xpeng produces and sells premium electric vehicles, positioned as more affordable rivals to Tesla’s Model Y SUV and Model 3 sedan.

This year, traditional carmakers including VW, Geely and BMW will launch new models that have been designed as electric vehicles from the start. For example, VW will launch its ID.4 at below RMB250,000, with a range of 550km.

The bargaining power big car manufacturers have over their suppliers is expected to cut costs further and to provide more price-competitive products in the future. This should allow EVs to enter the mass market.

3. Vehicle smartisation

Chinese consumers view EVs very differently from Europeans, whose focus is on their environmentally friendly credentials. By contrast, Chinese consumers are more heavily influenced by the smart technology, or ‘vehicle smartisation’, that EVs offer. And this trend could tilt the market decisively in favour of EVs, particularly once price parity with conventional cars is reached; expected within the next five years.

There is ongoing debate over when autonomous driving will become the norm, but this is a moot point. The role of the driver has already started to be diminished by technology, and this trend is set to continue. Smart driving systems are now a major feature. Meanwhile, the interior is increasingly seen as a “cabin”, with infotainment systems another differentiator.

Advanced driver-assistance systems (ADAS), which control speed, or help drivers park their cars, are a particularly attractive feature. ADAS uses automated technology, such as sensors and cameras, to detect nearby obstacles or driver errors, and respond accordingly. The system increases passenger and road safety by, for example, braking automatically if the car senses the proximity of another vehicle. Other sensors detect the driver’s eye movements, and therefore whether they are at risk of dozing off.

Many of these systems are produced by less widely-known companies such as Huizhou Desay Automotive and Ningbo Joyson Electronics. Both offer ADAS systems among a host of other products, some of which are compatible with traditional combustion engine models too. Ningbo Joyson’s safety products, for example, already feature in over 300 vehicle models from more than 60 manufacturers around the world. Nexteer and Ningbo Tuopu Group meanwhile, provide braking/steering systems for autonomous driving.

And it doesn’t stop there. Smartisation covers the range of tasks performed by drivers. Adaptive Driving Beam headlights, produced by companies including Changzhou Xingyu Automotive Lighting Systems, provide significantly better illumination but with less glare for oncoming drivers. Keboda is another company which produces innovative lighting systems, including LED headlight control. And of course so much of the electronics in these vehicles comprise high tech semiconductors, or microchips.

Conventional vehicles are trying to catch up but face technical obstacles, and EVs are expected to hold the edge in terms of vehicle smartisation. We expect smart driving technology to become a big differentiating factor for EVs and to increase their overall attractiveness as price competitiveness improves.

How critical is Chinese government support?

While industry trends are encouraging, Chinese government policy support will remain crucial for the accelerated development of the EV sector. However, the nature of the support is changing.

Direct price subsidies are being phased out as the costs of batteries fall and their efficiency improves. Instead, the government’s New Energy Vehicle Development Plan (2021-2031) and Technology Roadmap 2.0 for energy saving and new energy vehicles, both published in October, aim to shift support to the construction of the charging infrastructure.

There are several groups involved in the charging infrastructure market, including the state-owned electric utility, State Grid Corp, third-party independent charger operators and leading EV makers, which are building their own fast-charging and battery switching networks.

Charging infrastructure companies are an increasingly important part of the EV ecosystem. There are currently about 600,000 EV charging points in China, equivalent to about one for every five vehicles; this is lower than previous government targets and considered insufficient. Government subsidies may promote faster construction of charging infrastructure.

Does China’s EV growth aligns with broader climate goals?

There are several factors underpinning Chinese government support for EVs: they reduce China’s dependence on imported oil; they lower air pollution in cities and help to reduce the country’s carbon emissions; and they are spearheading the creation of a world-class, technology-driven industrial ecosystem that supports jobs and exports.

With President Xi Jinping’s pledge to make China carbon neutral by 2060, EVs will become one of the strategic industries helping the country to achieve its climate goals. Which is why, despite of some of the current exaggerated hype and market valuations, we are confident that the outlook for the EV industry will remain strong for many years to come.

Is there still an opportunity for investors?

There is little doubt that EVs are going to become increasingly dominant as a share of overall vehicle sales over the next decade.

However, the number of EV manufactures has increased, while traditional, ICE manufacturers are have their sights firmly on gaining market share in the EV segment. This makes for a crowded, more competitive, market place which will likely erode manufacturer profitability. In particular, it is worth noting that EVs have far fewer moving parts than traditional cars; barriers to entry are low.

The industry is likely to see some consolidation as a result. The winners will emerge, but predicting which companies is at this stage a difficult task. Where we have more conviction is for EV supply chain component companies, whether that be in electronics, parts or batteries production. In our view, these “pick and shovel” plays are most interesting for investors, albeit a focus on valuation remains key.

This article was published on 15 March 2021. Any company references are for illustrative purposes only and are not a recommendation to buy and/or sell, or an opinion as to the value of that company’s shares.

The article is not intended to provide, and should not be relied on, for investment advice or research.

Topics:

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.