Will rising commodity prices prompt a shift for equity investors?

A number of different factors are coming together to support rising commodity prices. Such price rises could have a profound effect on the type of companies equity investors want to own. After years of being out of favour, suddenly commodity-related stocks – which are often found at the value end of the spectrum – may find themselves back in demand.

Why are commodity prices rising?

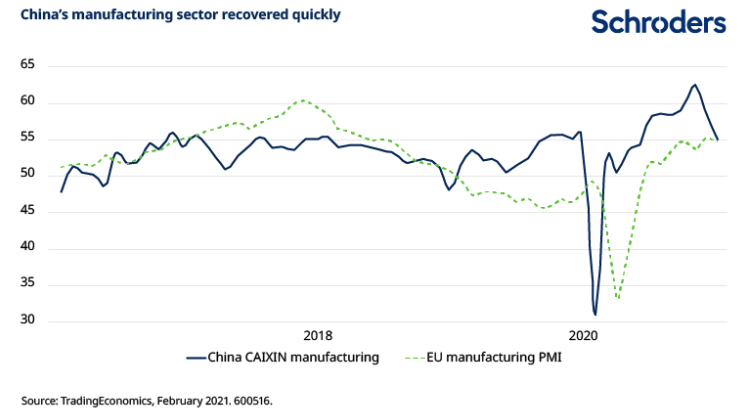

With much of the world still in the grip of Covid-19 induced lockdowns, the strength of manufacturing demand may seem surprising. However, China – first in and first out of the Covid crisis – is leading the way.

The Chinese Caixin manufacturing purchasing managers’ index (PMI) reached a ten-year high of 54.9 in November 2020. This has since slipped back slightly with Covid infections rising again globally, but still represents robust growth in manufacturing activity, implying increased demand for commodities.

Other regions, including Europe, are starting to see manufacturing pick up too. Importantly, this is happening from a low base. The trade war fears and economic slowdown of 2019 represented a difficult period for Europe’s manufacturers, with the manufacturing PMI below 50 for much of that time, representing contraction in the sector.

Now, pent-up demand is being unleashed, especially with Covid-19 vaccines on the way. These should hopefully herald the end of the pandemic and a return to a more normal economic environment.

The fiscal and monetary support being made available by governments and central banks in the wake of Covid-19 is also supporting asset prices, including commodities.

For example, oil prices fell sharply at the peak of the crisis in March/April 2020 but have since risen substantially as economic stimulus and successful vaccines prompt hopes of a relatively swift return to higher levels of economic activity. The Brent oil price was below $20 per barrel in April 2020 but is currently back above $60 per barrel.

Discover more from Schroders:

– Learn: Why I can stomach higher equity valuations

– Read: Why lockdown winners aren’t vaccine loser

– Watch: Will 2021 be the time for investors to stop hibernating?

How important is a “green” recovery?

While oil prices react quickly to changes in demand, the emphasis on a “green” recovery from the pandemic is another important factor at play. Investment in the energy transition is driving up the prices of metals that will be crucial to a successful transition. Lithium is crucial for electric vehicle batteries, while copper is needed across a wide range of energy transition applications, from electric cars to carbon capture and storage.

Meanwhile, other sustainability themes are also sending commodity prices higher. Companies’ and consumers’ desire to move away from plastic – particularly single-use plastic – is resulting in increased use of paper and cardboard packaging. This includes packaging for food & beverages, as well as for other goods

Then there is the cost of carbon. The European Union’s renewed focus on cutting emissions helped push carbon prices to a record high above €38 per tonne earlier this month. This in turn pushes input costs higher for polluting industries, including many commodities producers, and thereby adds to inflation. In the longer term, it encourages the transition to “green” technology as such companies will need to find ways to reduce their emissions.

How could equity investors react?

From an equity investor’s perspective, rising commodity prices don’t just have an impact on miners and oil companies. They also affect companies producing all kinds of products further along the chain, such as chemicals, steel or paper products. A reconfiguration of supply chains, as companies seek more local suppliers, is also increasing costs.

While overall inflation remains very low, these commodity price rises are starting to show up in producer price inflation. Eurozone producer prices for January 2021 were up 0.8% compared to December 2020. Rising producer prices are good news for companies operating in the commodity complex because their revenues go up while their cost of production remains static.

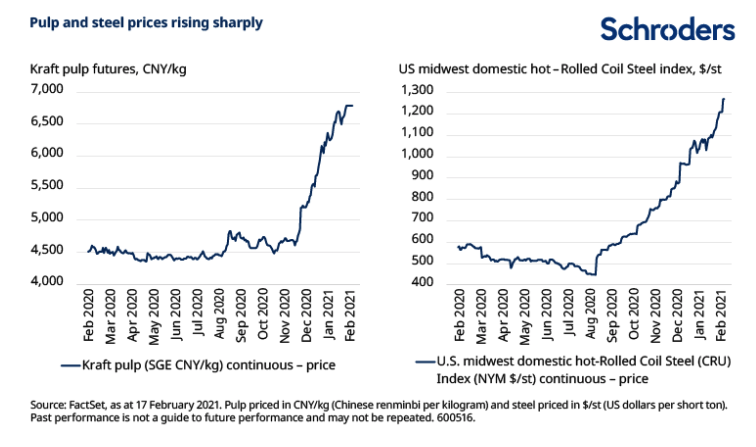

Prices of pulp and steel have been rising sharply in recent months, as the charts below show. Rising prices tend to favour more lowly-valued parts of the market, which have been left behind in recent years. We could see a rotation into these kinds of stocks, particularly those in the materials sector that are aligned to the commodity cycle.

Companies in the pulp & paper and steel sectors are among those that could draw benefit from these price rises. Clearly, their own input costs may be on the rise too, but some companies have the ability to mitigate this. Certain steel companies also produce iron ore, for example, a key input into the steelmaking process. Companies that make alternatives to plastic packaging stand to benefit from increased demand for card and paper products.

Are other commodity prices rising too?

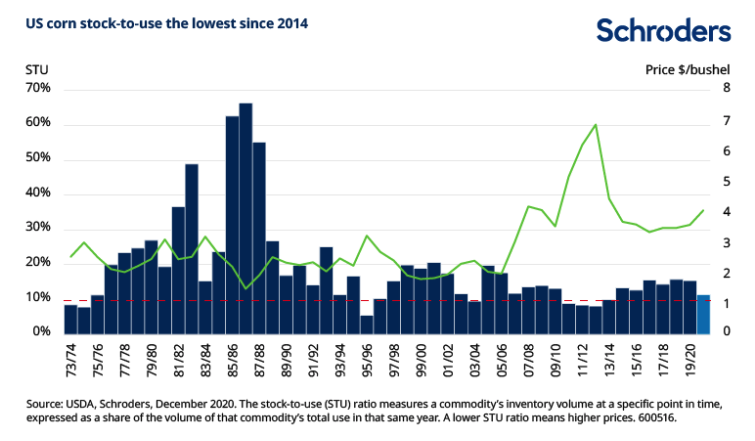

Rising prices are also in evidence when it comes to agricultural commodities. Our commodities team sees a broadly positive outlook for agricultural prices this year with strong Chinese demand for US grains and oilseeds.

Again, these rising agricultural prices have implications for equity investors. Rising prices should translate into higher incomes for farmers. Higher incomes could then be expected to lead to an increase in investment. North American farm incomes are already at their highest in eight years and this looks set to continue as agricultural prices rise, potentially driving increased spending on farm equipment and machinery.

Agricultural machinery has a relatively long cycle, meaning the useful life of such machinery is longer than for similar equipment like trucks. However, we estimate that we’re now at the end of a seven-year down cycle in agricultural equipment with signs of the cycle turning positive from last summer. This, plus current low inventory levels of such machinery and rising agricultural prices, could be a tailwind for the agricultural equipment manufacturers.

Other related industries could benefit too. Crop protection and fertilisers look set to see increased demand as farmers seek to both protect and enhance their crop yields. And it remains to be seen whether these rising prices of agricultural commodities will filter through to consumers in the form of higher food prices, which would affect both food producer and food retail stocks.

What effect could inflation have?

We’ve identified some of the specific opportunities that we think this rise in commodity prices could uncover, but could it be the start of a broader shift into value?

Inflation is typically good news for value areas of the market: in an inflationary environment, money now is worth more than money in the future. Value stocks, with their low price-to-earnings ratio, see investors recoup their money sooner rather than later (making them “short duration” assets, in the jargon). By contrast, growth stocks, with a higher price-to-earnings ratio, are “long duration” – investors pay a higher price now in anticipation of future growth. This makes value more attractive in an inflationary world.

That said, we don’t expect equity markets to make a wholesale shift away from growth stocks and towards more lowly-valued stocks. There are still plenty of structural growth opportunities to be found in areas such as technology and green energy. Meanwhile, some value parts of the market face challenges, notably the energy sector as it needs to adapt swiftly to the energy transition and banks with the financial impact of Covid yet to be fully felt.

But, after years of underperformance for value stocks, we do think this could be the start of more balance returning to the market. Investors will as ever need to tread carefully and make sure they consider the specifics of any stock they buy. However, rising prices across a broad array of commodities could broaden the range of companies that investors might want to own in 2021 and beyond.

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.